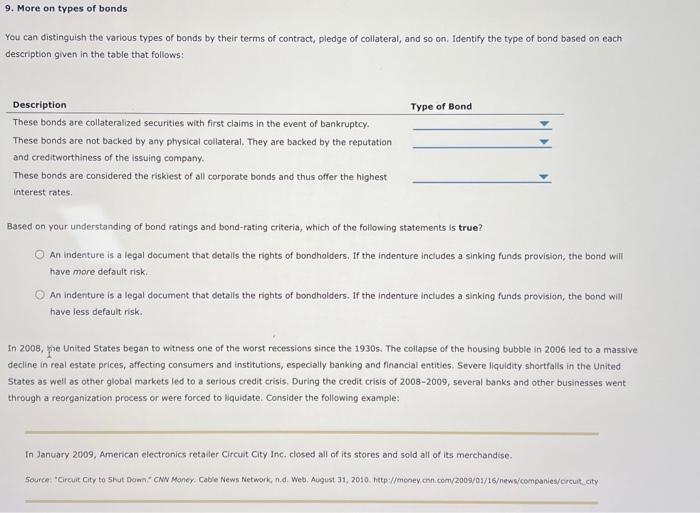

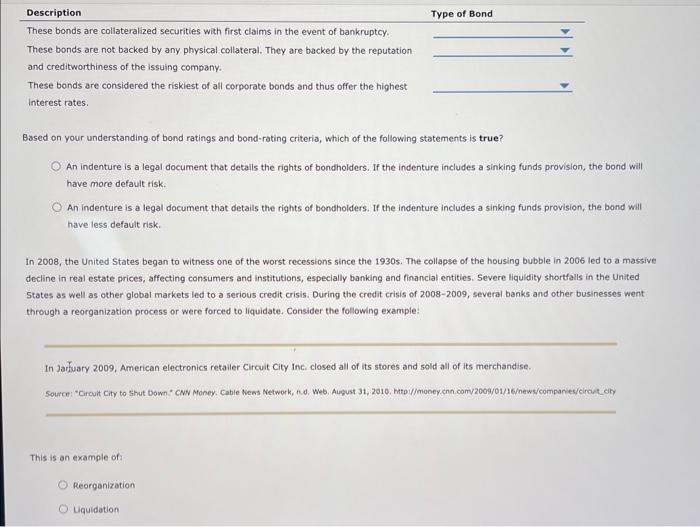

You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows: Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is true? An indenture is a legal document that detalls the rights of bondholders, If the indenture includes a sinking funds provision, the bond will have more default risk. An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have less default risk. In 2008, ye United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to Bquidate. Consider the following example: In January 2009, American electronics retalier Circuit City Inc. closed all of its stores and sold all of its merchandise. Source: "Circuit City to 5hut Dom." CNN Maner. Cable News Network, n.d. Web. Alygust 31, 2010. hetp://money conn com/2009/01/16ews/companies/orcuit. city An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have more default risk. An indenture is a legal document that details the rights of bondholders. If the indenture includes a sinking funds provision, the bond will have less default risk. In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massiv decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In Jarfuary 2009, American electronics retailer Circuit City inc. closed all of its stores and sold all of its merchandise. This is an example of: Reorganization Lquidation