Answered step by step

Verified Expert Solution

Question

1 Approved Answer

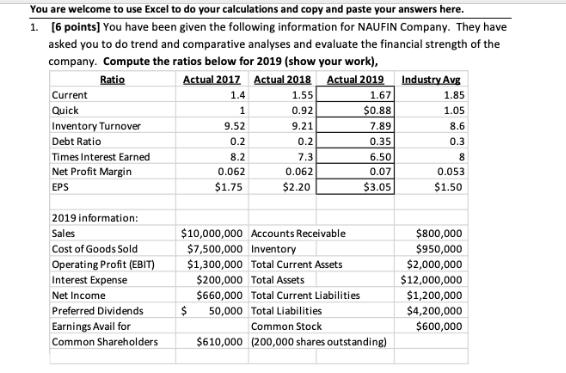

You are welcome to use Excel to do your calculations and copy and paste your answers here. 1. [6 points] You have been given

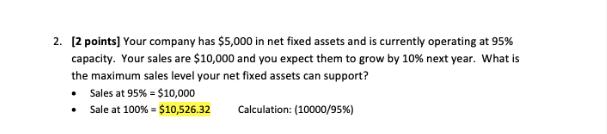

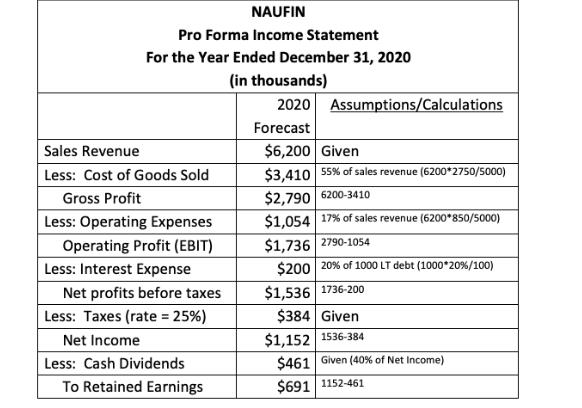

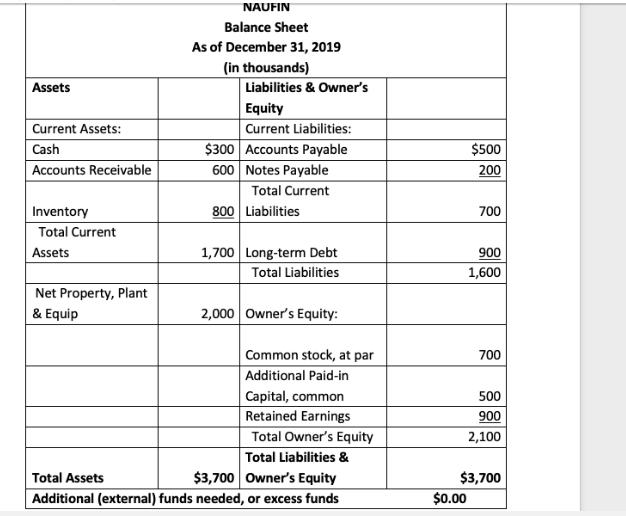

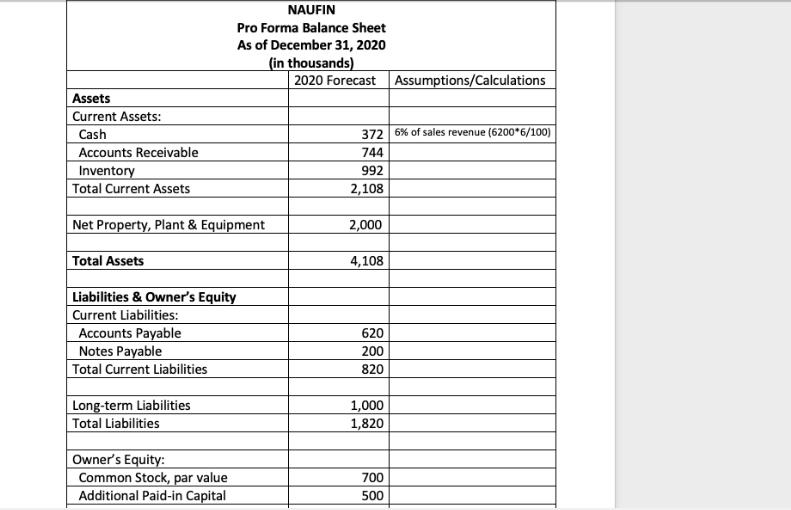

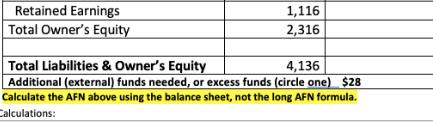

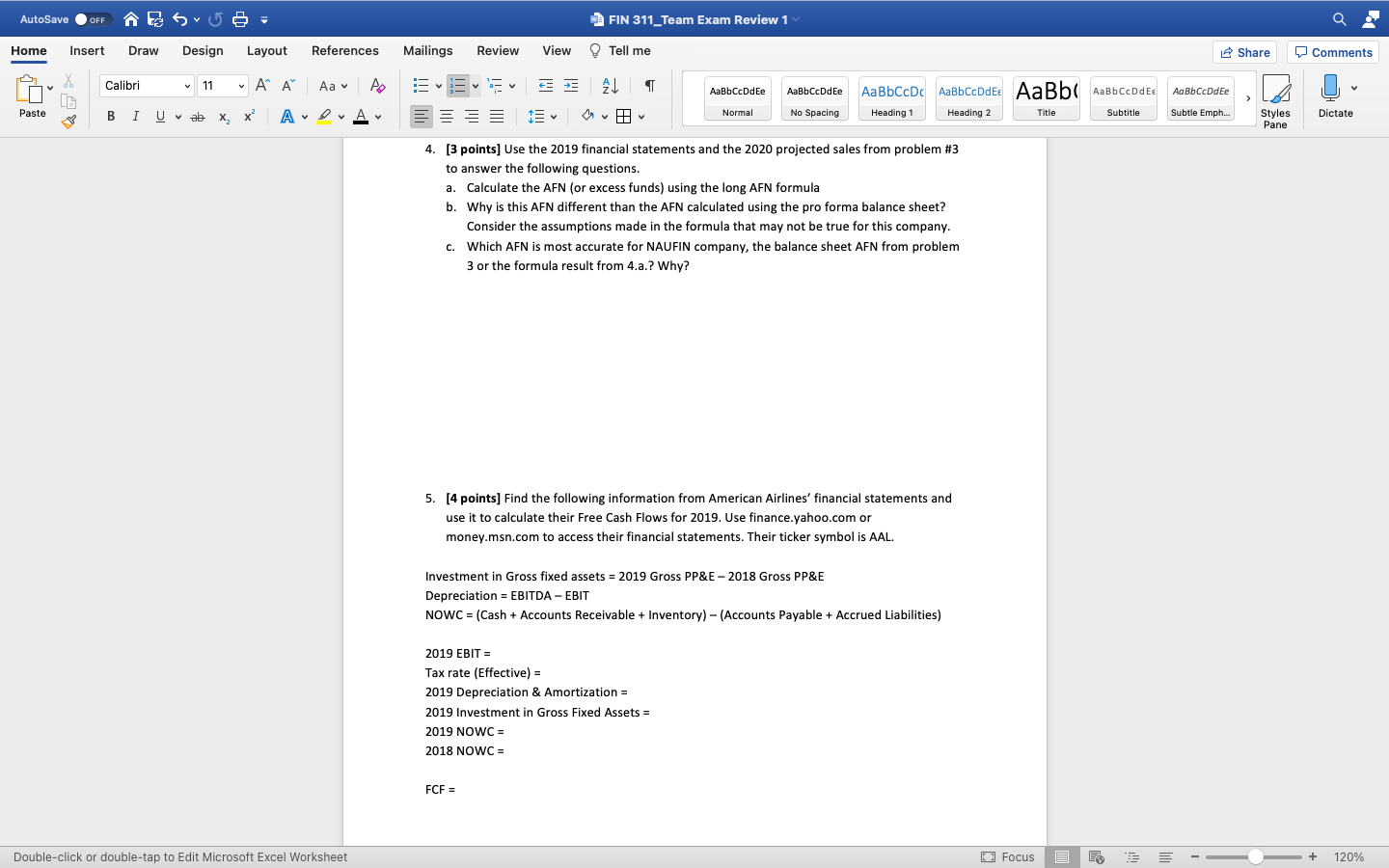

You are welcome to use Excel to do your calculations and copy and paste your answers here. 1. [6 points] You have been given the following information for NAUFIN Company. They have asked you to do trend and comparative analyses and evaluate the financial strength of the company. Compute the ratios below for 2019 (show your work), Ratio Actual 2017 Actual 2018 Actual 2019 1.55 0.92 9.21 0.2 7.3 0.062 $2.20 Current Quick Inventory Turnover Debt Ratio Times Interest Earned Net Profit Margin EPS 2019 information: Sales Cost of Goods Sold Operating Profit (EBIT) Interest Expense Net Income Preferred Dividends Earnings Avail for Common Shareholders 1.4 1 9.52 0.2 8.2 0.062 $1.75 $10,000,000 Accounts Receivable $7,500,000 Inventory $1,300,000 Total Current Assets $200,000 Total Assets $660,000 Total Current Liabilities $ 50,000 Total Liabilities 1.67 $0.88 7.89 0.35 6.50 0.07 $3.05 Common Stock $610,000 (200,000 shares outstanding) Industry Avg 1.85 1.05 8.6 0.3 8 0.053 $1.50 $800,000 $950,000 $2,000,000 $12,000,000 $1,200,000 $4,200,000 $600,000 2. [2 points] Your company has $5,000 in net fixed assets and is currently operating at 95% capacity. Your sales are $10,000 and you expect them to grow by 10% next year. What is the maximum sales level your net fixed assets can support? Sales at 95% = $10,000 Sale at 