Question: You are to prepare a tax return using the following information. You will need to use Form 1040, Schedule B if applicable, you determine (Read

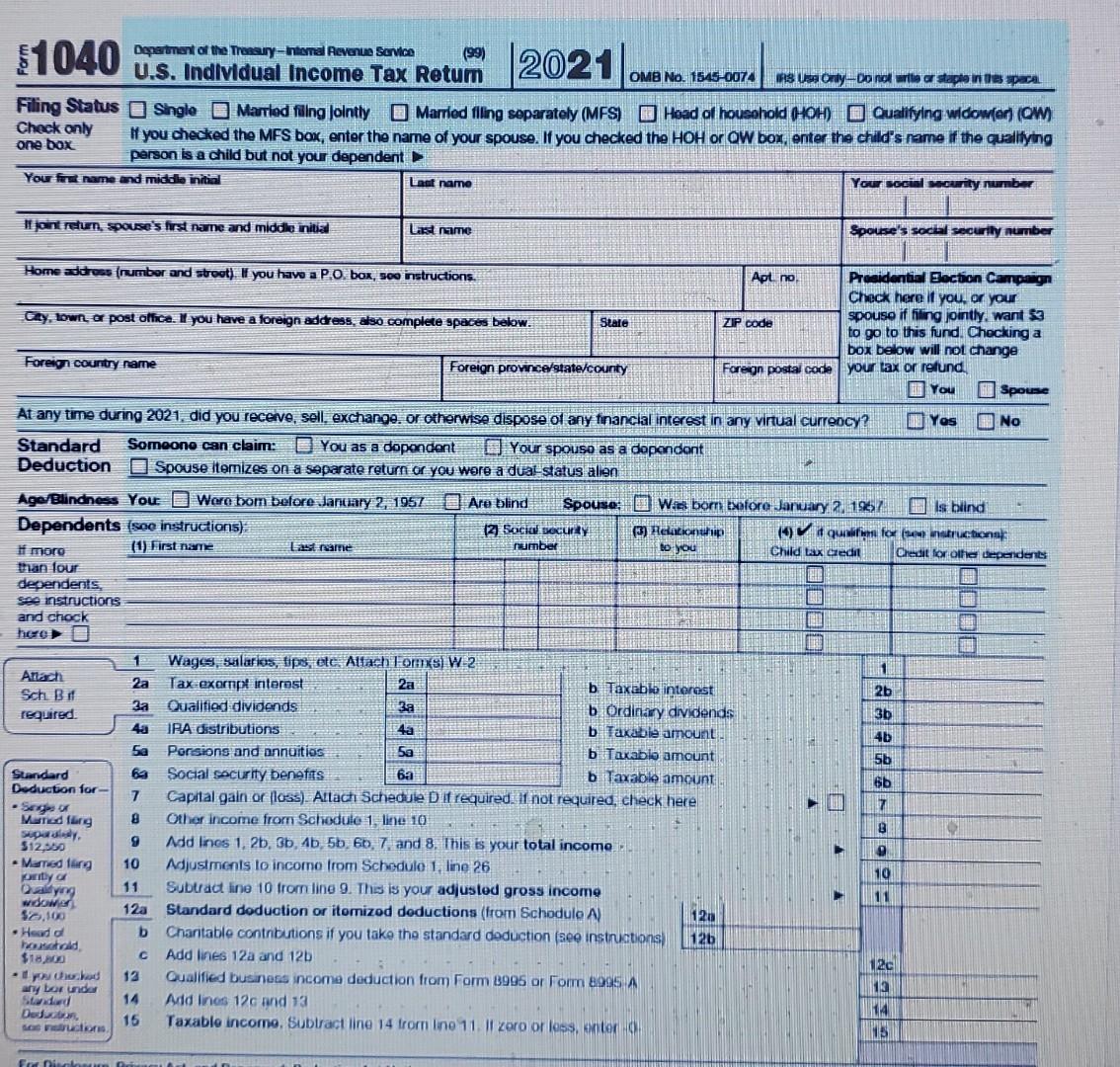

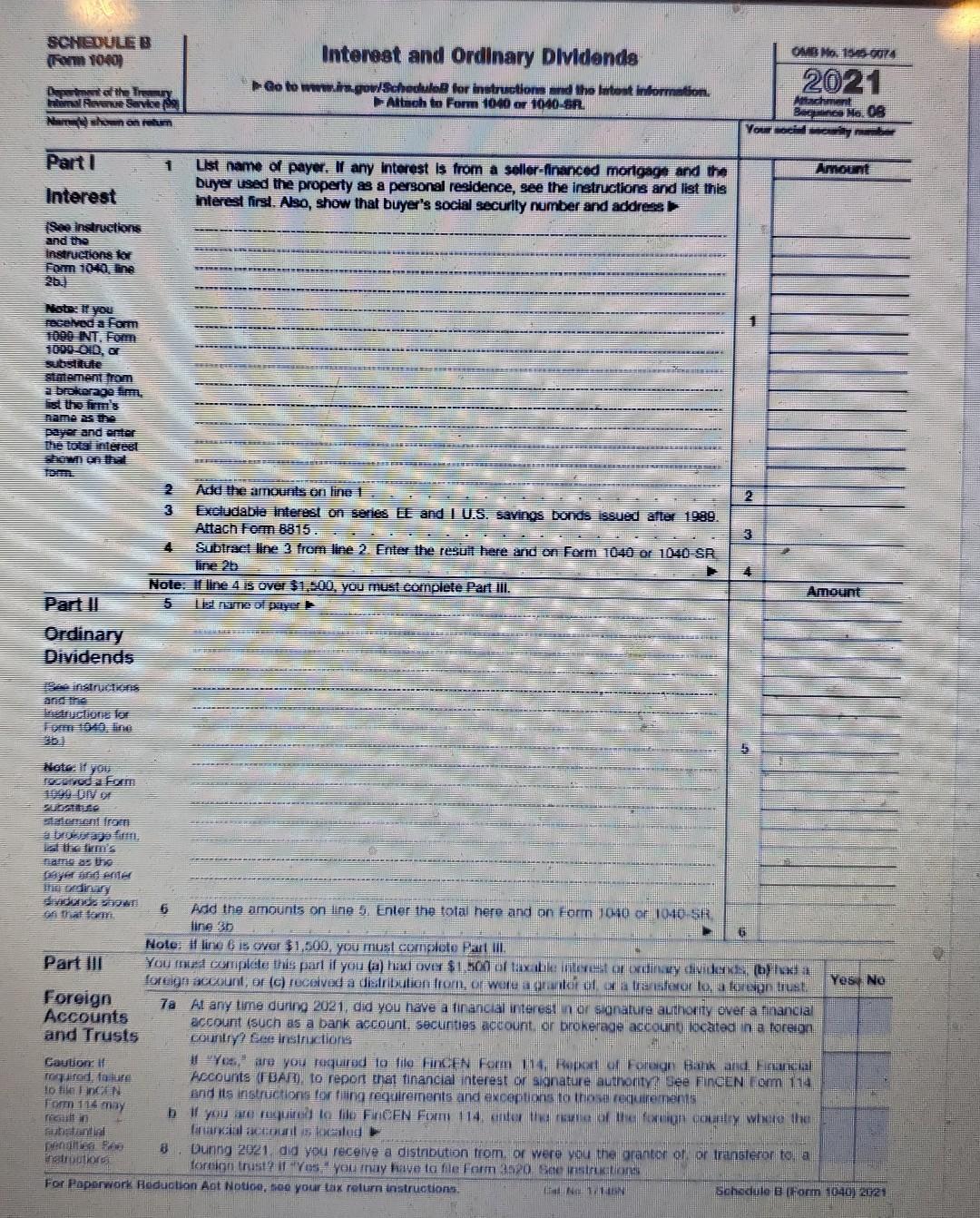

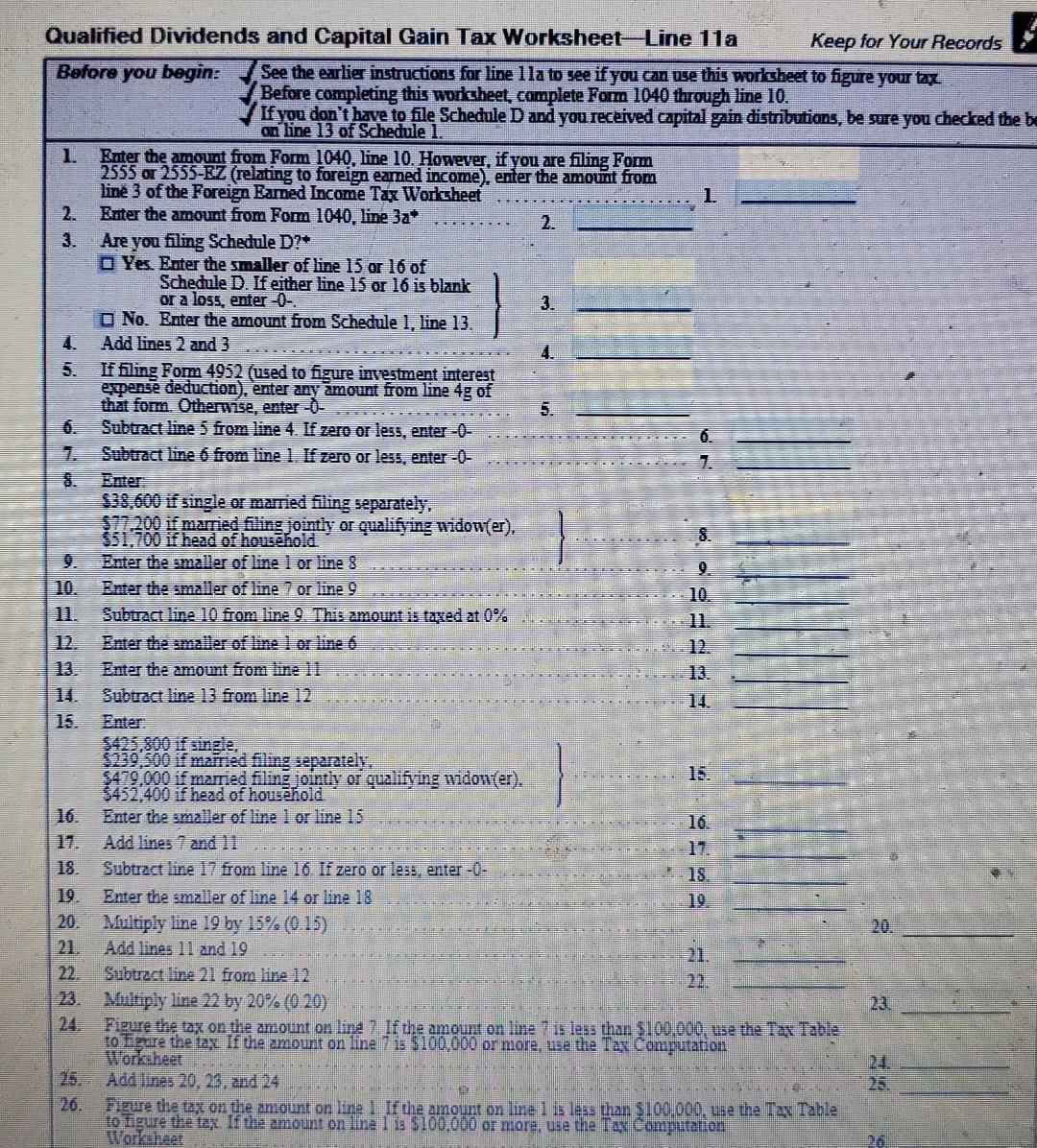

You are to prepare a tax return using the following information. You will need to use Form 1040, Schedule B if applicable, you determine (Read requirements in text). John Doby, age 53, (social security number 554-78-4556) is single and is supporting his 18 year old son, David (social security number 444-55-7777). David i a student at West High School. They live in a rented home at 1245 West 5Th Street, Coalinga, CA. John is employed as a engineer and received the following on his W-2, Wages, $124,566, Federal Income Tax withheld, $32,400. John also received dividends from Pepsico, $1500 of which $1344 were qualified dividends. Be sure to calculate the tax using the Qualified Dividends and Capital Gains tax worksheet. He also received interest from Bank of America totaling $245. Other items of income were a gift from John's father of cash, $50,000, lottery winnings of $1500 on a Lottery Scratcher ticket. You are to prepare the 2021 tax return manually using the forms provided in the Resources section titled Forms and Publications. You will only need to submi Form 1040 and Sch B if required. 1040 2021 Department at the Treasury=ne Revenue Service (99) U.S. Individual Income Tax Retum OMB No. 1545-0074 Sony-Dondersteponos para Filing Status Single Married filling Jointly Married fling separately (MFS D Head of household (HOH) Qualifying widower (W) Check only you checked the MFS box, enter the name of your spouse. If you checked the HOH or OW box, enter the child's name if the qualitying one box person is a child but not your dependent Your for name and mida initial Your social security number Last name ljon return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and stoot). If you have a P.O. box, sow instructions. Gay, town of post office. I you have a foreign address, also complete spaces below. Stale Apt no Presidential Election Campaign Check here if you, or your ZIP code spouso if filing jointly, want $3 to go to this fund. Chocking a box below will not change Foreign postal code your tax or refund. HD You BD Spouse Foreign country name Foreign province/state/county