Question

You can buy a 5-year bond today for $9,000 though the bond's face value is $10,000. The bond rate is 10% p.a. (nominal) and

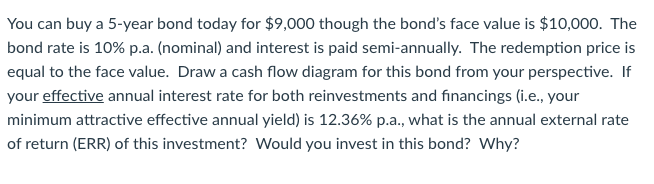

You can buy a 5-year bond today for $9,000 though the bond's face value is $10,000. The bond rate is 10% p.a. (nominal) and interest is paid semi-annually. The redemption price is equal to the face value. Draw a cash flow diagram for this bond from your perspective. If your effective annual interest rate for both reinvestments and financings (i.e., your minimum attractive effective annual yield) is 12.36% p.a., what is the annual external rate of return (ERR) of this investment? Would you invest in this bond? Why?

Step by Step Solution

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ans Wehave been given 5 Years 9000 Tenure Present Value Face Value Coupon Interest 10000 10 sem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App