Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you can see questions 5 part a and b in the 1st and 2nd picture and the tables mentioned in question are in picture 3

you can see questions 5 part a and b in the 1st and 2nd picture and the tables mentioned in question are in picture 3 and 4. thank you.

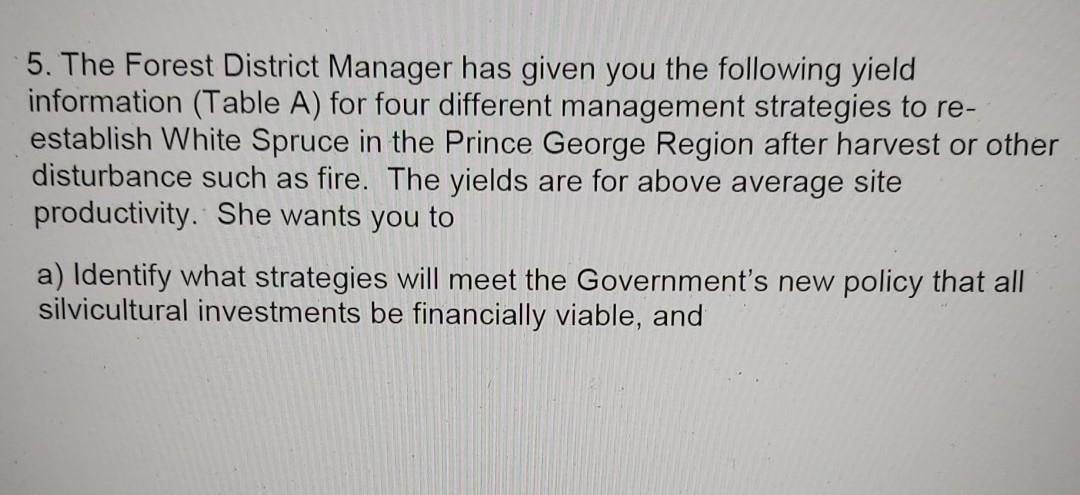

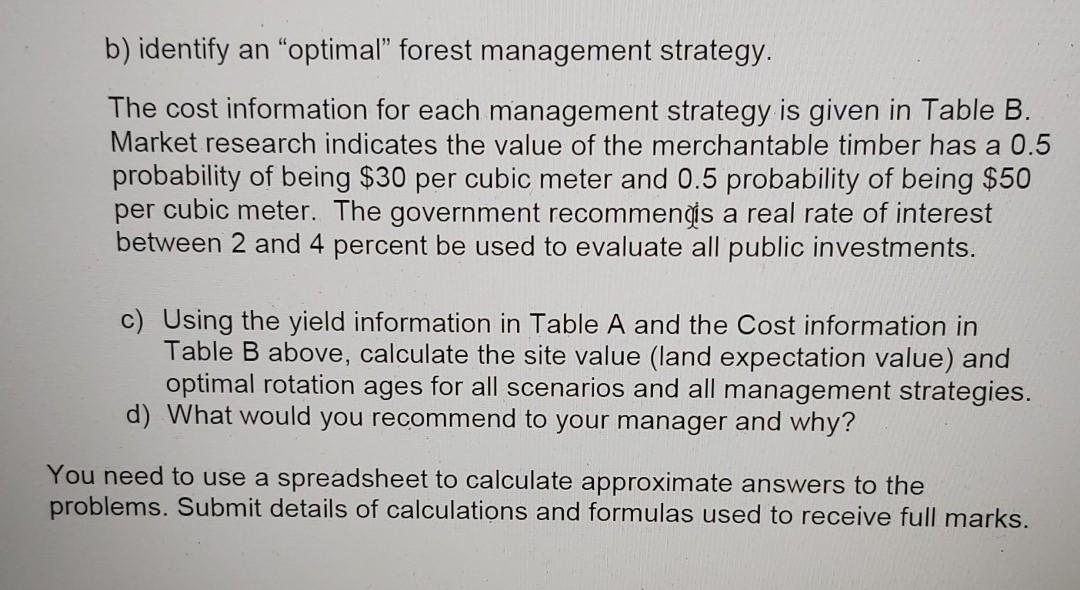

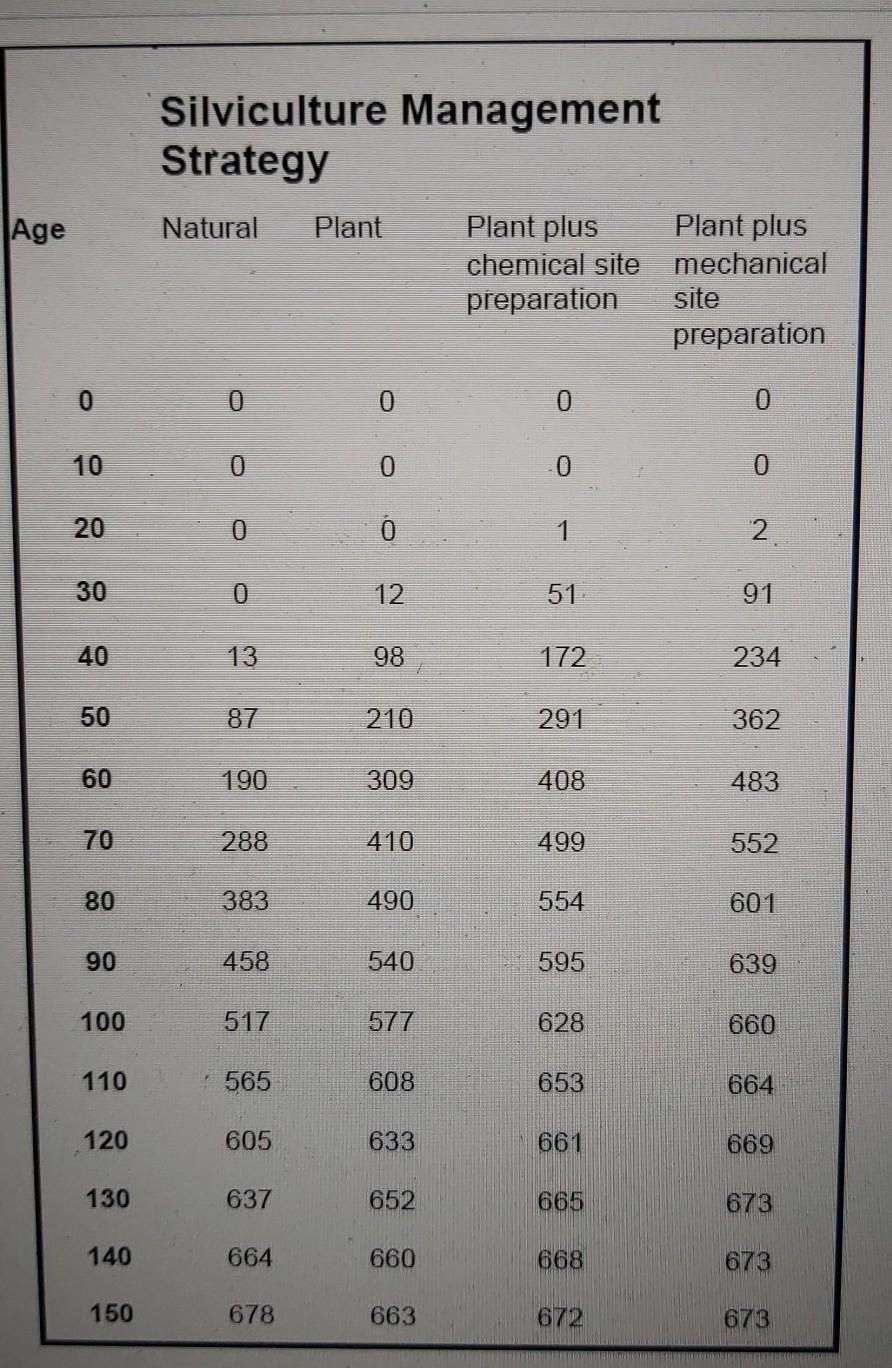

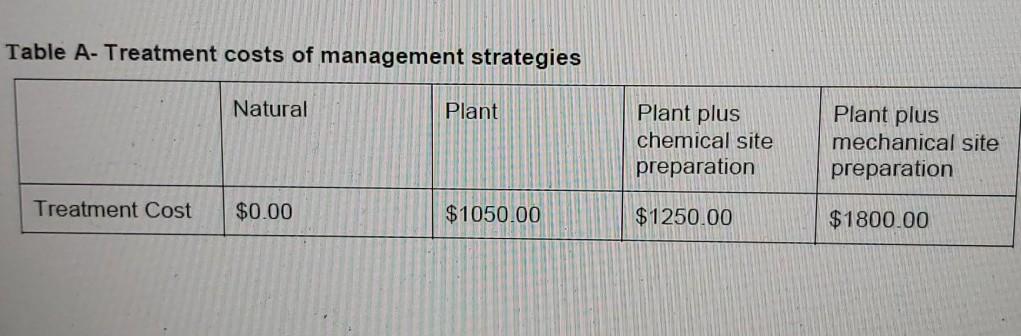

5. The Forest District Manager has given you the following yield information (Table A) for four different management strategies to re- establish White Spruce in the Prince George Region after harvest or other disturbance such as fire. The yields are for above average site productivity. She wants you to a) Identify what strategies will meet the Government's new policy that all silvicultural investments be financially viable, and b) identify an "optimal" forest management strategy. The cost information for each management strategy is given in Table B. Market research indicates the value of the merchantable timber has a 0.5 probability of being $30 per cubic meter and 0.5 probability of being $50 per cubic meter. The government recommengis a real rate of interest between 2 and 4 percent be used to evaluate all public investments. c) Using the yield information in Table A and the Cost information in Table B above, calculate