w your spa to you At any time during 2021. did you receive, sell, exchange. or otherwise dispose of any financial interest in any virtual currency? Yos No Standard Someone can claim: You as a dopondent Your spouso as a dependent Deduction B Spouse itemizes on a separate return or you wore a dual status alien Age/Blindness You Were bom before January 2, 1957 Are blind Spouse: Was bom tetore January 2, 1957 Is blind Dependents (see instructions): (2) Social secury (3) Recup (4) equilinnu teritone Instruction (1) First name East rarre number Child Lax credit more Chedit for other dependents than four dependents, see instructions and chock here 1 Wages, salarios, tips, etc. Alfach TomKS) W-2 1 Anach 2a Tax-exempt interest 2a b. Taxable interest 25 Sch. Bi 3a Qualified dividends 3a b Ordinary dividends 3b required 43 IBA distributions 43 b Taxable amount 4b 59 Porsions and annoitios 5a b Taxablo amount 5b Standard 64 Social security benefits 6a b Taxable amount 6b Deduction for 7 Capital gain or loss). Allach Schedule D it required. In not required, check here 7 . Sego Married ang 8 Other income from Schedule 1. line 10 B 9 $12.950 Add lines 1, 2b, 3b, 1b, 5b, Eb, 7 and 8. This is your total income 9 Mamedling 10 Adjustments to income from Schedulo 1, line 26 10 pritly a Dalyng 11 Subtract line 10 from line 9. This is your adjustod gross income 11 widow 12a Standard doduction or itorizod doductions (from Schodule A) 120 $0,100 Head o b Charitable contnbutions if you take the standard deduction (see instructions 126 hounced $18.00 Add lines 12a and 12b 12c . you had 13 Qualified business income deduction from Form B995 or Form 8995 A 13 any or under Standard Add Ines 12 and 13 14 Dude 16 Taxable incomo. Subtract line 14 tromn line 11. Il zoro or less, ter 13 e auctions 8 , SCHEDULEB m 1040 OMB No 1545-0074 Interest and Ordinary Dividends Go to www.in.gow Schedule for instruction and the best Information Aktuch to Form 1040 1040-SR. 2021 Dit of the he Revenge Sevede ar en in Attachment Boa No.08 You Part 1 1 Amount List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this Interest first. Also, show that buyer's social security number and address Interest See Instructions and the Instructions for From 1040. line Nate you sedam 1000 INT. Form 1000, Substitute Ament from 2 brokeragem Es thems De De and enter The interest wat 2 Add the