Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You bought an 8-year bond with $1,000 face value with semi-annual coupon at 6.5% when the YTM is 7.5%. You sold the bond after

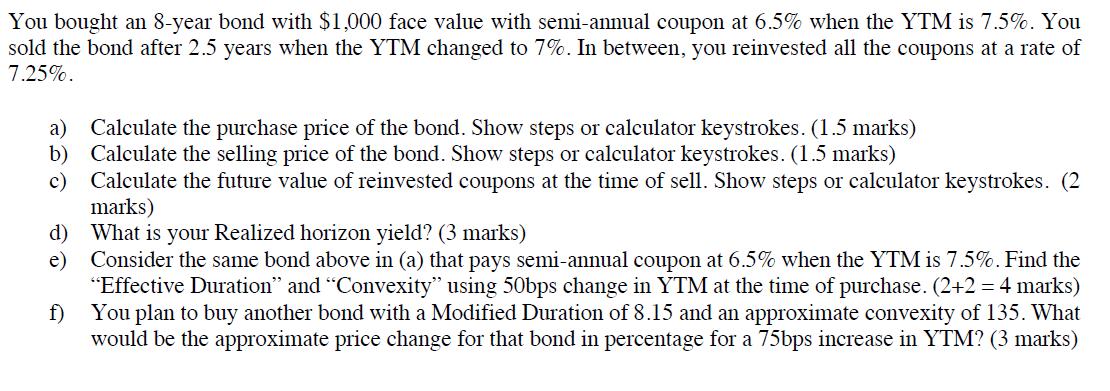

You bought an 8-year bond with $1,000 face value with semi-annual coupon at 6.5% when the YTM is 7.5%. You sold the bond after 2.5 years when the YTM changed to 7%. In between, you reinvested all the coupons at a rate of 7.25%. a) Calculate the purchase price of the bond. Show steps or calculator keystrokes. (1.5 marks) b) Calculate the selling price of the bond. Show steps or calculator keystrokes. (1.5 marks) c) Calculate the future value of reinvested coupons at the time of sell. Show steps or calculator keystrokes. (2 marks) d) What is your Realized horizon yield? (3 marks) e) Consider the same bond above in (a) that pays semi-annual coupon at 6.5% when the YTM is 7.5%. Find the "Effective Duration" and "Convexity" using 50bps change in YTM at the time of purchase. (2+2 = 4 marks) f) You plan to buy another bond with a Modified Duration of 8.15 and an approximate convexity of 135. What would be the approximate price change for that bond in percentage for a 75bps increase in YTM? (3 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started