You believe that oil prices will be rising more than expected, and that rising prices will result in lower earnings for industrial companies that

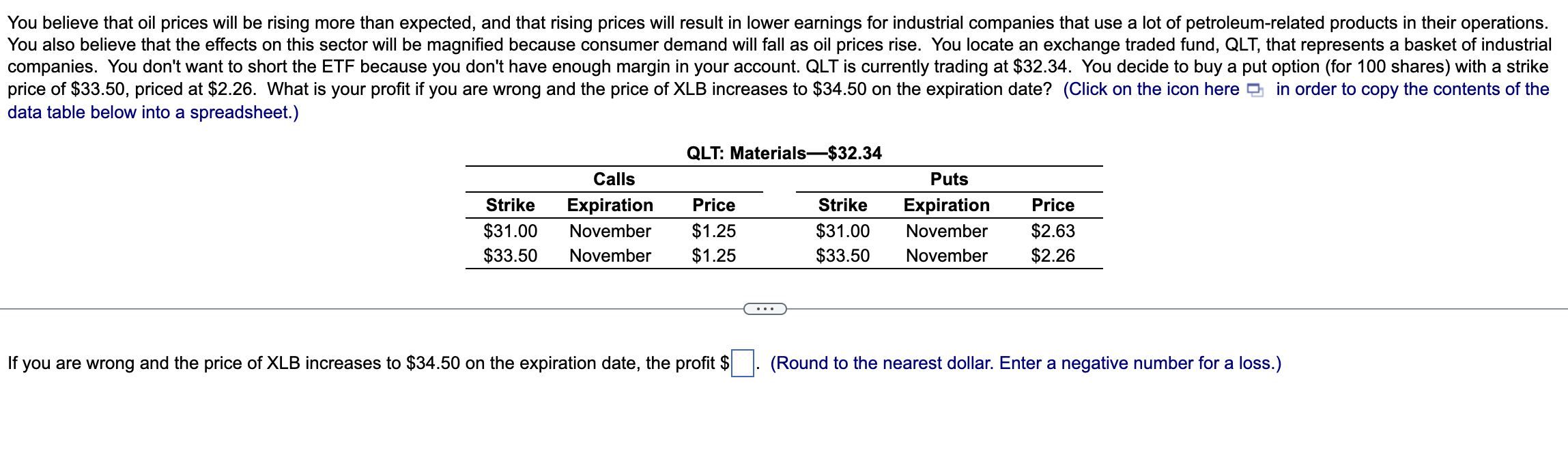

You believe that oil prices will be rising more than expected, and that rising prices will result in lower earnings for industrial companies that use a lot of petroleum-related products in their operations. You also believe that the effects on this sector will be magnified because consumer demand will fall as oil prices rise. You locate an exchange traded fund, QLT, that represents a basket of industrial companies. You don't want to short the ETF because you don't have enough margin in your account. QLT is currently trading at $32.34. You decide to buy a put option (for 100 shares) with a strike price of $33.50, priced at $2.26. What is your profit if you are wrong and the price of XLB increases to $34.50 on the expiration date? (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) QLT: Materials-$32.34 Strike Calls Expiration $31.00 November $33.50 November Price $1.25 $1.25 Puts Strike Expiration Price $31.00 November $2.63 $33.50 November $2.26 ... If you are wrong and the price of XLB increases to $34.50 on the expiration date, the profit $ (Round to the nearest dollar. Enter a negative number for a loss.)

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

If the price of XLB increases to 3450 on the expiration date it means that the put option y...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started