Answered step by step

Verified Expert Solution

Question

1 Approved Answer

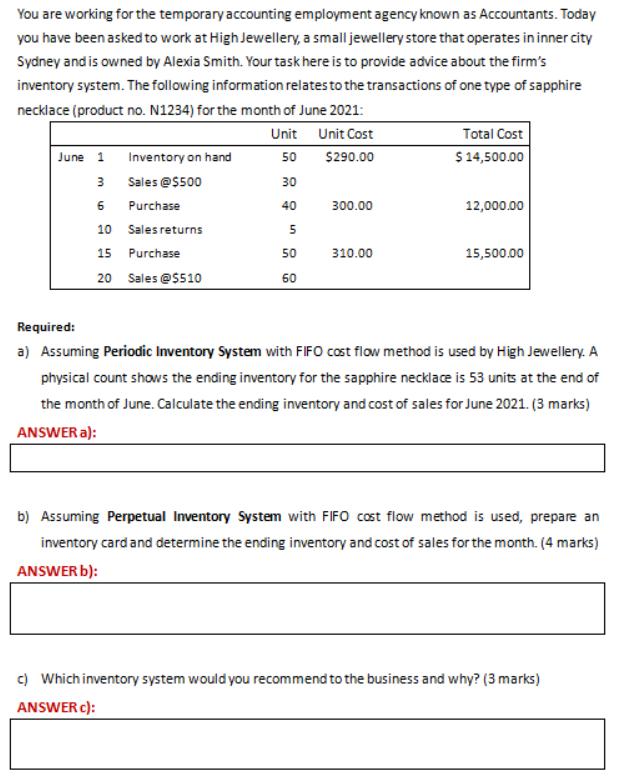

You are working for the temporary accounting employment agency known as Accountants. Today you have been asked to work at High Jewellery, a smail

You are working for the temporary accounting employment agency known as Accountants. Today you have been asked to work at High Jewellery, a smail jewellery store that operates in inner city Sydney and is owned by Alexia Smith. Your task here is to provide advice about the firm's inventory system. The following information relates to the transactions of one type of sapphire necklace (product no. N1234) for the month of June 2021: Unit Unit Cost Total Cost June 1 Inventory on hand 50 S290.00 $14,500.00 3 Sales @S500 30 6 Purchase 40 300.00 12,000.00 10 Sales returns 15 Purchase 50 310.00 15,500.00 20 Sales @5510 60 Required: a) Assuming Periodic Inventory System with FIFO cost flow method is used by High Jewellery. A physical count shows the ending inventory for the sapphire necklace is 53 units at the end of the month of June. Calculate the ending inventory and cost of sales for June 2021. (3 marks) ANSWER a): b) Assuming Perpetual Inventory System with FIFO cost flow method is used, prepare an inventory card and determine the ending inventory and cost of sales for the month. (4 marks) ANSWER b): c) Which inventory system would you recommend to the business and why? (3 marks) ANSWER c):

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Periodic Inventory System Method 290 14500 300 12000 310 15500 42000 01Jun Beginning Inventory 06J...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started