Question

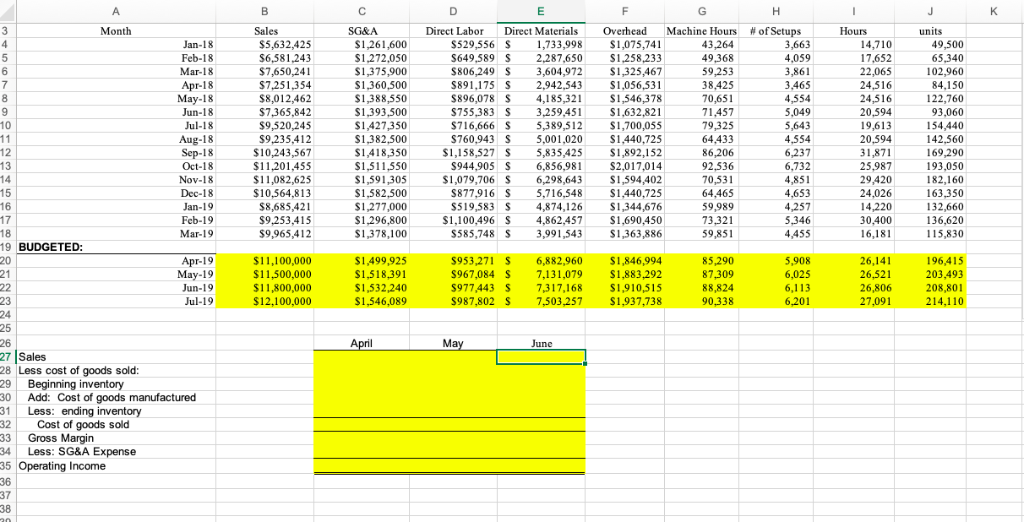

You are to prepare a P&L budget for the 2nd quarter of 2019 based on data from the previous 15 months. Your budget should include

You are to prepare a P&L budget for the 2nd quarter of 2019 based on data from the previous 15 months. Your budget should include only cell references and formulas based on the budgeted data you will fill in for April through June. The budgeted data you will fill in for April through June should also use cell references and formulas based on your regression models which should be labeled as other sheets within your workbook.

-Management likes to keep an inventory equal to 15% of next month's estimated production. Build this into your budget to correctly calculate cost of goods sold. You can assume the company followed this pattern when purchasing March 2018 production needs. The average cost of each unit in ending inventory at March 31, 2019 is $51.29 (you should be able to calculate this number from the data). You will need to calculate the average cost of each unit in ending inventory for April through June based on each month's forecasted production costs.

I have to do the last part, the income statement. it can only be cell references. So I am not sure where he gets the $51.29 from the instructions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started