100% = $10,526.32 Calculation: (10000/95%) NAUFIN Pro Forma Income Statement For the Year Ended December 31, 2020 (in Sales Revenue Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Operating Profit (EBIT) Less: Interest Expense Net profits before taxes Less: Taxes (rate = 25%) Net Income Less: Cash Dividends To Retained Earnings thousands) 2020 Assumptions/Calculations Forecast $6,200 Given $3,410 55% of sales revenue (6200*2750/5000) $2,790 6200-3410 $1,054 17% of sales revenue (6200*850/5000) $1,736 2790-1054 $200 20% of 1000 LT debt (1000*20%/100) $1,536 1736-200 $384 Given $1,152 1536-384 $461 Given (40% of Net Income) $691 1152-461 Assets Current Assets: Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equip NAUFIN Balance Sheet As of December 31, 2019 (in thousands) Liabilities & Owner's Equity Current Liabilities: $300 Accounts Payable 600 Notes Payable Total Current 800 Liabilities 1,700 Long-term Debt Total Liabilities 2,000 Owner's Equity: Common stock, at par Additional Paid-in Capital, common Retained Earnings Total Owner's Equity Total Liabilities & Total Assets $3,700 Owner's Equity Additional (external) funds needed, or excess funds $500 200 $0.00 700 900 1,600 700 500 900 2,100 $3,700 Assets Current Assets: Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equipment Total Assets Liabilities & Owner's Equity Current Liabilities: Accounts Payable Notes Payable Total Current Liabilities NAUFIN Pro Forma Balance Sheet As of December 31, 2020 (in thousands) Long-term Liabilities Total Liabilities Owner's Equity: Common Stock, par value Additional Paid-in Capital 2020 Forecast Assumptions/Calculations 372 6% of sales revenue (6200*6/100) 744 992 2,108 2,000 4,108 620 200 820 1,000 1,820 700 500 Retained Earnings Total Owner's Equity 1,116 2,316 Total Liabilities & Owner's Equity 4,136 Additional (external) funds needed, or excess funds (circle one) $28 Calculate the AFN above using the balance sheet, not the long AFN formula. Calculations: AutoSave OFF Home Insert Draw Design Layout A^ A BIU al x, x A Paste LG S Calibri 11 References Aav Po A A Double-click or double-tap to Edit Microsoft Excel Worksheet V Mailings E- Review View E E FCF = | FIN 311_Team Exam Review 1 Tell me A AaBbCcDdEe Normal AaBbCcDdEe No Spacing 4. [3 points] Use the 2019 financial statements and the 2020 projected sales from problem #3 to answer the following questions. a. Calculate the AFN (or excess funds) using the long AFN formula b. Why is this AFN different than the AFN calculated using the pro forma balance sheet? Consider the assumptions made in the formula that may not be true for this company. c. Which AFN is most accurate for NAUFIN company, the balance sheet AFN from problem 3 or the formula result from 4.a.? Why? 2019 EBIT = Tax rate (Effective) = 2019 Depreciation & Amortization = 2019 Investment in Gross Fixed Assets = 2019 NOWC = 2018 NOWC= AaBbCcDc AaBbCcDdEe AaBb( AaBbcDdEe Heading 1 Heading 2 Title Subtitle 5. [4 points] Find the following information from American Airlines' financial statements and use it to calculate their Free Cash Flows for 2019. Use finance.yahoo.com or money.msn.com to access their financial statements. Their ticker symbol is AAL. Investment in Gross fixed assets=2019 Gross PP&E - 2018 Gross PP&E Depreciation EBITDA - EBIT NOWC = (Cash + Accounts Receivable + Inventory) - (Accounts Payable + Accrued Liabilities) Focus AaBb CcDdEe Subtle Emph... REE Share Styles Pane Comments Dictate + 120%

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for NAUFIN Company based on the information provided 1 Ratios for 2019 Cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started