Answered step by step

Verified Expert Solution

Question

1 Approved Answer

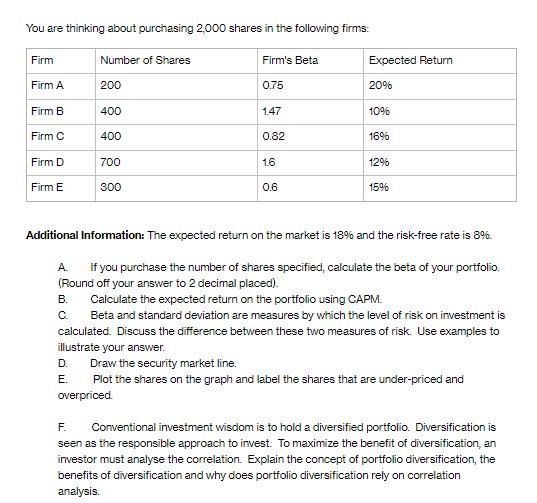

You are thinking about purchasing 2,000 shares in the following firms: Firm Firm A Firm B Firm C Firm D Firm E Number of

You are thinking about purchasing 2,000 shares in the following firms: Firm Firm A Firm B Firm C Firm D Firm E Number of Shares 200 400 400 700 300 Firm's Beta 0.75 1.47 0.82 1.6 0.6 Expected Return 20% 10% 16% 12% 15% Additional Information: The expected return on the market is 18% and the risk-free rate is 8%. A. If you purchase the number of shares specified, calculate the beta of your portfolio. (Round off your answer to 2 decimal placed). B. Calculate the expected return on the portfolio using CAPM. C. Beta and standard deviation are measures by which the level of risk on investment is calculated. Discuss the difference between these two measures of risk. Use examples to illustrate your answer. D. Draw the security market line. E. Plot the shares on the graph and label the shares that are under-priced and overpriced. F. Conventional investment wisdom is to hold a diversified portfolio. Diversification is seen as the responsible approach to invest. To maximize the benefit of diversification, an investor must analyse the correlation. Explain the concept of portfolio diversification, the benefits of diversification and why does portfolio diversification rely on correlation analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you provided shows a table with information about different firms A B C D and E along with the number of shares available for purchase each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started