Answered step by step

Verified Expert Solution

Question

1 Approved Answer

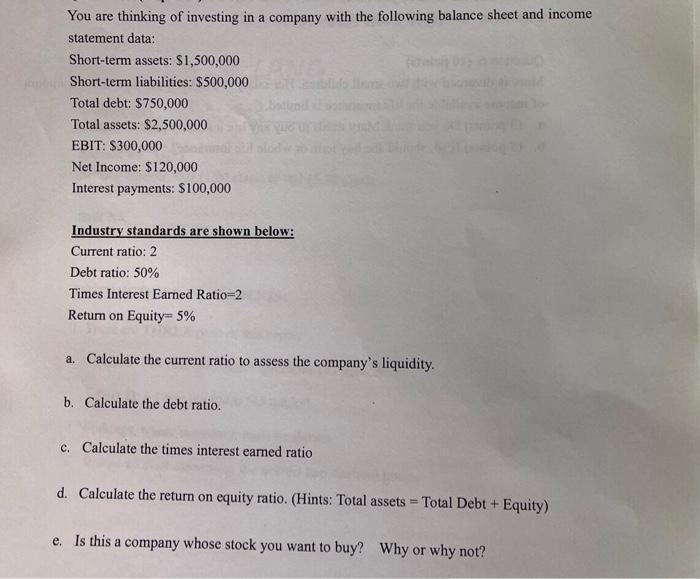

You are thinking of investing in a company with the following balance sheet and income statement data: Short-term assets: $1,500,000 Short-term liabilities: $500,000 Total

You are thinking of investing in a company with the following balance sheet and income statement data: Short-term assets: $1,500,000 Short-term liabilities: $500,000 Total debt: $750,000 Total assets: $2,500,000 EBIT: $300,000 Net Income: $120,000 Interest payments: $100,000 Industry standards are shown below Current ratio: 2 Debt ratio: 50% Times Interest Earned Ratio=2 Return on Equity= 5% a. Calculate the current ratio to assess the company's liquidity. b. Calculate the debt ratio. c. Calculate the times interest earned ratio d. Calculate the return on equity ratio. (Hints: Total assets = Total Debt + Equity) e. Is this a company whose stock you want to buy? Why or why not?

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Current Ratio Shortterm Assets Shortterm Liabilities Current Ratio 1500000 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started