Answered step by step

Verified Expert Solution

Question

1 Approved Answer

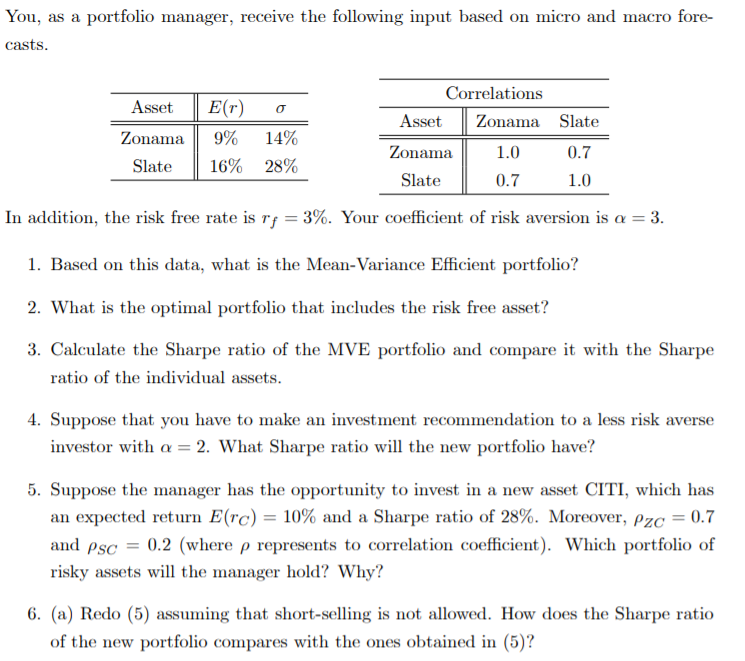

You, as a portfolio manager, receive the following input based on micro and macro fore- casts. Asset E(r) 0 Zonama 9% 14% Slate 16%

You, as a portfolio manager, receive the following input based on micro and macro fore- casts. Asset E(r) 0 Zonama 9% 14% Slate 16% 28% Correlations Asset Zonama Slate 1.0 0.7 Zonama Slate 0.7 1.0 In addition, the risk free rate is r = 3%. Your coefficient of risk aversion is a = 3. 1. Based on this data, what is the Mean-Variance Efficient portfolio? 2. What is the optimal portfolio that includes the risk free asset? 3. Calculate the Sharpe ratio of the MVE portfolio and compare it with the Sharpe ratio of the individual assets. 4. Suppose that you have to make an investment recommendation to a less risk averse investor with a = 2. What Sharpe ratio will the new portfolio have? 5. Suppose the manager has the opportunity to invest in a new asset CITI, which has an expected return E(rc) = 10% and a Sharpe ratio of 28%. Moreover, Pzc = 0.7 and psc = 0.2 (where p represents to correlation coefficient). Which portfolio of risky assets will the manager hold? Why? 6. (a) Redo (5) assuming that short-selling is not allowed. How does the Sharpe ratio of the new portfolio compares with the ones obtained in (5)?

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions well use the meanvariance portfolio optimization framework 1 MeanVariance Efficient MVE Portfolio To find the MVE portfolio we need to calculate the weights of the assets that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started