Answered step by step

Verified Expert Solution

Question

1 Approved Answer

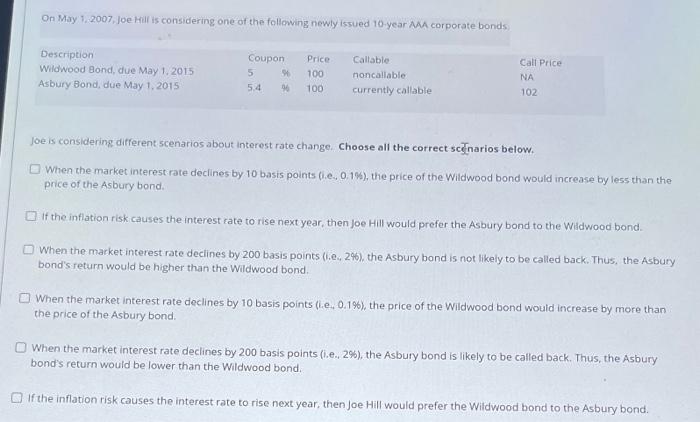

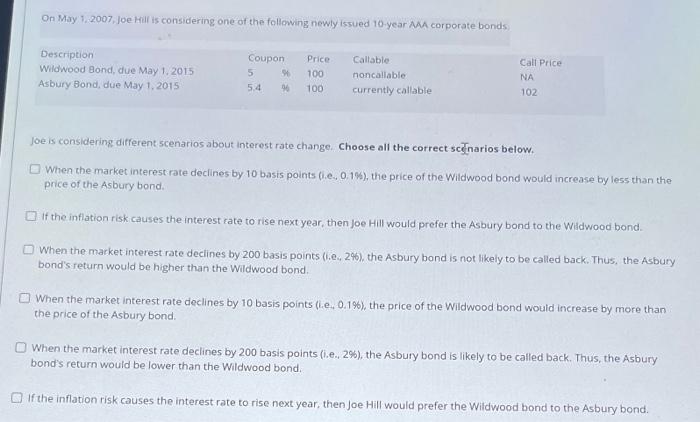

you can chiise more than one correct option. please look at all the options carefully. thank you! On May 1, 2007, Joe Hill is considering

you can chiise more than one correct option. please look at all the options carefully. thank you!

On May 1, 2007, Joe Hill is considering one of the following newly issued 10 year MMA corporate bonds Description Wildwood Bond, due May 1, 2015 Asbury Bond, due May 1, 2015 Coupon 5 5.4 90 Price 100 100 Callable noncallable currently callable Call Price NA 102 Joe is considering different scenarios about interest rate change. Choose all the correct scenarios below. When the market interest rate declines by 10 basis points (.e. 0.1%), the price of the Wildwood bond would increase by less than the price of the Asbury bond. If the inflation risk causes the interest rate to rise next year, then Joe Hill would prefer the Asbury bond to the Wildwood bond When the market interest rate declines by 200 basis points (.e., 24), the Asbury bond is not likely to be called back. Thus, the Asbury bond's return would be higher than the Wildwood bond, When the market interest rate declines by 10 basis points (ie. 0.1%), the price of the Wildwood bond would increase by more than the price of the Asbury bond. When the market interest rate declines by 200 basis points (i.e. 2%), the Asbury bond is likely to be called back. Thus, the Asbury bond's return would be lower than the Wildwood bond If the inflation risk causes the interest rate to rise next year, then Joe Hill would prefer the Wildwood bond to the Asbury bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started