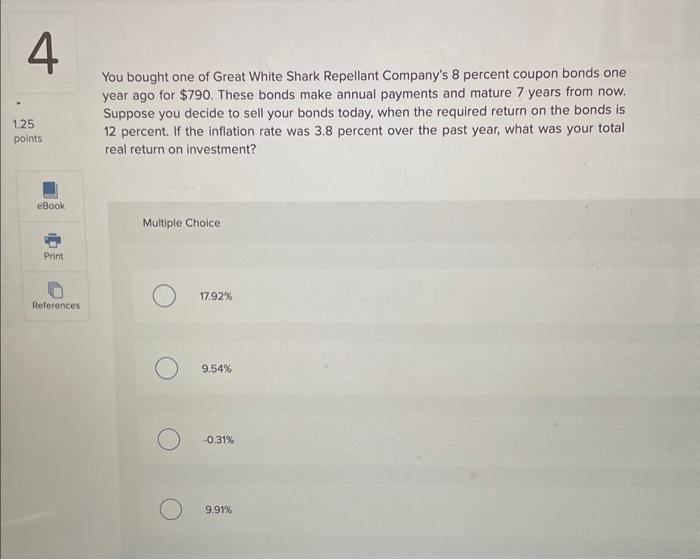

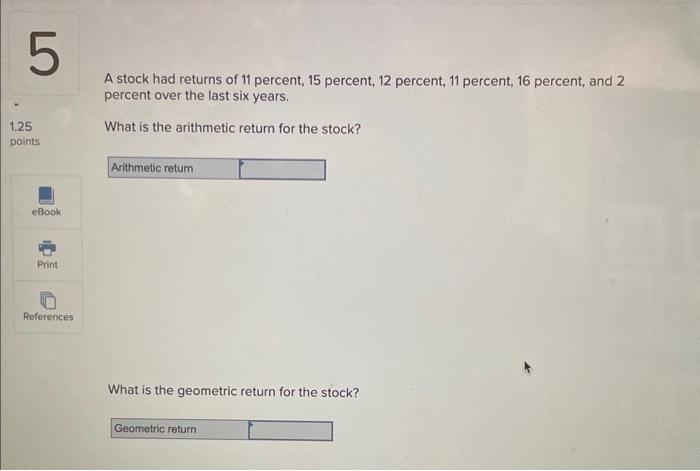

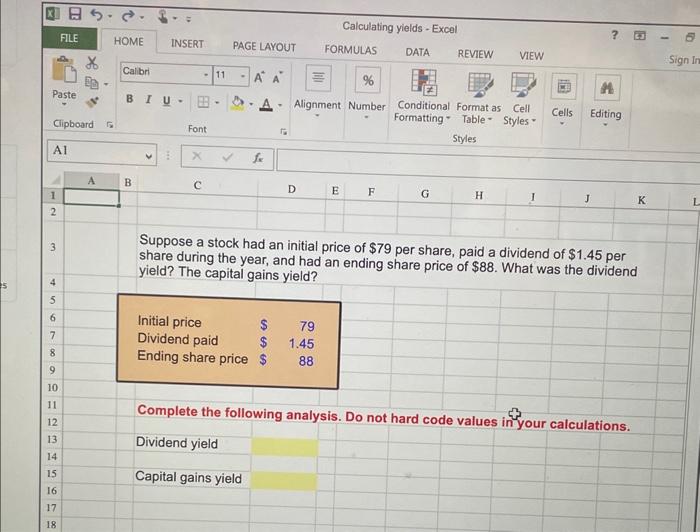

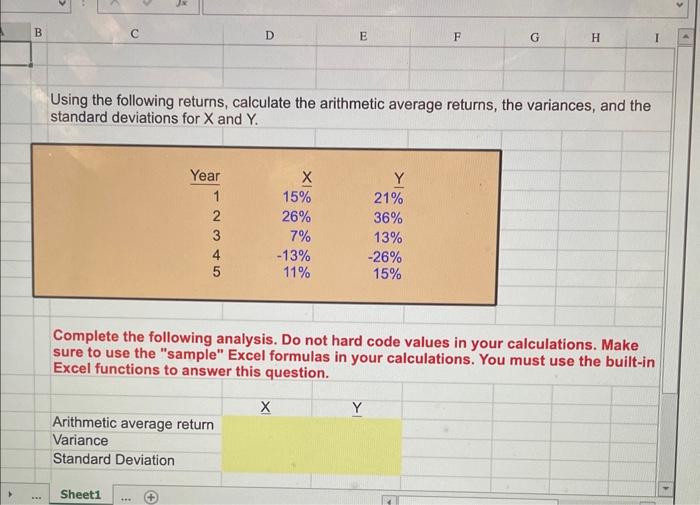

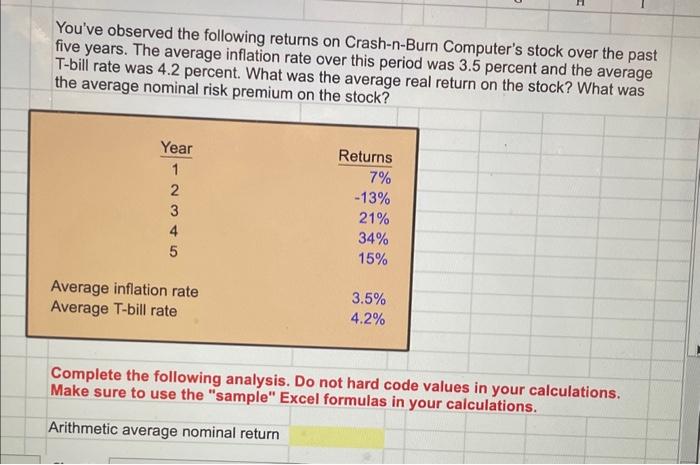

You bought one of Great White Shark Repellant Company's 8 percent coupon bonds one year ago for $790. These bonds make annual payments and mature 7 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 12 percent. If the inflation rate was 3.8 percent over the past year, what was your total real return on investment? Multiple Choice 17.92% 9.54% 0.31% 9.91% A stock had returns of 11 percent, 15 percent, 12 percent, 11 percent, 16 percent, and 2 percent over the last six years. What is the arithmetic return for the stock? What is the geometric return for the stock? Suppose a stock had an initial price of $79 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $88. What was the dividend yield? The capital gains yield? Complete the following analysis. Do not hard code values in your calculations. Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Complete the following analysis. Do not hard code values in your calculations. Make sure to use the "sample" Excel formulas in your calculations. You must use the built-in Excel functions to answer this question. You've observed the following returns on Crash-n-Burn Computer's stock over the past five years. The average inflation rate over this period was 3.5 percent and the average T-bill rate was 4.2 percent. What was the average real return on the stock? What was the average nominal risk premium on the stock? Complete the following analysis. Do not hard code values in your calculations. Make sure to use the "sample" Excel formulas in your calculations. You bought one of Great White Shark Repellant Company's 8 percent coupon bonds one year ago for $790. These bonds make annual payments and mature 7 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 12 percent. If the inflation rate was 3.8 percent over the past year, what was your total real return on investment? Multiple Choice 17.92% 9.54% 0.31% 9.91% A stock had returns of 11 percent, 15 percent, 12 percent, 11 percent, 16 percent, and 2 percent over the last six years. What is the arithmetic return for the stock? What is the geometric return for the stock? Suppose a stock had an initial price of $79 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $88. What was the dividend yield? The capital gains yield? Complete the following analysis. Do not hard code values in your calculations. Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Complete the following analysis. Do not hard code values in your calculations. Make sure to use the "sample" Excel formulas in your calculations. You must use the built-in Excel functions to answer this question. You've observed the following returns on Crash-n-Burn Computer's stock over the past five years. The average inflation rate over this period was 3.5 percent and the average T-bill rate was 4.2 percent. What was the average real return on the stock? What was the average nominal risk premium on the stock? Complete the following analysis. Do not hard code values in your calculations. Make sure to use the "sample" Excel formulas in your calculations