Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are using WACC to value a firm and you have detailed free cash flow forecasts for the years 1 through 5. You estimate

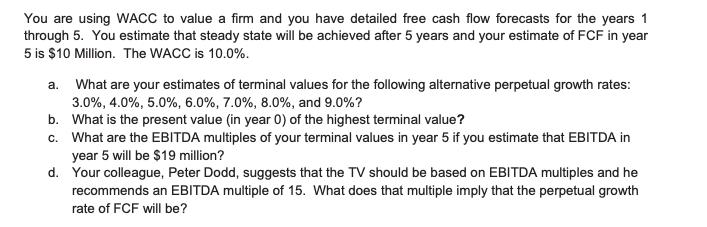

You are using WACC to value a firm and you have detailed free cash flow forecasts for the years 1 through 5. You estimate that steady state will be achieved after 5 years and your estimate of FCF in year 5 is $10 Million. The WACC is 10.0%. What are your estimates of terminal values for the following alternative perpetual growth rates: 3.0%, 4.0%, 5.0%, 6.0%, 7.0%, 8.0%, and 9.0%? b. What is the present value (in year 0) of the highest terminal value? c. What are the EBITDA multiples of your terminal values in year 5 if you estimate that EBITDA in year 5 will be $19 million? d. Your colleague, Peter Dodd, suggests that the TV should be based on EBITDA multiples and he recommends an EBITDA multiple of 15. What does that multiple imply that the perpetual growth rate of FCF will be? a.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer these questions we will need to employ the Gordon Growth Model for calculating terminal value TV and then discount this value back to the pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started