Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are to measure the overall cost of capital for VIU Tech. The firm has a tax rate of 40% and the following information had

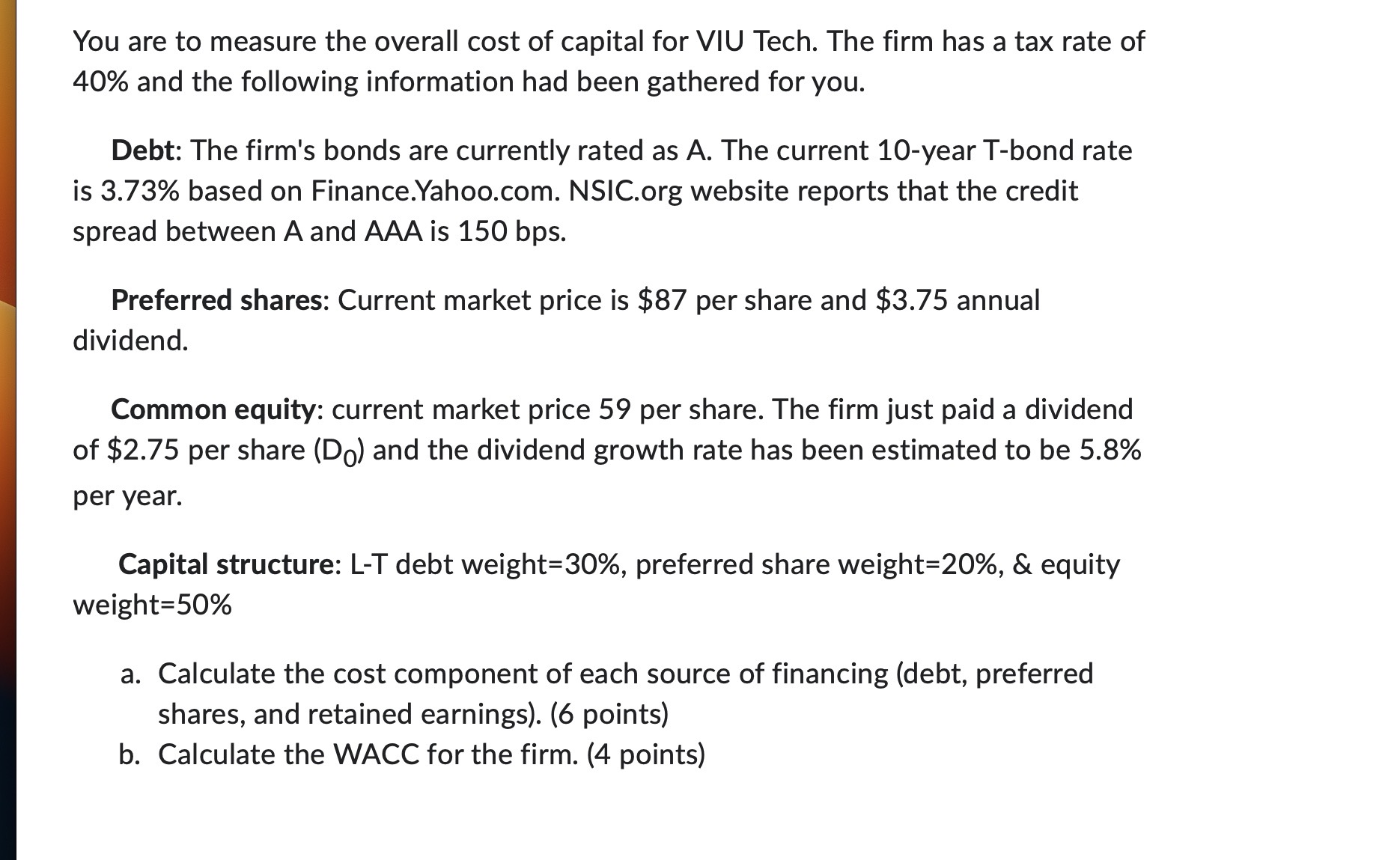

You are to measure the overall cost of capital for VIU Tech. The firm has a tax rate of 40% and the following information had been gathered for you. Debt: The firm's bonds are currently rated as A. The current 10-year T-bond rate is 3.73\% based on Finance.Yahoo.com. NSIC.org website reports that the credit spread between A and AAA is 150 bps. Preferred shares: Current market price is $87 per share and $3.75 annual dividend. Common equity: current market price 59 per share. The firm just paid a dividend of $2.75 per share (D0) and the dividend growth rate has been estimated to be 5.8% per year. Capital structure: L-T debt weight =30%, preferred share weight =20%,& equity weight =50% a. Calculate the cost component of each source of financing (debt, preferred shares, and retained earnings). (6 points) b. Calculate the WACC for the firm. (4 points)

You are to measure the overall cost of capital for VIU Tech. The firm has a tax rate of 40% and the following information had been gathered for you. Debt: The firm's bonds are currently rated as A. The current 10-year T-bond rate is 3.73\% based on Finance.Yahoo.com. NSIC.org website reports that the credit spread between A and AAA is 150 bps. Preferred shares: Current market price is $87 per share and $3.75 annual dividend. Common equity: current market price 59 per share. The firm just paid a dividend of $2.75 per share (D0) and the dividend growth rate has been estimated to be 5.8% per year. Capital structure: L-T debt weight =30%, preferred share weight =20%,& equity weight =50% a. Calculate the cost component of each source of financing (debt, preferred shares, and retained earnings). (6 points) b. Calculate the WACC for the firm. (4 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started