Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the 30-year mortgage with interest rate 6%. Assuming

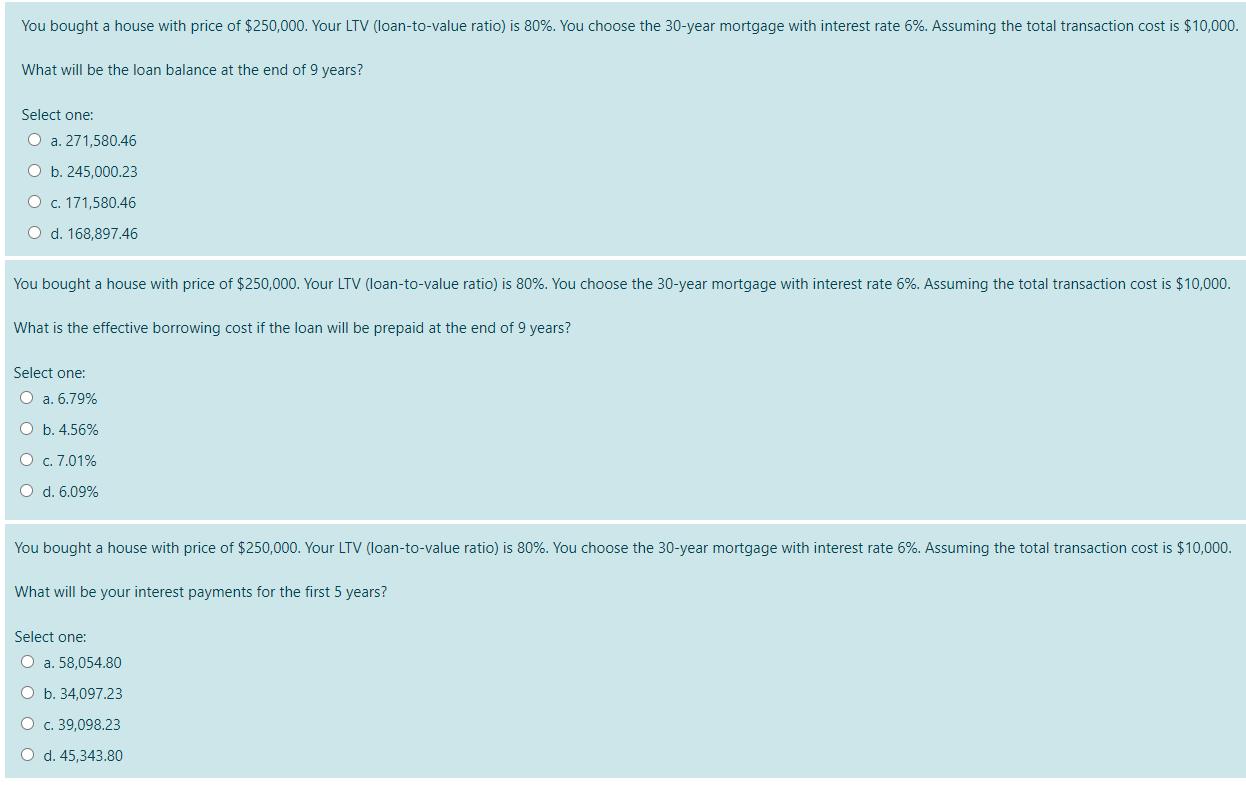

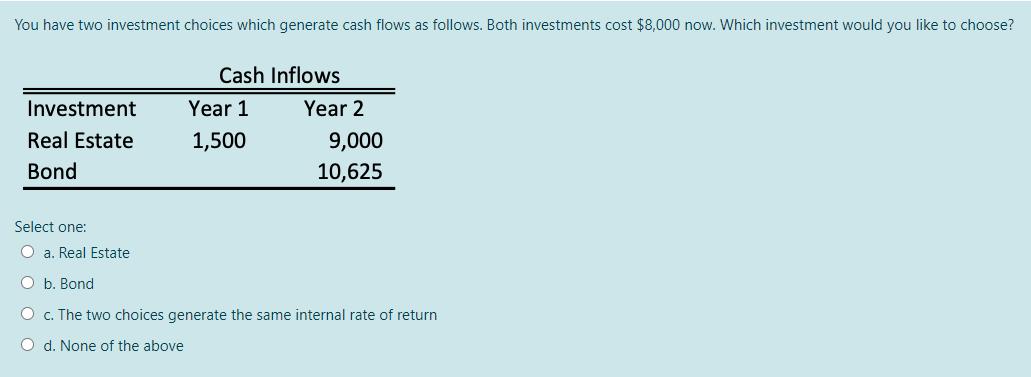

You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the 30-year mortgage with interest rate 6%. Assuming the total transaction cost is $10,000. What will be the loan balance at the end of 9 years? Select one: O a. 271,580.46 O b. 245,000.23 O c. 171,580.46 O d. 168,897.46 You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the 30-year mortgage with interest rate 6%. Assuming the total transaction cost is $10,000. What is the effective borrowing cost if the loan will be prepaid at the end of 9 years? Select one: O a. 6.79% O b. 4.56% O c. 7.01% O d. 6.09% You bought a house with price of $250,000. Your LTV (loan-to-value ratio) is 80%. You choose the 30-year mortgage with interest rate 6%. Assuming the total transaction cost is $10,000. What will be your interest payments for the first 5 years? Select one: O a. 58,054.80 O b. 34,097.23 O c. 39,098.23 O d. 45,343.80 You have two investment choices which generate cash flows as follows. Both investments cost $8,000 now. Which investment would you like to choose? Cash Inflows Investment Year 1 Year 2 Real Estate 1,500 9,000 Bond 10,625 Select one: O a. Real Estate O b. Bond O c. The two choices generate the same internal rate of return O d. None of the above

Step by Step Solution

★★★★★

3.60 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Total amount borrowed 25000080 200000 Interest rate per month ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started