Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can afford a $900 monthly mortgage payment with a 30 year loan of 6.1% interest. a. How big of a loan can you b.

you can afford a $900 monthly mortgage payment with a 30 year loan of 6.1% interest.

a. How big of a loan can you

b. How much total money will you pay the loan company?.

c. How much of that money is interest

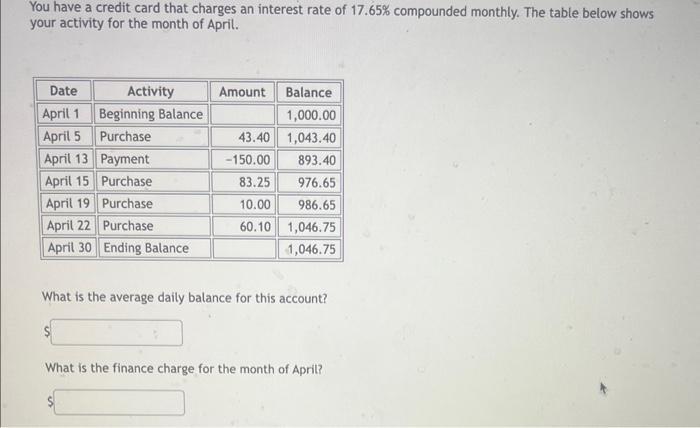

You have a credit card that charges an interest rate of 17.65% compounded monthly. The table below shows your activity for the month of April. Date April 1 April 5 April 13 Payment April 15 Purchase April 19 Purchase April 22 Purchase April 30 Ending Balance Activity Beginning Balance Purchase Amount 43.40 -150.00 83.25 10.00 60.10 Balance 1,000.00 1,043.40 893.40 976.65 986.65 1,046.75 1,046.75 What is the average daily balance for this account? What is the finance charge for the month of April?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Determine how big of a loan you can afford Monthly Payment 900 Annual Interest Rate 61 Number of Payments 30 years 12 monthsyear 360 months Convert ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started