Question

You are valuing Harley using its fiscal 2018 10-K as your final year of historical data. You are in the expansion/adjustment stages, where you are

You are valuing Harley using its fiscal 2018 10-K as your final year of historical data. You are in the expansion/adjustment stages, where you are using information from the Notes to Consolidated Financial Statements.

As of the end of fiscal year 2018, by how much will liabilities increase (over and above the as-reported Consolidated Balance Sheet) as a result of the total "grossing-up" adjustments for pension and SERPA benefits and post retirement healthcare benefits

14. Employee Benefit Plans and Other Postretirement Benefits

The Company has a qualified defined benefit pension plan and postretirement healthcare benefit plans, which cover employees of the Motorcycles segment. The Company also has unfunded supplemental employee retirement plan agreements (SERPA) with certain employees which were instituted to replace benefits lost under the Tax Revenue Reconciliation Act of 1993.

Pension benefits are based primarily on years of service and, for certain plans, levels of compensation. Employees are eligible to receive postretirement healthcare benefits upon attaining age 55 after rendering at least 10 years of service to the Company. Some of the plans require employee contributions to partially offset benefit costs.

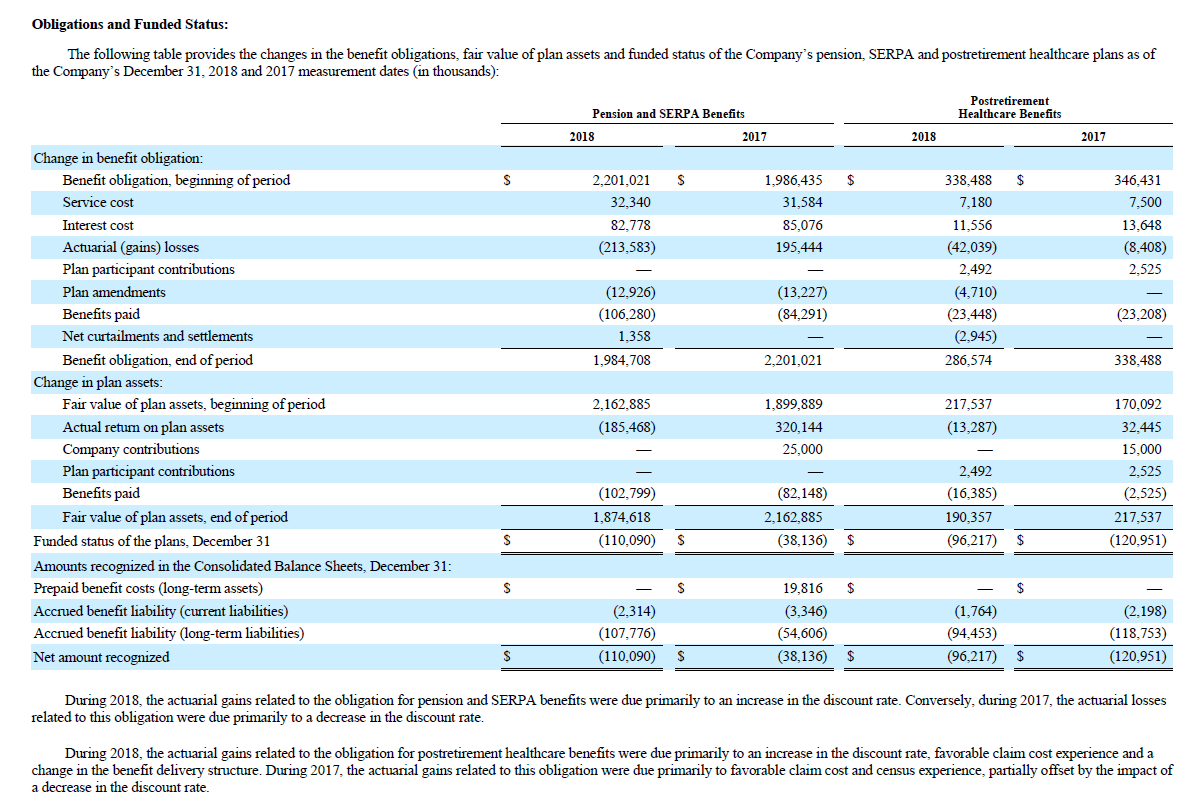

Obligations and Funded Status: The following table provides the changes in the benefit obligations, fair value of plan assets and funded status of the Company's pension, SERPA and postretirement healthcare plans as of the Company's December 31, 2018 and 2017 measurement dates (in thousands): During 2018, the actuarial gains related to the obligation for postretirement healthcare benefits were due primarily to an increase in the discount rate, favorable claim cost experience and a change in the benefit delivery structure. During 2017 , the actuarial gains related to this obligation were due primarily to favorable claim cost and census experience, partially offset by the impact of a decrease in the discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started