Question

You are told to value a private business for private to private transaction and have the following information: a) The private business has a

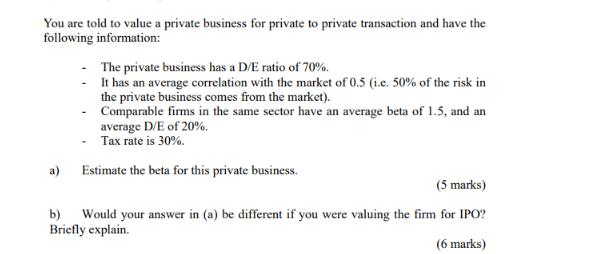

You are told to value a private business for private to private transaction and have the following information: a) The private business has a D/E ratio of 70%. - It has an average correlation with the market of 0.5 (i.e. 50% of the risk in the private business comes from the market). Comparable firms in the same sector have an average beta of 1.5, and an average D/E of 20%. Tax rate is 30%. Estimate the beta for this private business. (5 marks) b) Would your answer in (a) be different if you were valuing the firm for IPO? Briefly explain. (6 marks)

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: James R Mcguigan, R Charles Moyer, William J Kretlow

10th Edition

978-0324289114, 0324289111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App