Question

You can only invest in two securities: A and X. The correlation between the returns of A and X is 0.2. Expected returns and

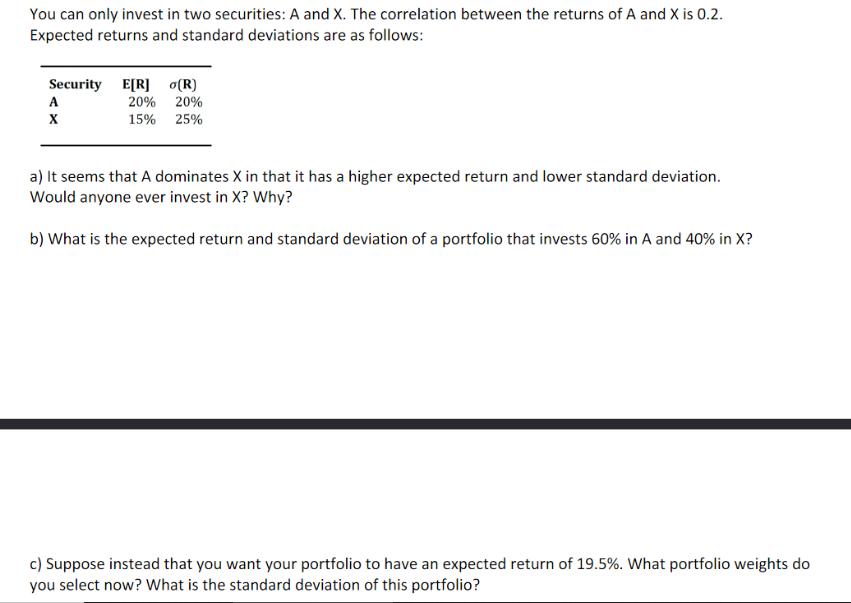

You can only invest in two securities: A and X. The correlation between the returns of A and X is 0.2. Expected returns and standard deviations are as follows: Security E[R] A X o(R) 20% 20% 15% 25% a) It seems that A dominates X in that it has a higher expected return and lower standard deviation. Would anyone ever invest in X? Why? b) What is the expected return and standard deviation of a portfolio that invests 60% in A and 40% in X? c) Suppose instead that you want your portfolio to have an expected return of 19.5%. What portfolio weights do you select now? What is the standard deviation of this portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Yes some investors may still choose to invest in X despite its lower expected return and higher volatility compared to A The reason is that diversif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard Brealey, Stewart Myers, Franklin Allen

13th edition

1260013901, 1260565553, 978-1260013900

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App