Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to estimate the value of Pear Corporation using the WACC approach. As a first step, you decided to estimate the company's

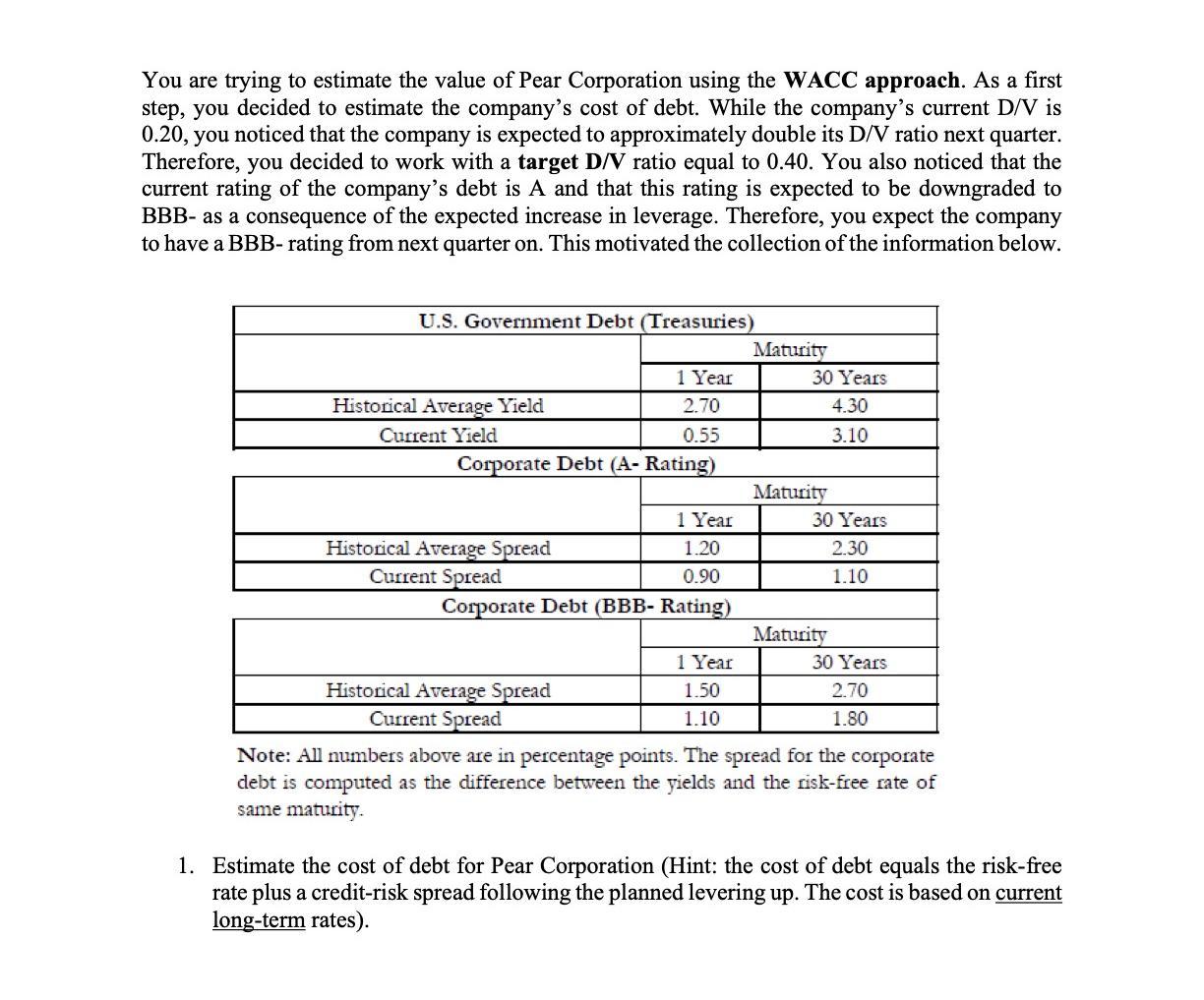

You are trying to estimate the value of Pear Corporation using the WACC approach. As a first step, you decided to estimate the company's cost of debt. While the company's current D/V is 0.20, you noticed that the company is expected to approximately double its D/V ratio next quarter. Therefore, you decided to work with a target D/V ratio equal to 0.40. You also noticed that the current rating of the company's debt is A and that this rating is expected to be downgraded to BBB- as a consequence of the expected increase in leverage. Therefore, you expect the company to have a BBB- rating from next quarter on. This motivated the collection of the information below. U.S. Government Debt (Treasuries) Maturity 1 Year 30 Years 2.70 4.30 0.55 3.10 Historical Average Yield Current Yield Corporate Debt (A- Rating) Maturity 1 Year 30 Years Historical Average Spread 1.20 2.30 Current Spread 0.90 1.10 Corporate Debt (BBB- Rating) Maturity 1 Year 30 Years Historical Average Spread Current Spread 1.50 2.70 1.10 1.80 Note: All numbers above are in percentage points. The spread for the corporate debt is computed as the difference between the yields and the risk-free rate of same maturity. 1. Estimate the cost of debt for Pear Corporation (Hint: the cost of debt equals the risk-free rate plus a credit-risk spread following the planned levering up. The cost is based on current long-term rates). You decided to use the Fama-French 3-factor model to compute the cost of equity for Pear Corporation. As a first step in your analysis, you download historical data on the returns and estimate the following time-series regression: - (rit rft): = a + B[rMT ft] + B'SMB [r small,t- Big.t]+BHML [High B/M,t - "Low B/M,t] + Et Your estimates for , SMB and HML for Pear Corporation were 0.95, 0.43 and 0.25, respectively. The debt-to-value ratio of the company over the estimation period of your regression is 0.20. The Fama-French 3-factor model is given by: E(r) = r; + BME[r RMRF] + 'sMBE[rsMB] + BHMLE[THML] You also decide to make the following additional assumptions: (i) Risk-free rate given by previous table (U.S. Treasuries). (ii) Market minus Risk-free Risk-premium =E[RRMRF]=5.00%; Small-minus-Big Risk-premium= E[RSMB] 4.50%; High B/M-minus-Low B/M Risk Premium =E[RHML]=3.60% (These are the expected return on each of the 3 risk factors, where the latter are represented by 3 zero-cost long-short portfolios). (iii) Company's debt beta = 0 (for all betas; meaning the debt is not sensitive to any of those risk factors). (iv) Target debt-to-value ratio for the company in the future (as previously described): 0.40. (v) Tax rate 40%. 2. Based on this approach, what is the cost of equity and after-tax WACC for the company at the target debt-to-value ratio? (Hint: un-lever and re-lever each of the single equity betas, then use the three re-levered equity betas to calculate firm's cost of equity based on the Fama-French 3-factor model. Then simply calculate the after-tax WACC).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Cost of Debt for Pear Corporation Since Pear Corporations debt rating is expected to downgrade to BBB after the planned increase in leverage we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started