amounts on line 1 3 Excludable interest on series and I U.S. savings bonds issued after 1989. Attach Fo 8815. Subtract line 3 from line 2. Enter the result here and on Ferm 1040 or 1040-SR be Note: if line 4 IS Over $100, you must complete Part Ill. TO Blyert Amount Part I Ordinary Dividends and he rote lo ered a Form 099 ON OF o lement from ago fum. elim's Date einar 6 Add the amounts on line 5. Enter the tota here and en form 40 or 010-S Note: if line 6 is over $1,500, you must completo Part Part II You must complete this part if you (a) hand over $1,500 of taxatie: eest odny dudas bluda foreign account, or (c) received a distribution from, or weru a gundial a atrastuor lo u forcon trust Yes No Foreign 7a At any time during 2021, did you have a financial interest n or sonature authority over a mnancial Accounts account (such as a bank account securties account or brokerage account located in a foreign and Trusts country? fe instructions Caution: # Vos" are you required to filo HINKEN Fom 11. Huport of Foreign Bank and Francial tafad, folur accounts (TBAm to report that financial interest or signature authony Dee Finden form 114 to file CD And its instructions forfing recklirements and exceptions to those courements Toen 114 may out in b you were to bilo FOCEN Fom 114. ane tarnen on what financial accounsealed pen 8. Dunng 2021 did you receive a distnbution from or were you the grantor er or transleror to a ro fornian true fos you may have la file Form20 se ustalones For Paperwork Reduction Act Notice, so your tax return instructions Schedule Bhor 1940) 2021 Qualified Dividends and Capital Gain Tax Worksheet-Line 11a Keep for Your Records Before you begin: See the earlier instructions for line lla to see if you can use this worksheet to figure your tax Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the be on line 13 of Schedule 1. 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income). enter the amount from line 3 of the Foreign Eamed Income Tax Worksheet 1 2. Enter the amount from Fom 1040, line 32 2. Are you filing Schedule D? o Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter-O- 3. O No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 4. If filling For 4952 (used to figure investment interest expense deduction), enter any amount from line 4g of that form. Otherwise, enter-O- 5. Subtract line 5 from line 4. If