Question

You are working as a bookkeeper of XYD Limited and have prepared the following trial balan ce as at 31st March 2022. However, you did

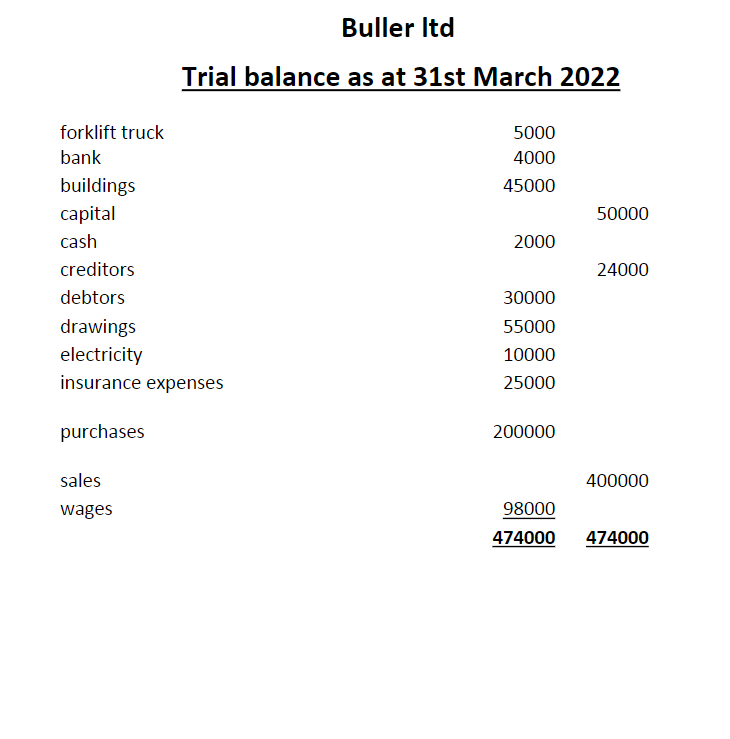

You are working as a bookkeeper of XYD Limited and have prepared the following trial balan ce as at 31st March 2022.

ce as at 31st March 2022.

However, you did not take the following transactions into consideration: 1. Electricity bill of 200 was not taken into account 2. Insurance premium of 150 was paid in advance for next year but you did not take this into account 3. A 10% depreciation charge on fork-lift truck costing 5000 was not taken into account 4. Mr Abdul owes the business 250 for goods he previously bought but now he has gone abroad and does not pay. TASK REQUIRED: (a): You are required to prepare final accounts (income statement, and balance sheet) for the business taking the above 4 transactions into consideration, explaining the adjustments involved and showing their effect on the business income statement and balance sheet. (b): List 3 users of financial accounts and suggest one piece of information that each user group may require from those set of accounts.

Buller Itd Trial balance as at 31st March 2022 5000 4000 45000 50000 2000 24000 30000 55000 10000 25000 200000 400000 98000 474000 474000 forklift truck bank buildings capital cash creditors debtors drawings electricity insurance expenses purchases sales wagesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started