Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the VP of Finance for the wine company SIPP. Your company wants to reduce the volatility of its cash flows by making its

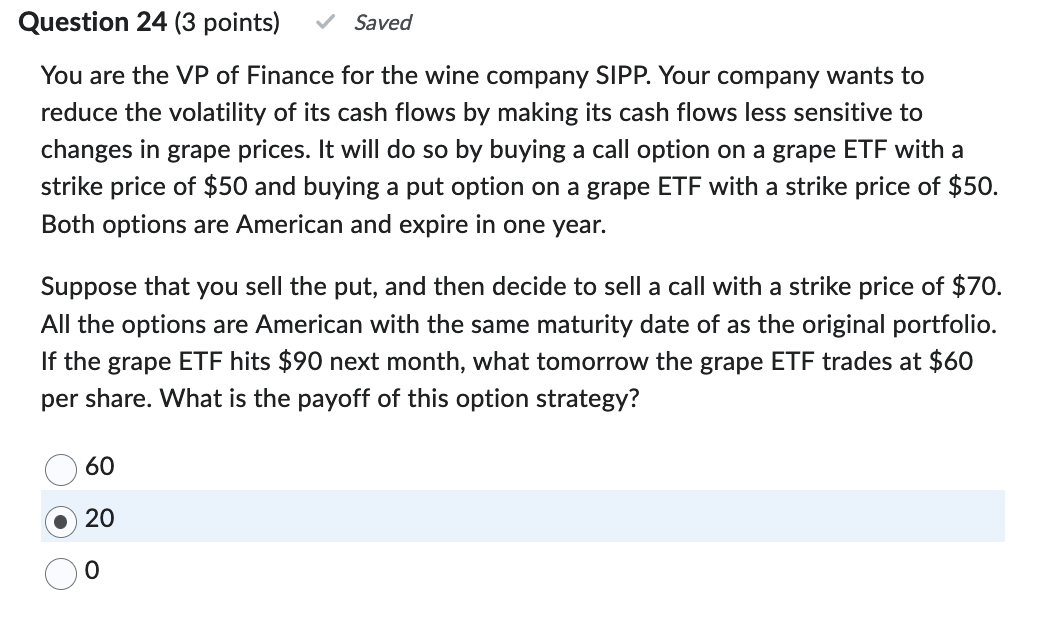

You are the VP of Finance for the wine company SIPP. Your company wants to reduce the volatility of its cash flows by making its cash flows less sensitive to changes in grape prices. It will do so by buying a call option on a grape ETF with a strike price of $50 and buying a put option on a grape ETF with a strike price of $50. Both options are American and expire in one year. Suppose that you sell the put, and then decide to sell a call with a strike price of $70. All the options are American with the same maturity date of as the original portfolio. If the grape ETF hits $90 next month, what tomorrow the grape ETF trades at $60 per share. What is the payoff of this option strategy? 60

You are the VP of Finance for the wine company SIPP. Your company wants to reduce the volatility of its cash flows by making its cash flows less sensitive to changes in grape prices. It will do so by buying a call option on a grape ETF with a strike price of $50 and buying a put option on a grape ETF with a strike price of $50. Both options are American and expire in one year. Suppose that you sell the put, and then decide to sell a call with a strike price of $70. All the options are American with the same maturity date of as the original portfolio. If the grape ETF hits $90 next month, what tomorrow the grape ETF trades at $60 per share. What is the payoff of this option strategy? 60 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started