Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You assume that you form a team. Your team is going to take part in an HKMU competition. The maximum number of students in

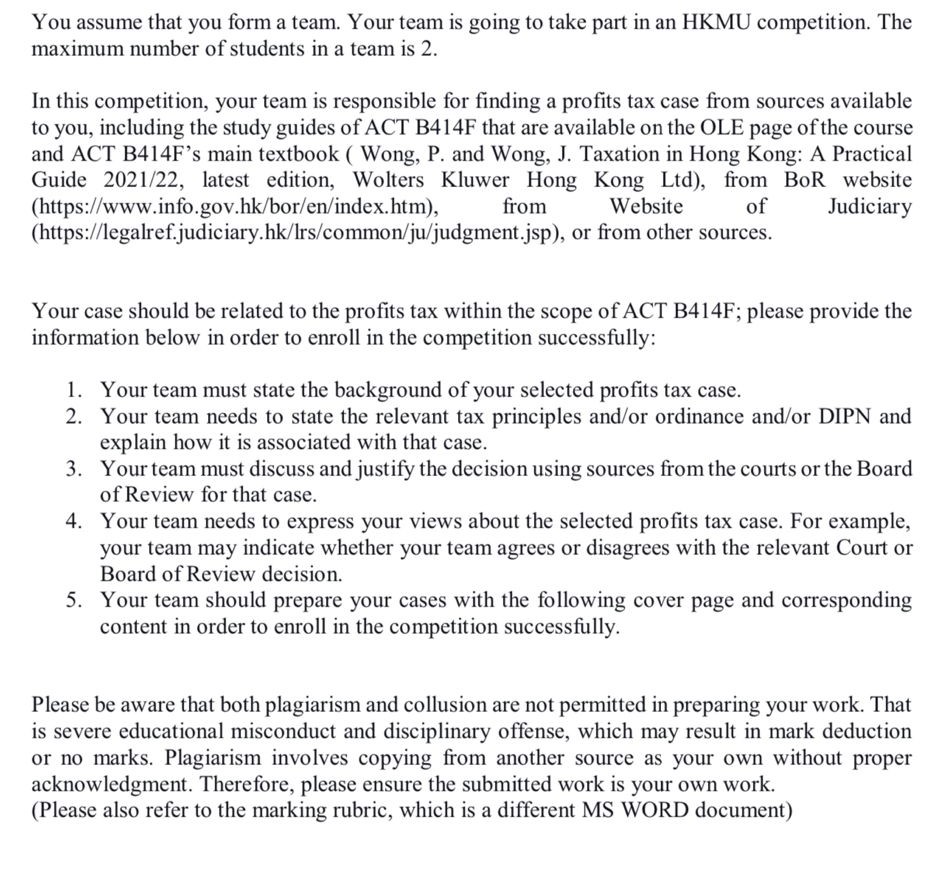

You assume that you form a team. Your team is going to take part in an HKMU competition. The maximum number of students in a team is 2. In this competition, your team is responsible for finding a profits tax case from sources available to you, including the study guides of ACT B414F that are available on the OLE page of the course and ACT B414F's main textbook ( Wong, P. and Wong, J. Taxation in Hong Kong: A Practical Guide 2021/22, latest edition, Wolters Kluwer Hong Kong Ltd), from BoR website (https://www.info.gov.hk/bor/en/index.htm), Website from of Judiciary (https://legalref.judiciary.hk/lrs/common/ju/judgment.jsp), or from other sources. Your case should be related to the profits tax within the scope of ACT B414F; please provide the information below in order to enroll in the competition successfully: 1. Your team must state the background of your selected profits tax case. 2. Your team needs to state the relevant tax principles and/or ordinance and/or DIPN and explain how it is associated with that case. 3. Your team must discuss and justify the decision using sources from the courts or the Board of Review for that case. 4. Your team needs to express your views about the selected profits tax case. For example, your team may indicate whether your team agrees or disagrees with the relevant Court or Board of Review decision. 5. Your team should prepare your cases with the following cover page and corresponding content in order to enroll in the competition successfully. Please be aware that both plagiarism and collusion are not permitted in preparing your work. That is severe educational misconduct and disciplinary offense, which may result in mark deduction or no marks. Plagiarism involves copying from another source as your own without proper acknowledgment. Therefore, please ensure the submitted work is your own work. (Please also refer to the marking rubric, which is a different MS WORD document)

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

HKMU Competition Entry Profit Tax Case Analysis Team Name Tax Savvy Team Members Alice Chen David Lee Kevin White Case Background Our selected profits ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started