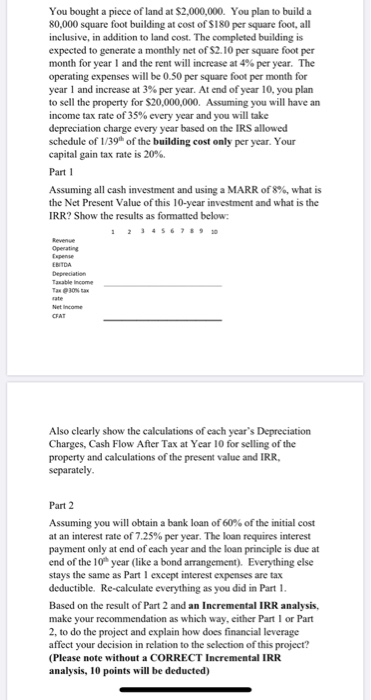

You bought a piece of land at $2,000,000. You plan to build a 80,000 square foot building at cost of S180 per square foot, all inclusive, in addition to land cost. The completed building is expected to generate a monthly net of $2.10 per square foot per month for year 1 and the rent will increase at 4% per year. The operating expenses will be 0.50 per square foot per month for year 1 and increase at 3% per year. At end of year 10, you plan to sell the property for $20,000,000. Assuming you will have an income tax rate of 35% every year and you will take depreciation charge every year based on the IRS allowed schedule of 1/39 of the building cost only per year. Your capital gain tax rate is 20%. Part 1 Assuming all cash investment and using a MARR of 8%, what is the Net Present Value of this 10-year investment and what is the IRR? Show the results as formatted below: Operating Taxable income Tax Also clearly show the calculations of each year's Depreciation Charges, Cash Flow After Tax at Year 10 for selling of the property and calculations of the present value and IRR, separately. Part 2 Assuming you will obtain a bank loan of 60% of the initial cost at an interest rate of 7.25% per year. The loan requires interest payment only at end of each year and the loan principle is due at end of the 10 year (like a bond arrangement). Everything else stays the same as Part 1 except interest expenses are tax deductible. Re-calculate everything as you did in Part 1 Based on the result of Part 2 and an incremental IRR analysis, make your recommendation as which way, either Part I or Part 2, to do the project and explain how does financial leverage affect your decision in relation to the selection of this project? (Please note without a CORRECT Incremental IRR analysis, 10 points will be deducted) You bought a piece of land at $2,000,000. You plan to build a 80,000 square foot building at cost of S180 per square foot, all inclusive, in addition to land cost. The completed building is expected to generate a monthly net of $2.10 per square foot per month for year 1 and the rent will increase at 4% per year. The operating expenses will be 0.50 per square foot per month for year 1 and increase at 3% per year. At end of year 10, you plan to sell the property for $20,000,000. Assuming you will have an income tax rate of 35% every year and you will take depreciation charge every year based on the IRS allowed schedule of 1/39 of the building cost only per year. Your capital gain tax rate is 20%. Part 1 Assuming all cash investment and using a MARR of 8%, what is the Net Present Value of this 10-year investment and what is the IRR? Show the results as formatted below: Operating Taxable income Tax Also clearly show the calculations of each year's Depreciation Charges, Cash Flow After Tax at Year 10 for selling of the property and calculations of the present value and IRR, separately. Part 2 Assuming you will obtain a bank loan of 60% of the initial cost at an interest rate of 7.25% per year. The loan requires interest payment only at end of each year and the loan principle is due at end of the 10 year (like a bond arrangement). Everything else stays the same as Part 1 except interest expenses are tax deductible. Re-calculate everything as you did in Part 1 Based on the result of Part 2 and an incremental IRR analysis, make your recommendation as which way, either Part I or Part 2, to do the project and explain how does financial leverage affect your decision in relation to the selection of this project? (Please note without a CORRECT Incremental IRR analysis, 10 points will be deducted)