Question

You are thinking of starting a business after graduation.Being a new business, the banks won't loan you money so you borrow the $20,000 you need

You are thinking of starting a business after graduation.Being a new business, the banks won't loan you money so you borrow the $20,000 you need from your brother.Your brother decides to do you a favor and charge you simple interest at only 4% APR.You plan to pay him back in three years.How much will you have to pay back in total (maturity value)?

2)The Central Oregon Economic Development council uses its Small Business Financing Program to assist businesses with short-term loans in operating their business.Bill's Cabinets decides to borrow $50,000 for 8 months at 6.2% APR.Bill must make monthly interest-only payments and then repay the loan at the end of the term.What are the monthly interest-only payments?How much is his final payment? (365)

3)You are starting a new bookkeeping and tax business and need $7,500 to set up your new office and print promotional literature.You will be able to pay the loan off after tax season.The terms of the loan are 160 days at 7% APR.What is the interest portion of the payment?What is the maturity value? Answer based on both 365 and 360 days.

4)You are looking at three different loan options to borrow $1000 for one year.The terms are as follows:

Loan A12% APR payable annually

Loan B12% APR payable every six months

Loan C12% APR payable monthly

Which loan has the best terms?Justify your choice.

5)Your 6-month promissory note has a maturity value of $8360.It has principle of $8,000.What is the simple interest APR charged on the note?

6)The simple interest on a 45-day loan of $5,200 is $55.25.What is the simple interest APR?

7)You borrowed $10,000 from your bank at 5.6% simple interest APR.You took out the loan on March 1 and plan on repaying it on August 1.What is the interest and maturity value of the loan?

8)Franz is planning to borrow $182,000 from Columbia River Bank to build a road into his property.The road building (and loan) will commence on March 17th and the road will be completed on April 27th.At that time the property will be sold and the loan repaid to the bank (April 27th).Terms for the loan are simple interest at 2 (percentage) points over prime plus a 1.5% loan fee (the loan fee is added to the $ amount being borrowed).The Bank's prime rate is 8.75% APR.What is the maturity value?

9)Bill is borrowing $150 from a pawnshop by giving the pawnshop a guitar worth $500.The pawnshop says she can repay the $150 plus 10% interest ($150 x 10 %=$15) in 30 days to redeem the guitar; if he does not repay the loan in 30 days, the pawn shop will sell his guitar.Help bill calculate the APR. (use 365 days)

10) Lee is purchasing ski clothing from a supplier for $2,450.The seller offers a 4% discount if the invoice is paid within 10 days; if not paid within 10 days, the full amount must be paid within 30 days of the invoice date (4/10,n/30). Find the Annual Effective Rate.(use 365 days)

