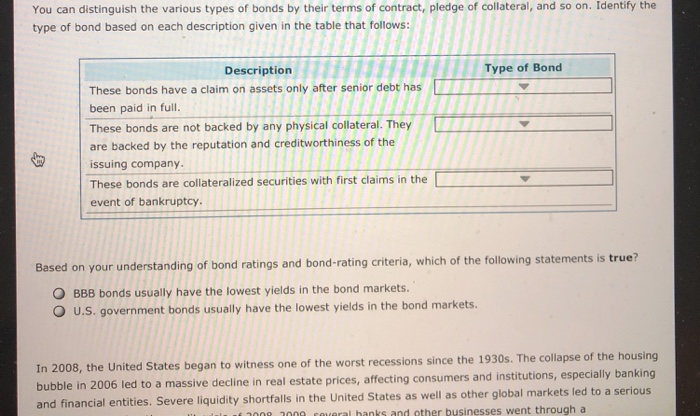

You can distinguish the various types of bonds by their terms of contract, pledge of collateral, and so on. Identify the type of bond based on each description given in the table that follows: Description Type of Bond These bonds have a claim on assets only after senior debt has been paid in full. These bonds are not backed by any physical collateral. They are backed by the reputation and creditworthiness of the issuing company These bonds are collateralized securities with first claims in the event of bankruptcy. Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is true? O BBB bonds usually have the lowest yields in the bond markets. O U.S. government bonds usually have the lowest yields in the bond markets. tes began to witness one of the worst recessions since the 1930s. The collapse of the housing tutions, especially banking In 2008, the United Sta bubble in 2006 led to a massive decline in real estate prices, affecting consumers and insti and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious o0g coweral hanks and other businesses went through a issuing company. These bonds are collateralized securities with first claims in the event of bankruptcy Based on your understanding of bond ratings and bond-rating criteria, which of the following statements is truei O BBB bonds usually have the lowest yields in the bond markets. O U.S. government bonds usually have the lowest yields in the bond markets. In 2008, the United States began to witness one of the worst recessions since the 1930s. The collapse of the housing bubble in 2006 led to a massive decline in real estate prices, affecting consumers and institutions, especially banking and financial entities. Severe liquidity shortfalls in the United States as well as other global markets led to a serious credit crisis. During the credit crisis of 2008-2009, several banks and other businesses went through a reorganization process or were forced to liquidate. Consider the following example: In January 2009, Amrican electronics retailer Circuit City Inc. closed all of its stores and sold all of its merchandise: Source: "Circuit City to Shut Down." CNN Money Cable News Network, n.d. Web. August 31, 2010 http://money.cnn.com/2009/01/16ews/companies/circuit city This is an example of: O Reorganization O Liquidation