Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are trying to value Kappa Inc., a small, publicly traded entertainment company. The firm generated $ 25 million in operating income (e.g. EBIT)

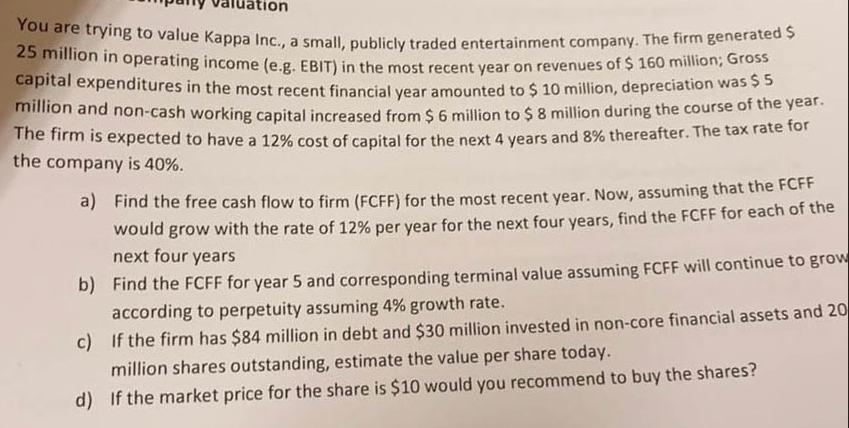

You are trying to value Kappa Inc., a small, publicly traded entertainment company. The firm generated $ 25 million in operating income (e.g. EBIT) in the most recent year on revenues of $ 160 million; Gross capital expenditures in the most recent financial year amounted to $ 10 million, depreciation was $5 million and non-cash working capital increased from $6 million to $8 million during the course of the year. The firm is expected to have a 12% cost of capital for the next 4 years and 8% thereafter. The tax rate for the company is 40%. a) Find the free cash flow to firm (FCFF) for the most recent year. Now, assuming that the FCFF would grow with the rate of 12% per year for the next four years, find the FCFF for each of the next four years b) Find the FCFF for year 5 and corresponding terminal value assuming FCFF will continue to grow according to perpetuity assuming 4% growth rate. c) If the firm has $84 million in debt and $30 million invested in non-core financial assets and 20 million shares outstanding, estimate the value per share today. d) If the market price for the share is $10 would you recommend to buy the shares?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To calculate the Free Cash Flow to Firm FCFF for the most recent year we need to subtract the taxes capital expenditures and changes in worki...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started