zero or less, enter -0- Subtract line 6 from line 1. If zero or less, enter-O- Se Enter: $33,600 i single or married filing separately. $77,200 if married fiting jointly or qualifying widow(er). $$1,700 if head of household Enter the smaller of line 1 or line 8 artemiler or line or line 9 10. Subtract line 10 from line 9 This amount is taxed at 0% Enter the smaller of timelor line 6 Enter the amount som iine 11 13. Subtract line 13 from line 12 1 Enter $425,800 if single, $239,500 if married filing separately. $479.000 if married filing jointly or qualifying widow(er). $452,400 if head of housnold Enter the smaller of line lor line 15 16. 16 18 Subtract line 17 from line 16. If zero or less, enter -0- 18 Enter the smailer of line 14 or line 19 19 20. Multiply line 19 by 15% (0.15) Add lines 11 and 19 Subtract live 21 from line 12 21. 23. Multiply line 22 by 20% (0.20) Figure the tax on the amount on line 7. If the amount on line 1 is less than $100.000, use the Tax Table to Egure the tax. If the amount on line 7 12 $100,000 or more, use the Tax Computation Add lines 20. 28. and 24 Figure the tax on the amount on line 1. If the amount on line 1 is less than $100.000, use the Tex Table to figure the tax. If the amount on line 1 is $100.000 or more, use the Tax Computation Worlane You are to prepare a tax return using the following information. You will need to use Form 1040, Schedule B if applicable, you determine (Read requirements in text). John Doby, age 53, (social security number 554-78-4556) is single and is supporting his 18 year old son, David (social security number 444-55-7777). David i a student at West High School. They live in a rented home at 1245 West 5Th Street, Coalinga, CA. John is employed as a engineer and received the following on his W-2, Wages, $124,566, Federal Income Tax withheld, $32,400. John also received dividends from Pepsico, $1500 of which $1344 were qualified dividends. Be sure to calculate the tax using the Qualified Dividends and Capital Gains tax worksheet. He also received interest from Bank of America totaling $245. Other items of income were a gift from John's father of cash, $50,000, lottery winnings of $1500 on a Lottery Scratcher ticket. You are to prepare the 2021 tax return manually using the forms provided in the Resources section titled Forms and Publications. You will only need to submi Form 1040 and Sch B if required. 