Question

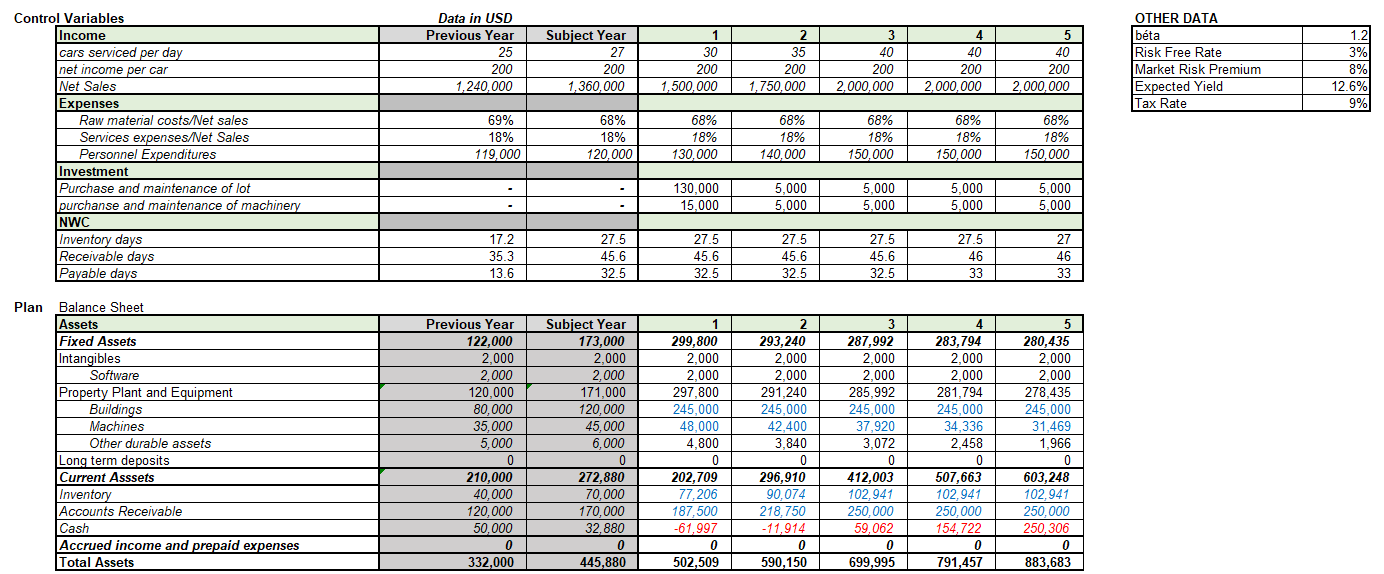

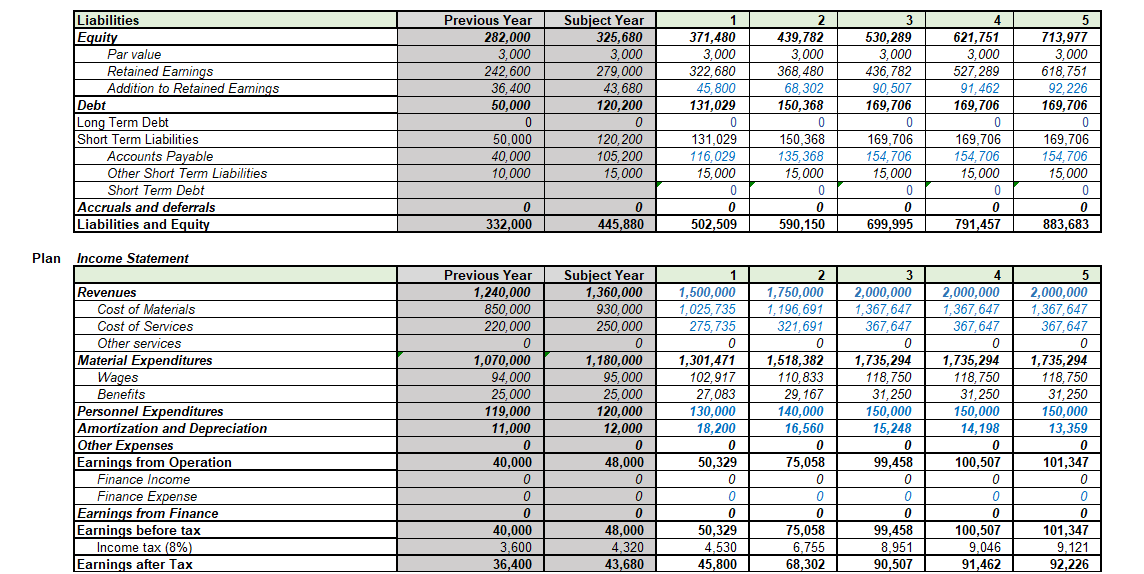

You are told that the firm will buy the neighboring lot, and the c-suite assumes a realistic scenario for the future. Does the firm have

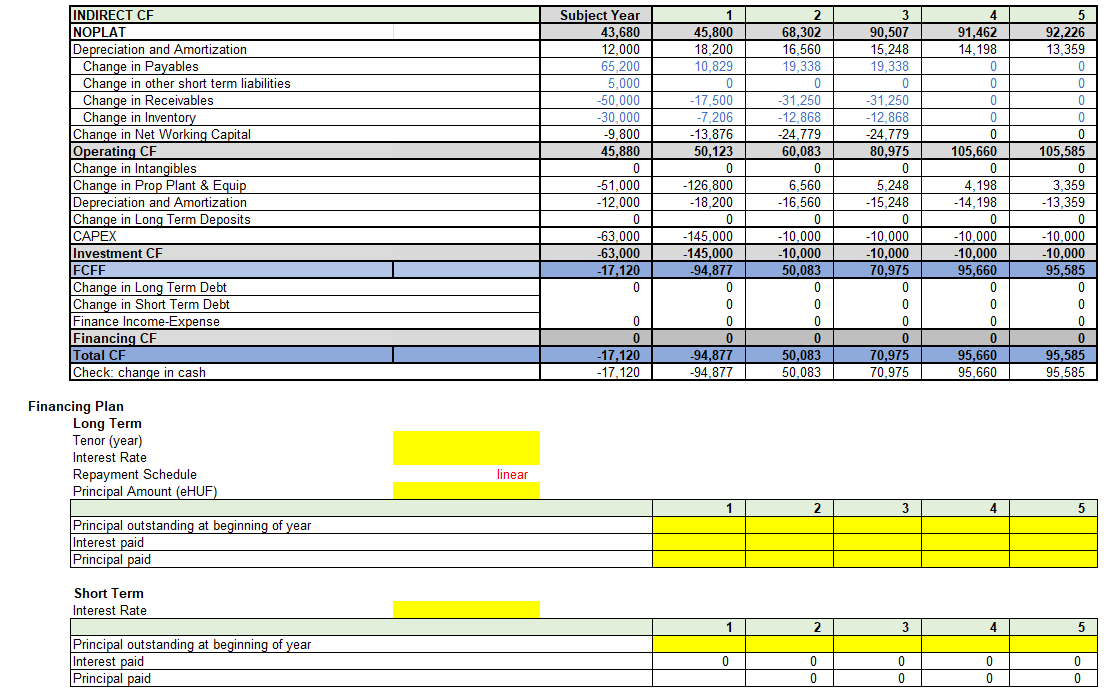

You are told that the firm will buy the neighboring lot, and the c-suite assumes a realistic scenario for the future. Does the firm have sufficient capital? You know that the firn's bank is offering both short and long term financing. Long term financing is available up to 100 mHUF (=100 000 eHUF), for 5 years, at 6% yearly compounded rate for any tenor. Bank deposits yield no interest. Make recommendations for financing plans, debt or equity. How will a particular financing play impact income and cashflow. (only deal with the yellow fields).

PLEASE GUYS, NEED THE ANSWER ASAP! All the information needed is in the question!

1wnnwn Ctatannnt Financing Plan Long Term Tenor (year) Interest Rate Repayment Schedule linear Principal Amount (eHUF) Short Term Interest Rate 1wnnwn Ctatannnt Financing Plan Long Term Tenor (year) Interest Rate Repayment Schedule linear Principal Amount (eHUF) Short Term Interest RateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started