Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the owner of four Taco Bell restaurant locations. You have a business loan with Citizens Bank taken out 60 days ago that is

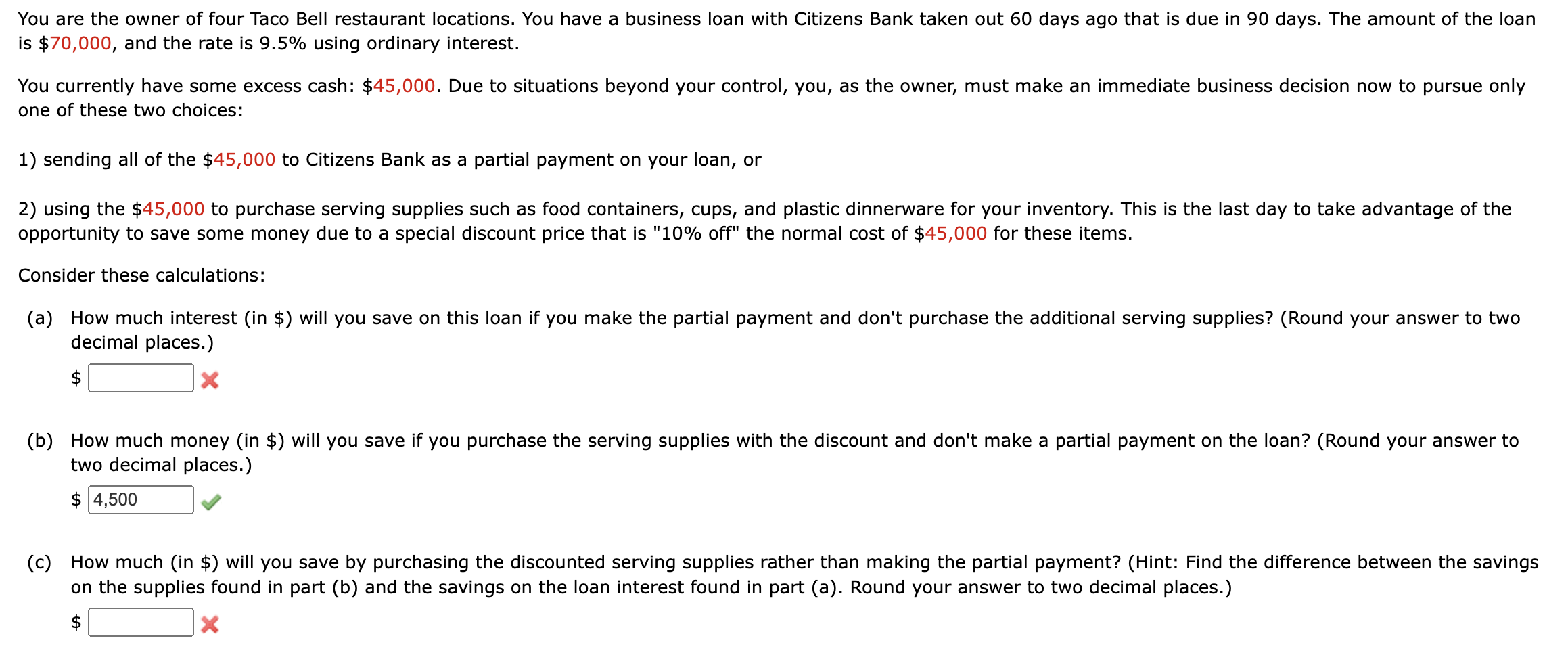

You are the owner of four Taco Bell restaurant locations. You have a business loan with Citizens Bank taken out 60 days ago that is due in 90 days. The amount of the loan is $70,000, and the rate is 9.5% using ordinary interest. You currently have some excess cash: $45,000. Due to situations beyond your control, you, as the owner, must make an immediate business decision now to pursue only one of these two choices: 1) sending all of the $45,000 to Citizens Bank as a partial payment on your loan, or 2) using the $45,000 to purchase serving supplies such as food containers, cups, and plastic dinnerware for your inventory. This is the last day to take advantage of the opportunity to save some money due to a special discount price that is "10\% off" the normal cost of $45,000 for these items. Consider these calculations: (a) How much interest (in \$) will you save on this loan if you make the partial payment and don't purchase the additional serving supplies? (Round your answer to two decimal places.) $ (b) How much money (in \$) will you save if you purchase the serving supplies with the discount and don't make a partial payment on the loan? (Round your answer to two decimal places.) $ (c) How much (in \$) will you save by purchasing the discounted serving supplies rather than making the partial payment? (Hint: Find the difference between the savings on the supplies found in part (b) and the savings on the loan interest found in part (a). Round your answer to two decimal places.)

You are the owner of four Taco Bell restaurant locations. You have a business loan with Citizens Bank taken out 60 days ago that is due in 90 days. The amount of the loan is $70,000, and the rate is 9.5% using ordinary interest. You currently have some excess cash: $45,000. Due to situations beyond your control, you, as the owner, must make an immediate business decision now to pursue only one of these two choices: 1) sending all of the $45,000 to Citizens Bank as a partial payment on your loan, or 2) using the $45,000 to purchase serving supplies such as food containers, cups, and plastic dinnerware for your inventory. This is the last day to take advantage of the opportunity to save some money due to a special discount price that is "10\% off" the normal cost of $45,000 for these items. Consider these calculations: (a) How much interest (in \$) will you save on this loan if you make the partial payment and don't purchase the additional serving supplies? (Round your answer to two decimal places.) $ (b) How much money (in \$) will you save if you purchase the serving supplies with the discount and don't make a partial payment on the loan? (Round your answer to two decimal places.) $ (c) How much (in \$) will you save by purchasing the discounted serving supplies rather than making the partial payment? (Hint: Find the difference between the savings on the supplies found in part (b) and the savings on the loan interest found in part (a). Round your answer to two decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started