1040 2021 Department at the Treasury=ne Revenue Service (99) U.S. Individual Income Tax Retum OMB No. 1545-0074 Sony-Dondersteponos para Filing Status Single Married filling Jointly Married fling separately (MFS D Head of household (HOH) Qualifying widower (W) Check only you checked the MFS box, enter the name of your spouse. If you checked the HOH or OW box, enter the child's name if the qualitying one box person is a child but not your dependent Your for name and mida initial Your social security number Last name ljon return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and stoot). If you have a P.O. box, sow instructions. Gay, town of post office. I you have a foreign address, also complete spaces below. Stale Apt no Presidential Election Campaign Check here if you, or your ZIP code spouso if filing jointly, want $3 to go to this fund. Chocking a box below will not change Foreign postal code your tax or refund. HD You BD Spouse Foreign country name Foreign province/state/county w your spa to you At any time during 2021. did you receive, sell, exchange. or otherwise dispose of any financial interest in any virtual currency? Yos No Standard Someone can claim: You as a dopondent Your spouso as a dependent Deduction B Spouse itemizes on a separate return or you wore a dual status alien Age/Blindness You Were bom before January 2, 1957 Are blind Spouse: Was bom tetore January 2, 1957 Is blind Dependents (see instructions): (2) Social secury (3) Recup (4) equilinnu teritone Instruction (1) First name East rarre number Child Lax credit more Chedit for other dependents than four dependents, see instructions and chock here 1 Wages, salarios, tips, etc. Alfach TomKS) W-2 1 Anach 2a Tax-exempt interest 2a b. Taxable interest 25 Sch. Bi 3a Qualified dividends 3a b Ordinary dividends 3b required 43 IBA distributions 43 b Taxable amount 4b 59 Porsions and annoitios 5a b Taxablo amount 5b Standard 64 Social security benefits 6a b Taxable amount 6b Deduction for 7 Capital gain or loss). Allach Schedule D it required. In not required, check here 7 . Sego Married ang 8 Other income from Schedule 1. line 10 B 9 $12.950 Add lines 1, 2b, 3b, 1b, 5b, Eb, 7 and 8. This is your total income 9 Mamedling 10 Adjustments to income from Schedulo 1, line 26 10 pritly a Dalyng 11 Subtract line 10 from line 9. This is your adjustod