Answered step by step

Verified Expert Solution

Question

1 Approved Answer

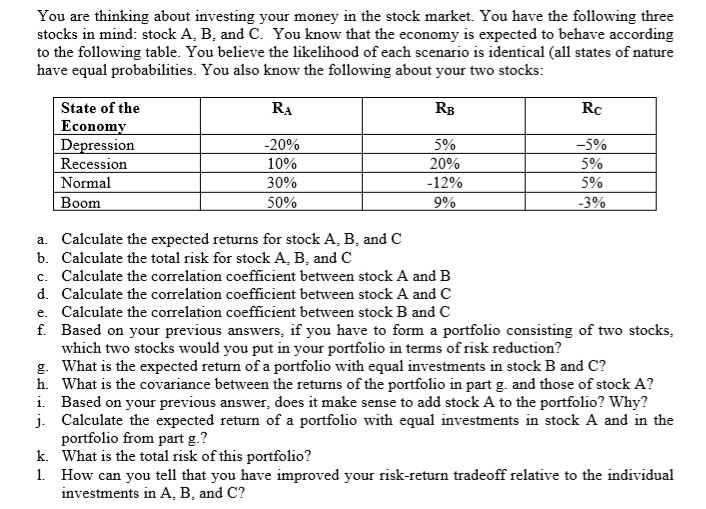

You are thinking about investing your money in the stock market. You have the following three stocks in mind: stock A, B, and C. You

You are thinking about investing your money in the stock market. You have the following three stocks in mind: stock A, B, and C. You know that the economy is expected to behave according to the following table. You believe the likelihood of each scenario is identical (all states of nature have equal probabilities. You also know the following about your two stocks: 0 State of the Economy RB 20% 10% 30% 50% Rc 5% 5% Depression Recession Normal Boom 8 20% -12% 990 Calculate the expected returns for stock A, B, and C a. b. Calculate the total risk for stock A, B, and C Calculate the correlation coefficient between stock A and B c. d. Calculate the correlation coefficient between stock A and C Calculate the correlation coefficient between stock B and C e. f. Based on your previous answers, if you have to form a portfolio consisting of two stocks, which two stocks would you put in your portfolio in terms of risk reduction? g. What is the expected return of a portfolio with equal investments in stock B and C? h. What is the covariance between the returns of the portfolio in part g. and those of stock A? i. Based on your previous answer, does it make sense to add stock A to the portfolio? Why? j. Calculate the expected return of a portfolio with equal investments in stock A and in the portfolio from part g.? k. What is the total risk of this portfolio? 1 How can you tell that you have improved your risk-return tradeoff relative to the individual 2 investments in A, B, and C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started