You are working on the bank reconciliation for Cadman Corp. for the year ended October 31. You're reperforming the bank reconciliation as part of

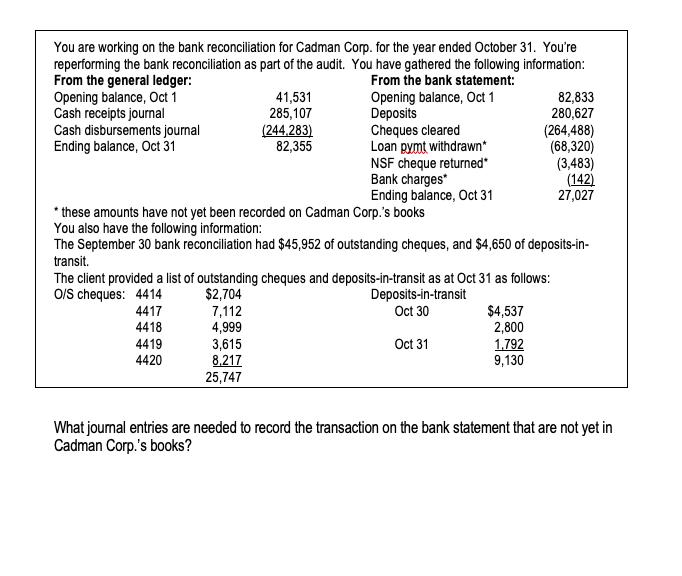

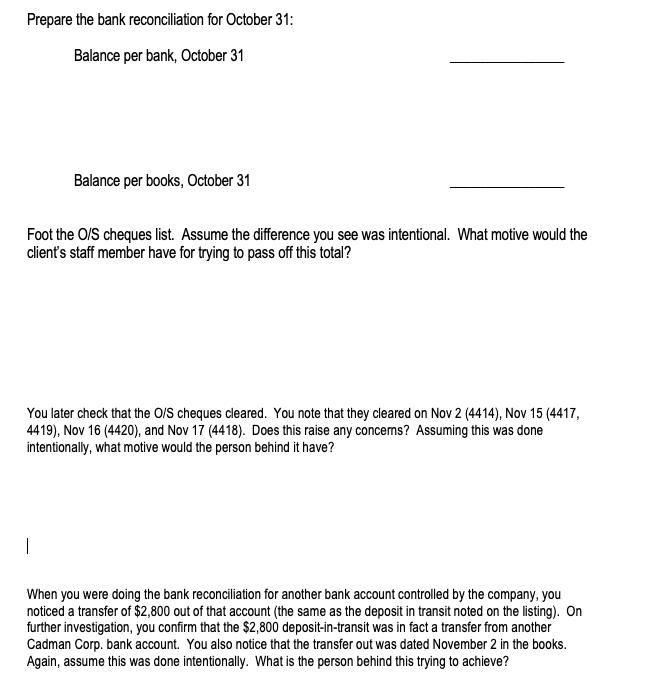

You are working on the bank reconciliation for Cadman Corp. for the year ended October 31. You're reperforming the bank reconciliation as part of the audit. You have gathered the following information: From the general ledger: Opening balance, Oct 1 Cash receipts journal From the bank statement: Cash disbursements journal Ending balance, Oct 31 41,531 285,107 (244,283) 82,355 Opening balance, Oct 1 Deposits Cheques cleared 3,615 8,217 25,747 Loan pymt withdrawn* NSF cheque returned* Bank charges* Ending balance, Oct 31 *these amounts have not yet been recorded on Cadman Corp.'s books You also have the following information: The September 30 bank reconciliation had $45,952 of outstanding cheques, and $4,650 of deposits-in- transit. 82,833 280,627 The client provided a list of outstanding cheques and deposits-in-transit as at Oct 31 as follows: O/S cheques: 4414 $2,704 4417 7,112 4418 4,999 4419 4420 Deposits-in-transit Oct 30 Oct 31 (264,488) (68,320) (3,483) (142) 27,027 $4,537 2,800 1.792 9,130 What journal entries are needed to record the transaction on the bank statement that are not yet in Cadman Corp.'s books? Prepare the bank reconciliation for October 31: Balance per bank, October 31 Balance per books, October 31 Foot the O/S cheques list. Assume the difference you see was intentional. What motive would the client's staff member have for trying to pass off this total? You later check that the O/S cheques cleared. You note that they cleared on Nov 2 (4414), Nov 15 (4417, 4419), Nov 16 (4420), and Nov 17 (4418). Does this raise any concerns? Assuming this was done intentionally, what motive would the person behind it have? 1 When you were doing the bank reconciliation for another bank account controlled by the company, you noticed a transfer of $2,800 out of that account (the same as the deposit in transit noted on the listing). On further investigation, you confirm that the $2,800 deposit-in-transit was in fact a transfer from another Cadman Corp. bank account. You also notice that the transfer out was dated November 2 in the books. Again, assume this was done intentionally. What is the person behind this trying to achieve?

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To record the transactions on the bank statement that are not yet in Cadman Corps books the following journal entries are needed Loan payment Debit Loan payable account for 3483 Credit Cash a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started