gross income 11 widow 12a Standard doduction or itorizod doductions (from Schodule A) 120 $0,100 Head o b Charitable contnbutions if you take the standard deduction (see instructions 126 hounced $18.00 Add lines 12a and 12b 12c . you had 13 Qualified business income deduction from Form B995 or Form 8995 A 13 any or under Standard Add Ines 12 and 13 14 Dude 16 Taxable incomo. Subtract line 14 tromn line 11. Il zoro or less, ter 13 e auctions 8 , SCHEDULEB m 1040 OMB No 1545-0074 Interest and Ordinary Dividends Go to www.in.gow Schedule for instruction and the best Information Aktuch to Form 1040 1040-SR. 2021 Dit of the he Revenge Sevede ar en in Attachment Boa No.08 You Part 1 1 Amount List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this Interest first. Also, show that buyer's social security number and address Interest See Instructions and the Instructions for From 1040. line Nate you sedam 1000 INT. Form 1000, Substitute Ament from 2 brokeragem Es thems De De and enter The interest wat 2 Add the amounts on line 1 3 Excludable interest on series and I U.S. savings bonds issued after 1989. Attach Fo 8815. Subtract line 3 from line 2. Enter the result here and on Ferm 1040 or 1040-SR be Note: if line 4 IS Over $100, you must complete Part Ill. TO Blyert Amount Part I Ordinary Dividends and he rote lo ered a Form 099 ON OF o lement from ago fum. elim's Date einar 6 Add the amounts on line 5. Enter the tota here and en form 40 or 010-S Note: if line 6 is over $1,500, you must completo Part Part II You must complete this part if you (a) hand over $1,500 of taxatie: eest odny dudas bluda foreign account, or (c) received a distribution from, or weru a gundial a atrastuor lo u forcon trust Yes No Foreign 7a At any time during 2021, did you have a financial interest n or sonature authority over a mnancial Accounts account (such as a bank account securties account or brokerage account located in a foreign and Trusts country? fe instructions Caution: # Vos" are you required to filo HINKEN Fom 11. Huport of Foreign Bank and Francial tafad, folur accounts (TBAm to report that financial interest or signature authony Dee Finden form 114 to file CD And its instructions forfing recklirements and exceptions to those courements Toen 114 may out in b you were to bilo FOCEN Fom 114. ane tarnen on what financial accounsealed pen 8. Dunng 2021 did you