Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the reserving actuary for a company that sells three-year immediate term annuity to 65 year old male retirees. This demographic experiences 10

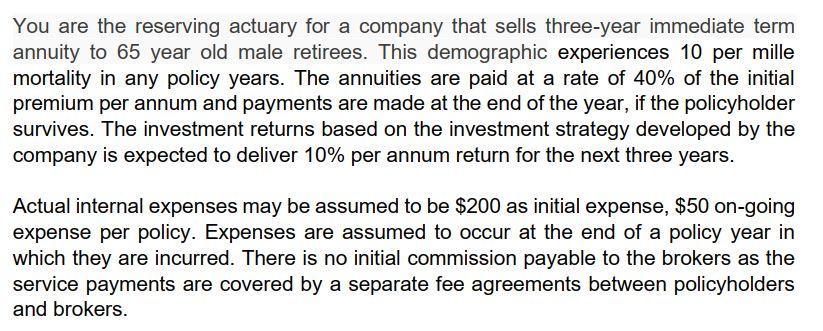

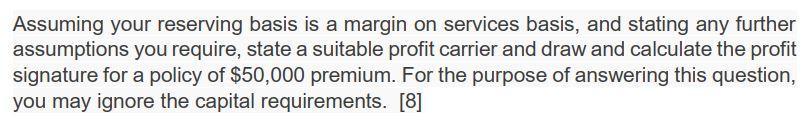

You are the reserving actuary for a company that sells three-year immediate term annuity to 65 year old male retirees. This demographic experiences 10 per mille mortality in any policy years. The annuities are paid at a rate of 40% of the initial premium per annum and payments are made at the end of the year, if the policyholder survives. The investment returns based on the investment strategy developed by the company is expected to deliver 10% per annum return for the next three years. Actual internal expenses may be assumed to be $200 as initial expense, $50 on-going expense per policy. Expenses are assumed to occur at the end of a policy year in which they are incurred. There is no initial commission payable to the brokers as the service payments are covered by a separate fee agreements between policyholders and brokers. Assuming your reserving basis is a margin on services basis, and stating any further assumptions you require, state a suitable profit carrier and draw and calculate the profit signature for a policy of $50,000 premium. For the purpose of answering this question, you may ignore the capital requirements. [8]

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 The present value of the ann uity payments is 1 000 The company s target rate of return is 10 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started