the site value (land expectation value) and optimal rotation ages for all scenarios and all management strategies. d) What would you recommend to your manager and why? You need to use a spreadsheet to calculate approximate answers to the problems. Submit details of calculations and formulas used to receive full marks. Silviculture Management Strategy Age Natural Plant Plant plus Plant plus chemical site mechanical preparation site preparation 0 0 0 0 10 0 0 0 0 0 0 20 0 1 2. 30 12 51 91 40 13 98 172 234 50 87 210 291 362 60 190 309 408 483 70 288 410 499 552 80 383 490 554 601 90 458 540 595 639 100 517 577 628 660 110 565 608 653 664 120 605 633 661 669 130 637 652 665 673 140 664 660 668 673 150 678 663 672 673 Table A- Treatment costs of management strategies Natural Plant Plant plus chemical site preparation Plant plus mechanical site preparation Treatment Cost $0.00 $1050.00 $1250.00 $1800.00 5. The Forest District Manager has given you the following yield information (Table A) for four different management strategies to re- establish White Spruce in the Prince George Region after harvest or other disturbance such as fire. The yields are for above average site productivity. She wants you to a) Identify what strategies will meet the Government's new policy that all silvicultural investments be financially viable, and b) identify an "optimal" forest management strategy. The cost information for each management strategy is given in Table B. Market research indicates the value of the merchantable timber has a 0.5 probability of being $30 per cubic meter and 0.5 probability of being $50 per cubic meter. The government recommengis a real rate of interest between 2 and 4 percent be used to evaluate all public investments. c) Using the yield information in Table A and the Cost information in Table B above, calculate the site value (land expectation value) and optimal rotation ages for all scenarios and all management strategies. d) What would you recommend to your manager and why? You need to use a spreadsheet to calculate approximate answers to the problems. Submit details of calculations and formulas used to receive full marks. Silviculture Management Strategy Age Natural Plant Plant plus Plant plus chemical site mechanical preparation site preparation 0 0 0 0 10 0 0 0 0 0 0 20 0 1 2. 30 12 51 91 40 13 98 172 234 50 87 210 291 362 60 190 309 408 483 70 288 410 499 552 80 383 490 554 601 90 458 540 595 639 100 517 577 628 660 110 565 608 653 664 120 605 633 661 669 130 637 652 665 673 140 664 660 668 673 150 678 663 672 673 Table A- Treatment costs of management strategies Natural Plant Plant plus chemical site preparation Plant plus mechanical site preparation Treatment Cost $0.00 $1050.00 $1250.00 $1800.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started