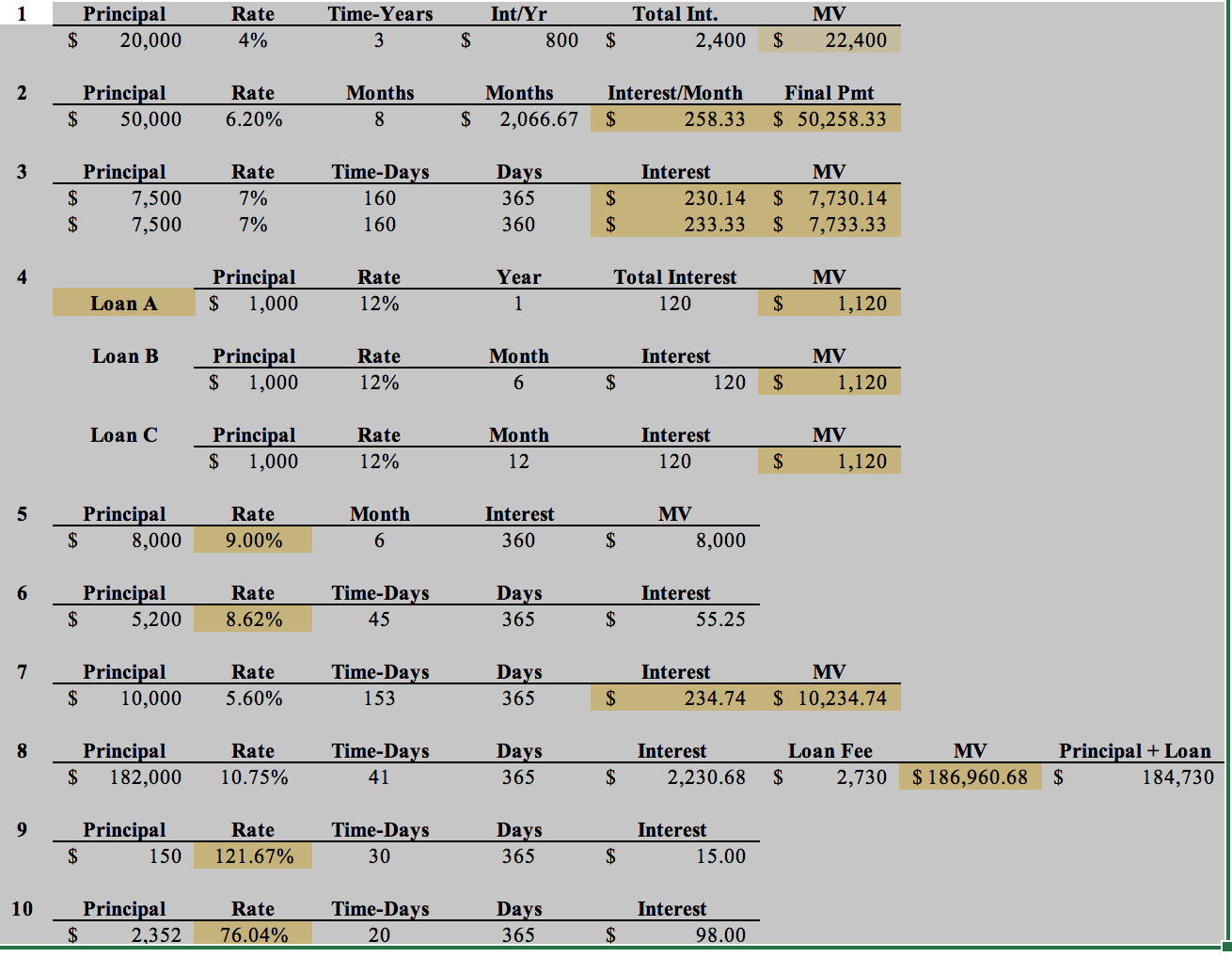

the yellow are the answers

1 Principal Rate Time-Years Int/Yr Total Int. MV $ 20,000 4% 3 $ 800 $ 2,400 S 22,400 2 Principal Rate Months Months Interest/Month Final Pmt $ 50,000 6.20% 8 $ 2,066.67 $ 258.33 $ 50,258.33 3 Principal Rate Time-Days Days Interest MV $ 7,500 7% 160 365 $ 230.14 $ 7,730.14 S 7,500 7% 160 360 $ 233.33 $ 7,733.33 Principal Rate Year Total Interest MV Loan A $ 1,000 12% 1 120 $ 1,120 Loan B Principal Rate Month Interest MV $ 1,000 12% 6 $ 120 $ 1,120 Loan C Principal Rate Month Interest MV $ 1,000 12% 12 120 S 1,120 5 Principal Rate $ 8,000 9.00% Month 6 Interest MV 360 $ 8,000 6 Principal Rate Time-Days Days Interest $ 5,200 8.62% 45 365 $ 55.25 7 Principal Rate Time-Days Days Interest MV $ 10,000 5.60% 153 365 $ 234.74 $ 10,234.74 8 Principal S Rate 182,000 10.75% Time-Days 41 Days Interest 365 $ Loan Fee MV 2,230.68 $ 2,730 $186,960.68 Principal + Loan $ 184,730 9 Principal Rate Time-Days Days Interest $ 150 121.67% 30 365 $ 15.00 10 Principal $ Rate 2,352 76.04% Time-Days 20 Days Interest 365 $ 98.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started