Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can answer a only 1. Consider a firm with no assets in place and debt outstanding with face value of $60. The firm is

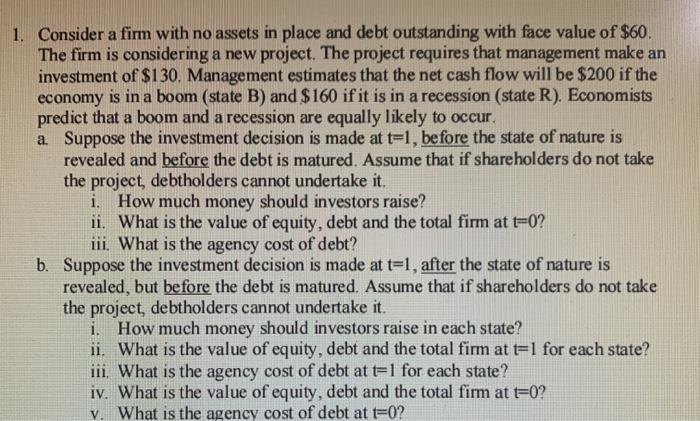

you can answer a only 1. Consider a firm with no assets in place and debt outstanding with face value of $60. The firm is considering a new project. The project requires that management make an investment of $130. Management estimates that the net cash flow will be $200 if the economy is in a boom (state B) and $160 if it is in a recession (state R). Economists predict that a boom and a recession are equally likely to occur. a. Suppose the investment decision is made at t=1, before the state of nature is revealed and before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise? ii. What is the value of equity, debt and the total firm at t=0? iii. What is the agency cost of debt? b. Suppose the investment decision is made at t=1, after the state of nature is revealed, but before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise in each state? ii. What is the value of equity, debt and the total firm at t=1 for each state? iii. What is the agency cost of debt at t=1 for each state? iv. What is the value of equity, debt and the total firm at t=0? v. What is the agency cost of debt at t=0? 1. Consider a firm with no assets in place and debt outstanding with face value of $60. The firm is considering a new project. The project requires that management make an investment of $130. Management estimates that the net cash flow will be $200 if the economy is in a boom (state B) and $160 if it is in a recession (state R). Economists predict that a boom and a recession are equally likely to occur. a. Suppose the investment decision is made at t=1, before the state of nature is revealed and before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise? ii. What is the value of equity, debt and the total firm at t=0? iii. What is the agency cost of debt? b. Suppose the investment decision is made at t=1, after the state of nature is revealed, but before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise in each state? ii. What is the value of equity, debt and the total firm at t=1 for each state? iii. What is the agency cost of debt at t=1 for each state? iv. What is the value of equity, debt and the total firm at t=0? v. What is the agency cost of debt at t=0

you can answer a only 1. Consider a firm with no assets in place and debt outstanding with face value of $60. The firm is considering a new project. The project requires that management make an investment of $130. Management estimates that the net cash flow will be $200 if the economy is in a boom (state B) and $160 if it is in a recession (state R). Economists predict that a boom and a recession are equally likely to occur. a. Suppose the investment decision is made at t=1, before the state of nature is revealed and before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise? ii. What is the value of equity, debt and the total firm at t=0? iii. What is the agency cost of debt? b. Suppose the investment decision is made at t=1, after the state of nature is revealed, but before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise in each state? ii. What is the value of equity, debt and the total firm at t=1 for each state? iii. What is the agency cost of debt at t=1 for each state? iv. What is the value of equity, debt and the total firm at t=0? v. What is the agency cost of debt at t=0? 1. Consider a firm with no assets in place and debt outstanding with face value of $60. The firm is considering a new project. The project requires that management make an investment of $130. Management estimates that the net cash flow will be $200 if the economy is in a boom (state B) and $160 if it is in a recession (state R). Economists predict that a boom and a recession are equally likely to occur. a. Suppose the investment decision is made at t=1, before the state of nature is revealed and before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise? ii. What is the value of equity, debt and the total firm at t=0? iii. What is the agency cost of debt? b. Suppose the investment decision is made at t=1, after the state of nature is revealed, but before the debt is matured. Assume that if shareholders do not take the project, debtholders cannot undertake it. i. How much money should investors raise in each state? ii. What is the value of equity, debt and the total firm at t=1 for each state? iii. What is the agency cost of debt at t=1 for each state? iv. What is the value of equity, debt and the total firm at t=0? v. What is the agency cost of debt at t=0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started