Question

You are the Vice President of Compensation & Benefits for Wolfman Enterprises, a large, high-technology products manufacturer that employs approximately 65,000 in the United States.

You are the Vice President of Compensation & Benefits for Wolfman Enterprises, a large, high-technology products manufacturer that employs approximately 65,000 in the United States. You have just learned that health insurance premiums for the following fiscal year were expected to increase approximately 26%, up dramatically from the 16% increase of the previous year and the 14% increase the year before that. Adding to your concern is the projection that, by 2015, the company's $375 million annual health-care bill would increase to a staggering $613 million. You have been asked by Wolfman's top management to develop a custom-designed health insurance program for the organization that would hold down health-care premium costs to a reasonable level while ensuring that employees would retain adequate health care coverage. The current health care plan is relatively traditional. The company pays the entire health care premium for single employees (approximately $480 per month); dependent coverage is available, but the employee pays the entire cost of this coverage. There is a $250 deductible, and no preferred provider network. Once the employee's deductible is met, the policy pays 80% of all covered expenses up to $5,000. Once the $5,000 threshold is met, the policy then pays 100% of covered expenses up to a lifetime maximum of $2,000,000 per person. Thus, each employee has an annual out-of-pocket maximum of $1,250. Preventive care (an annual physical, routine Pap smears and annual mammograms for women, and PSA for men) are covered at 100% with no deductible. Employees also have a prescription drug benefit. After payment of a $100 annual deductible (per person), generic prescription drugs are available with a $10 copay; brand-name prescription drugs are available with a $25 copay. Top management has asked you to provide them with a preliminary list of ideas to be considered, and how you believe employees would accept these changes, because the company is concerned about employee retention and does not want to lose valued employees.

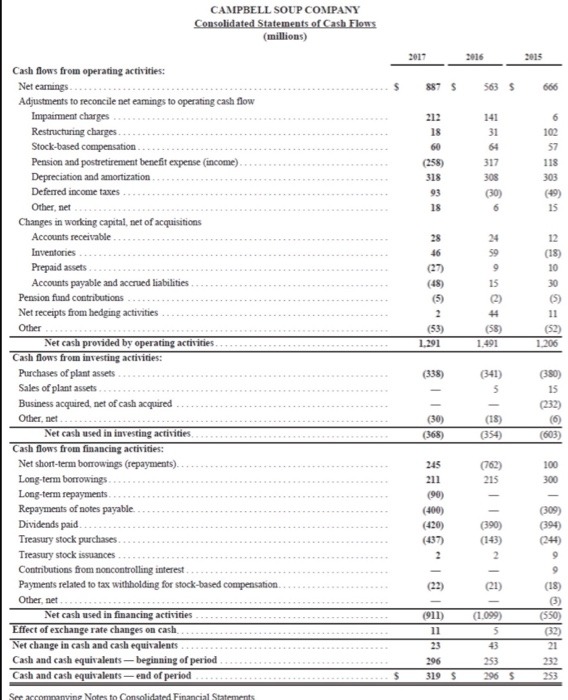

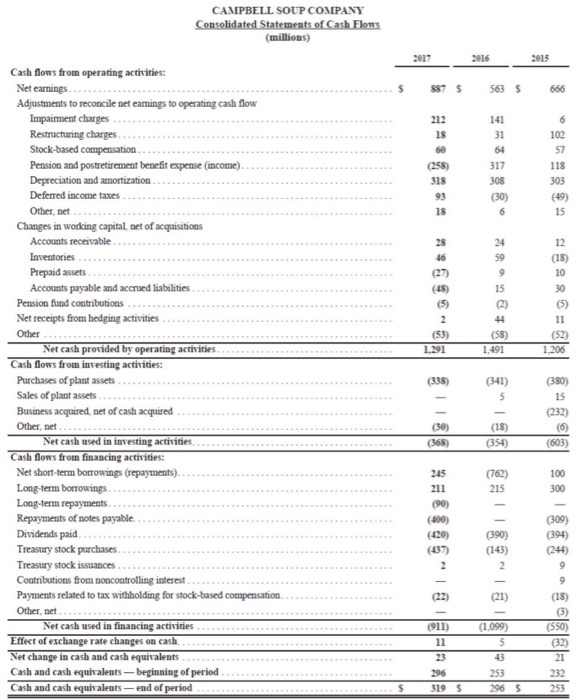

Cash flows from operating activities: Net earnings..... Adjustments to reconcile net eamings to operating cash flow Impairment charges Restructuring charges. Stock-based compensation. Pension and postretirement benefit expense (income). Depreciation and amortization. Deferred income taxes Other, net. Changes in working capital, net of acquisitions Accounts receivable. Inventories.. Prepaid assets. Accounts payable and accrued liabilities Pension fund contributions Net receipts from hedging activities Other Net cash provided by operating activities. Cash flows from investing activities: Purchases of plant assets Sales of plant assets. Business acquired, net of cash acquired Other, net... CAMPBELL SOUP COMPANY Consolidated Statements of Cash Flows (millions) Net cash used in investing activities. Cash flows from financing activities: Net short-term borrowings (repayments). Long-term borrowings. Long-term repayments. Repayments of notes payable. Dividends paid. Treasury stock purchases. Treasury stock issuances. Contributions from noncontrolling interest. Payments related to tax withholding for stock-based compensation. Other, net Net cash used in financing activities Effect of exchange rate changes on cash. Net change in cash and cash equivalents Cash and cash equivalents-beginning of period Cash and cash equivalents-end of period See accompanying Notes to Consolidated Financial Statements $ $ 2017 887 S 212 18 60 (258) 318 93 18 28 46 (27) (48) (5) 2 (53) 1,291 (338) (30) (368) 245 211 (90) (400) (420) (437) 2 (22) (911) 11 23 296 319 S 2016 563 S 141 31 64 317 308 (30) 6 24 59 9 15 (2) 44 (58) 1,491 (341) 5 (18) (354) (762) 215 (390) (143) 2 (21) (1,099) 5 43 253 296 S 2015 666 6 102 57 118 303 (49) 15 12 (18) 10 30 (5) 11 (52) 1,206 (380) 15 (232) (603) 100 300 (309) (394) (244) 9 9 (18) (3) (550) (32) 21 232 253

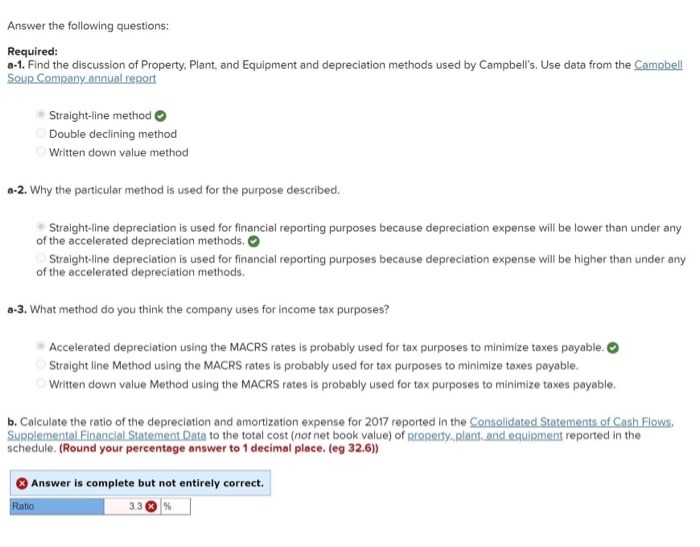

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started