receive a distnbution from or were you the grantor er or transleror to a ro fornian true fos you may have la file Form20 se ustalones For Paperwork Reduction Act Notice, so your tax return instructions Schedule Bhor 1940) 2021 Qualified Dividends and Capital Gain Tax Worksheet-Line 11a Keep for Your Records Before you begin: See the earlier instructions for line lla to see if you can use this worksheet to figure your tax Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the be on line 13 of Schedule 1. 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income). enter the amount from line 3 of the Foreign Eamed Income Tax Worksheet 1 2. Enter the amount from Fom 1040, line 32 2. Are you filing Schedule D? o Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter-O- 3. O No. Enter the amount from Schedule 1, line 13. Add lines 2 and 3 4. If filling For 4952 (used to figure investment interest expense deduction), enter any amount from line 4g of that form. Otherwise, enter-O- 5. Subtract line 5 from line 4. If zero or less, enter -0- Subtract line 6 from line 1. If zero or less, enter-O- Se Enter: $33,600 i single or married filing separately. $77,200 if married fiting jointly or qualifying widow(er). $$1,700 if head of household Enter the smaller of line 1 or line 8 artemiler or line or line 9 10. Subtract line 10 from line 9 This amount is taxed at 0% Enter the smaller of timelor line 6 Enter the amount som iine 11 13. Subtract line 13 from line 12 1 Enter $425,800 if single, $239,500 if married filing separately. $479.000 if married filing jointly or qualifying widow(er). $452,400 if head of housnold Enter the smaller of line lor line 15 16. 16 18 Subtract line 17 from line 16. If zero or less, enter -0- 18 Enter the smailer of line 14 or line 19 19 20. Multiply line 19 by 15% (0.15) Add lines 11 and 19 Subtract live 21 from line 12 21. 23. Multiply line 22 by 20% (0.20) Figure the tax on the amount on line 7. If the amount on line 1 is less than $100.000, use the Tax Table to Egure the tax. If the amount on line 7 12 $100,000 or more, use the Tax Computation Add lines 20. 28. and 24 Figure the tax on the amount on line 1. If the amount on line 1 is less than $100.000, use the Tex Table to figure the tax. If the amount on line 1 is $100.000 or more, use the Tax Computation Worlane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts