Question

You buy a car today for $23,100 making a $10,000 down payment and borrowing the balance from your bank with a 84 month fully

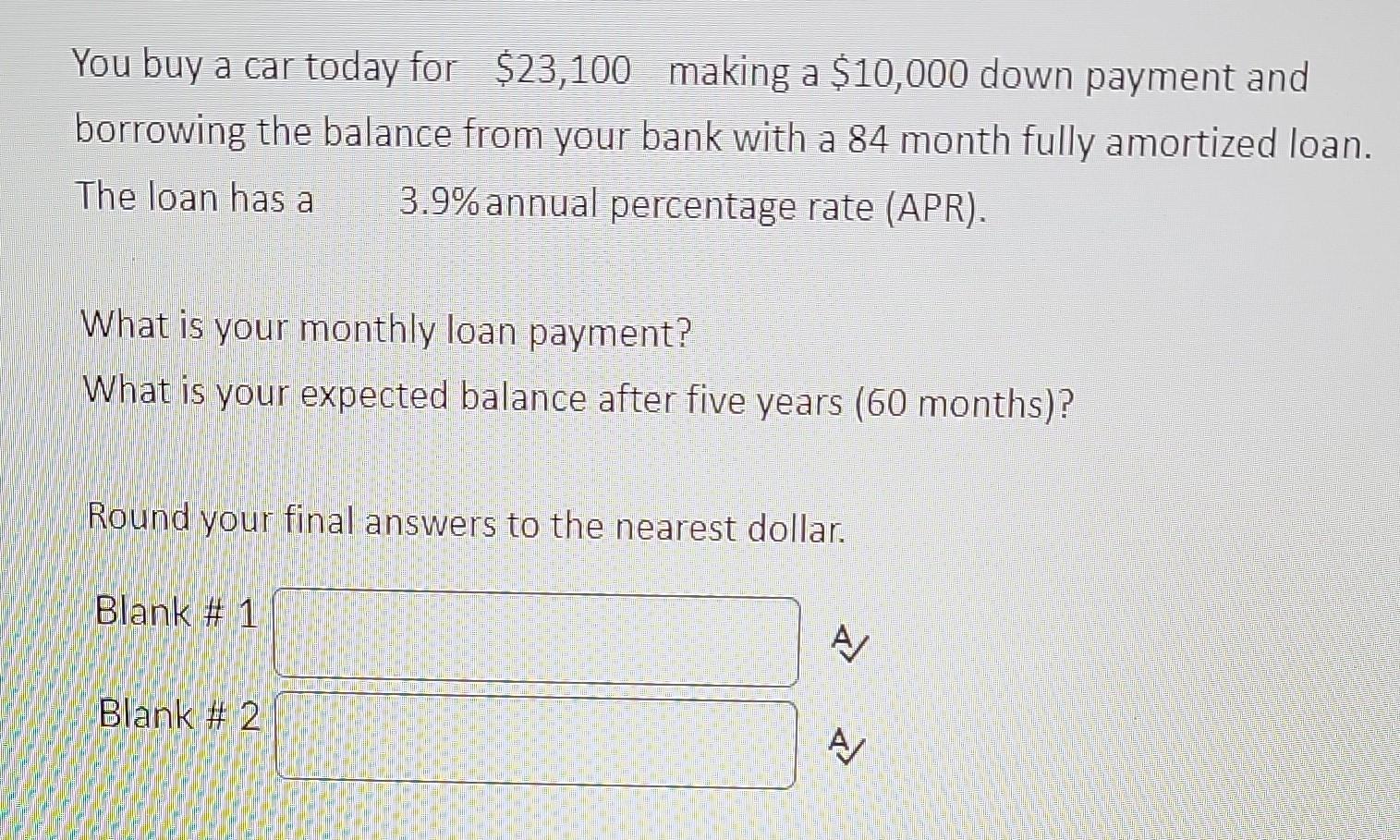

You buy a car today for $23,100 making a $10,000 down payment and borrowing the balance from your bank with a 84 month fully amortized loan. The loan has a 3.9% annual percentage rate (APR). What is your monthly loan payment? What is your expected balance after five years (60 months)? Round your final answers to the nearest dollar. Blank # 1 Blank # 2 A/ A

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the monthly loan payment and the expected balance after five years we can use the loan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App