Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can just have the answers Civil engineering consulting firms that provide services to outlying communities are vulnerable to a number of factors that affect

you can just have the answers

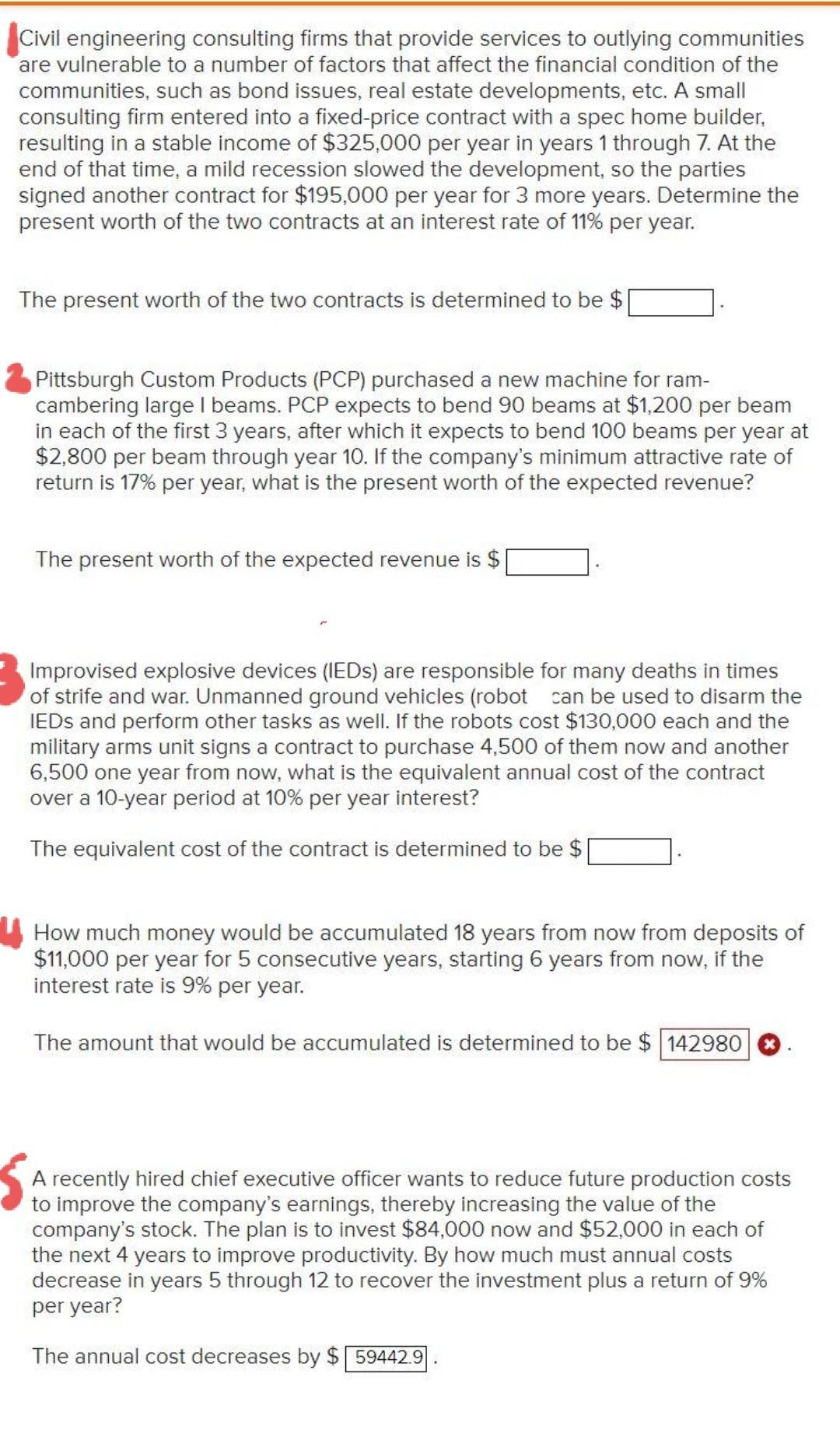

Civil engineering consulting firms that provide services to outlying communities are vulnerable to a number of factors that affect the financial condition of the communities, such as bond issues, real estate developments, etc. A small consulting firm entered into a fixed-price contract with a spec home builder, resulting in a stable income of $325,000 per year in years 1 through 7. At the end of that time, a mild recession slowed the development, so the parties signed another contract for $195,000 per year for 3 more years. Determine the present worth of the two contracts at an interest rate of 11% per year. The present worth of the two contracts is determined to be $ Pittsburgh Custom Products (PCP) purchased a new machine for ram- cambering largel beams. PCP expects to bend 90 beams at $1,200 per beam in each of the first 3 years, after which it expects to bend 100 beams per year at $2,800 per beam through year 10. If the company's minimum attractive rate of return is 17% per year, what is the present worth of the expected revenue? The present worth of the expected revenue is $ Improvised explosive devices (IEDs) are responsible for many deaths in times of strife and war. Unmanned ground vehicles (robot can be used to disarm the IEDs and perform other tasks as well. If the robots cost $130,000 each and the military arms unit signs a contract to purchase 4,500 of them now and another 6,500 one year from now, what is the equivalent annual cost of the contract over a 10-year period at 10% per year interest? The equivalent cost of the contract is determined to be $| How much money would be accumulated 18 years from now from deposits of $11,000 per year for 5 consecutive years, starting 6 years from now, if the interest rate is 9% per year. The amount that would be accumulated is determined to be $ 142980 A recently hired chief executive officer wants to reduce future production costs to improve the company's earnings, thereby increasing the value of the company's stock. The plan is to invest $84,000 now and $52,000 in each of the next 4 years to improve productivity. By how much must annual costs decrease in years 5 through 12 to recover the investment plus a return of 9% per year? The annual cost decreases by $ 59442.9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started