Question

You can assume that the next coupon payment on 8/15/19 is a full 6 months away, as we did in class. Additionally, to avoid a

You can assume that the next coupon payment on 8/15/19 is a full 6 months away, as we did in class. Additionally, to avoid a math error, there are 13 coupon payments remaining on this note. 1. What is the YTM of this bond. Round to one decimal place on rates (i.e. 3.2%)?

You can assume that the next coupon payment on 8/15/19 is a full 6 months away, as we did in class. Additionally, to avoid a math error, there are 13 coupon payments remaining on this note. 1. What is the YTM of this bond. Round to one decimal place on rates (i.e. 3.2%)?

**** PLEASE ASSIST AS TO HOW YOU FOUND N, I, PV, FV, ETC. I UNDERSTAND HOW TO ENTER ON CALCULATOR AND HAVE THE ANSWERS BUT DO NOT UNDERSTAND HOW TO GET TO THEM!!!!

Inputs

N=

I=

PV=

FV=

PMT=

Answer:

2. What would be the price of the bond if the YTM went to 5% (expressed as an APR with semiannual compounding) Again, you can assume that the next coupon payment on 8/15/19 is a full 6 months away?

Inputs

N=

I=

PV=

FV=

PMT=

Why do you think the price of this Note has fallen so much since issuance?

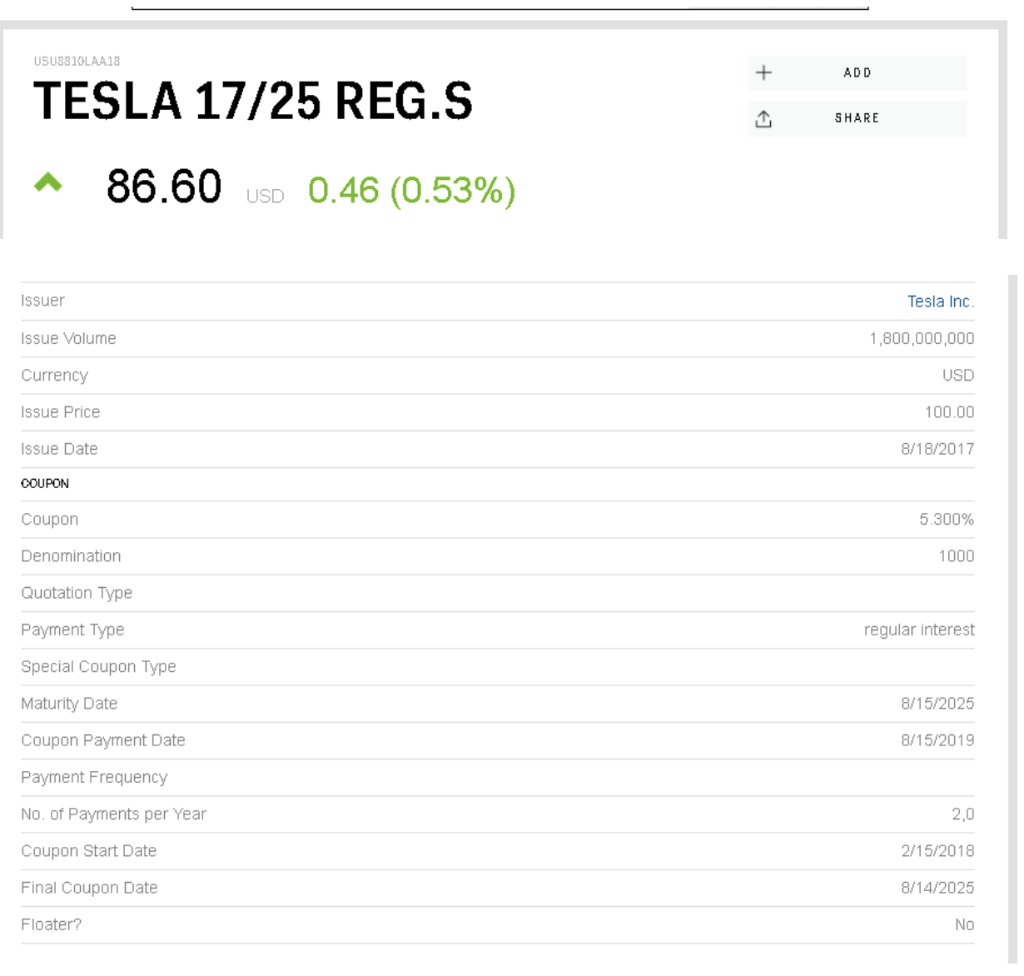

USU8810LAA18 ADD SHARE SHARE TESLA 17/25 REG.S * 86.60 USD 0.46 (0.53%) Issuer Tesla Inc Issue Volume 1,800,000,000 Currency USD Issue Price 100.00 Issue Date 8/18/2017 COUPON Coupon 5.300% Denomination 1000 Quotation Type Payment Type regular interest Special Coupon Type Maturity Date 8/15/2025 Coupon Payment Date 8/15/2019 Payment Frequency No. of Payments per Year 2,0 Coupon Start Date 2/15/2018 Final Coupon Date 8/14/2025 Floater? No USU8810LAA18 ADD SHARE SHARE TESLA 17/25 REG.S * 86.60 USD 0.46 (0.53%) Issuer Tesla Inc Issue Volume 1,800,000,000 Currency USD Issue Price 100.00 Issue Date 8/18/2017 COUPON Coupon 5.300% Denomination 1000 Quotation Type Payment Type regular interest Special Coupon Type Maturity Date 8/15/2025 Coupon Payment Date 8/15/2019 Payment Frequency No. of Payments per Year 2,0 Coupon Start Date 2/15/2018 Final Coupon Date 8/14/2025 Floater? NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started