Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can easily open the picture on second tab for better quality Interpreting and Applying Disclosures on Property and Equipment Following are selected disclosures from

you can easily open the picture on second tab for better quality

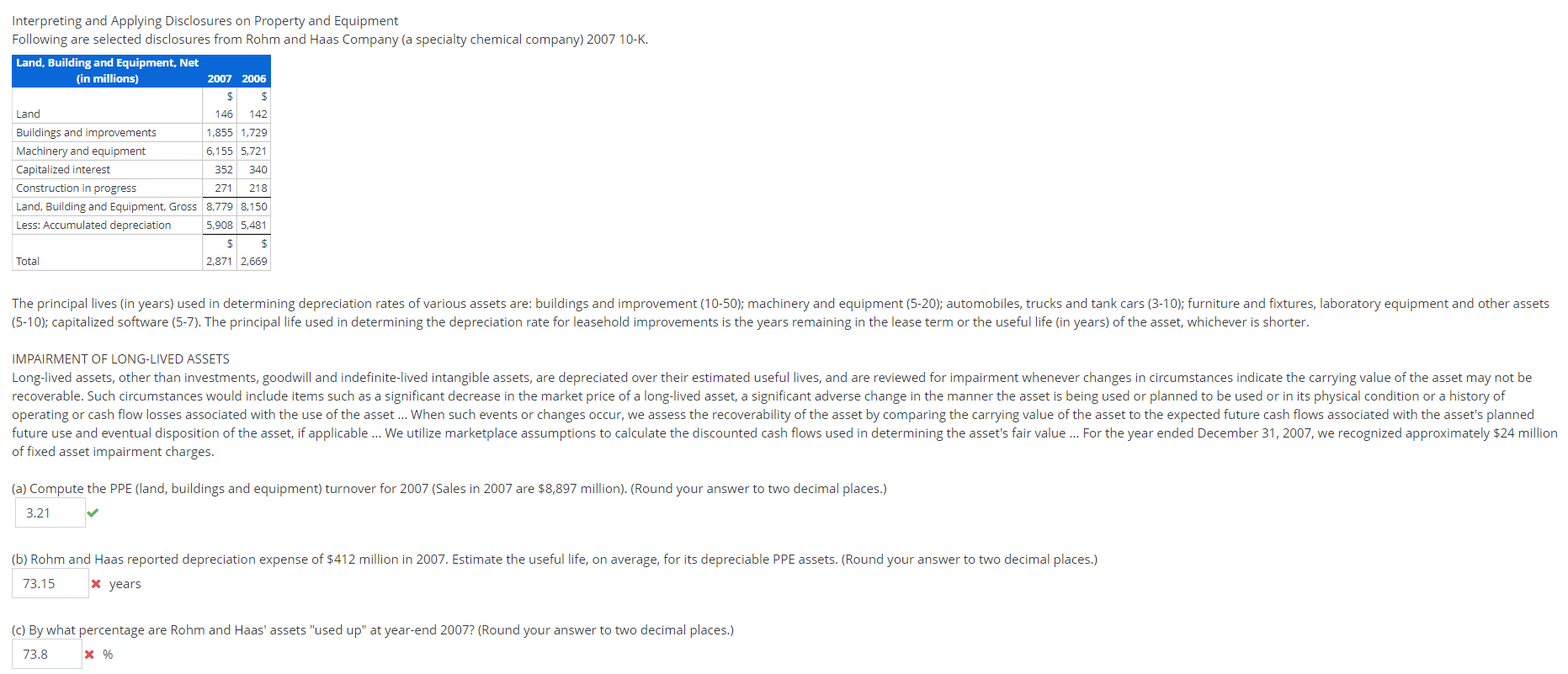

Interpreting and Applying Disclosures on Property and Equipment Following are selected disclosures from Rohm and Haas Company (a specialty chemical company) 2007 10-K. Land, Building and Equipment, Net (in millions) 2007 2006 $ $ Land 146 142 Buildings and improvements 1,855 1,729 Machinery and equipment 6,155 5,721 Capitalized interest 352 340 Construction in progress 271 218 Land, Building and Equipment, Gross 8,779 8,150 Less: Accumulated depreciation 5,908 5,481 $ $ Total 2,871 2,669 The principal lives (in years) used in determining depreciation rates of various assets are: buildings and improvement (10-50); machinery and equipment (5-20); automobiles, trucks and tank cars (3-10); furniture and fixtures, laboratory equipment and other assets (5-10); capitalized software (5-7). The principal life used in determining the depreciation rate for leasehold improvements is the years remaining in the lease term or the useful life (in years) of the asset, whichever is shorter. IMPAIRMENT OF LONG-LIVED ASSETS Long-lived assets, other than investments, goodwill and indefinite-lived intangible assets, are depreciated over their estimated useful lives, and are reviewed for impairment whenever changes in circumstances indicate the carrying value of the asset may not be recoverable. Such circumstances would include items such as a significant decrease in the market price of a long-lived asset, a significant adverse change in the manner the asset is being used or planned to be used or in its physical condition ra history of operating or cash flow losses associated with the use of the asset ... When such events or changes occur, we assess the recoverability of the asset by comparing the carrying value of the asset to the expected future cash flows associated with the asset's planned future use and eventual disposition of the asset, if applicable... We utilize marketplace assumptions to calculate the discounted cash flows used in determining the asset's fair value ... For the year ended December 31, 2007, we recognized approximately $24 million of fixed asset impairment charges. (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8,897 million). (Round your answer to two decimal places.) 3.21 (b) Rohm and Haas reported depreciation expense of $412 million in 2007. Estimate the useful life, on average, for its depreciable PPE assets. (Round your answer to two decimal places.) 73.15 x years (c) By what percentage are Rohm and Haas' assets "used up" at year-end 2007? (Round your answer to two decimal places.) 73.8 X %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started