Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to decide whether to lease a car for 4 years or buy a new car now and sell it for 4 years

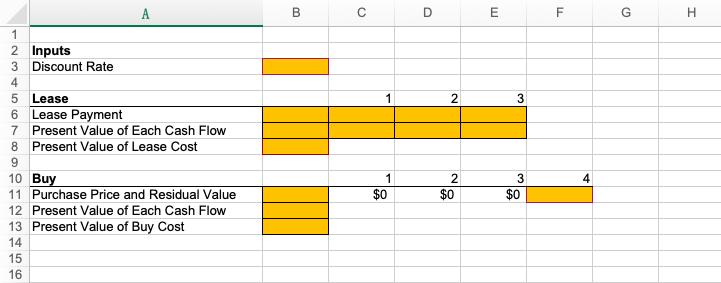

You are trying to decide whether to lease a car for 4 years or buy a new car now and sell it for 4 years later. The annual lease payment would be $6,300 with payments made at the beginning of each year. The new car price is $47,000 now. Four years later, you are expected to sell the car for $33,000. The appropriate discount rate for this project is 7.2%.

Should you buy or lease? Use the present value of cost comparison method Fill out following excel worksheet, please include all the formula or methods!

A Bi D E F H 1 2 Inputs 3 Discount Rate 4. 5 Lease 6 Lease Payment 7 Present Value of Each Cash Flow 1 3 8 Present Value of Lease Cost 9. 10 Buy 2 3 11 Purchase Price and Residual Value $0 $0 $0 12 Present Value of Each Cash Flow 13 Present Value of Buy Cost 14 15 16 4.

Step by Step Solution

★★★★★

3.51 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Net advantage of leasing NPV of leasing NPV of buying Calculation of net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started