Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You can set the rf at 0% or 0.5% I dont know there all informations that I have for this question so I think is

You can set the rf at 0% or 0.5% I dont know there all informations that I have for this question so I think is not necessary to have a rf I dont know

Exxplain your choice:

a) 0.041%

b) 0.035%

c) 0.047%

d) None of these answer

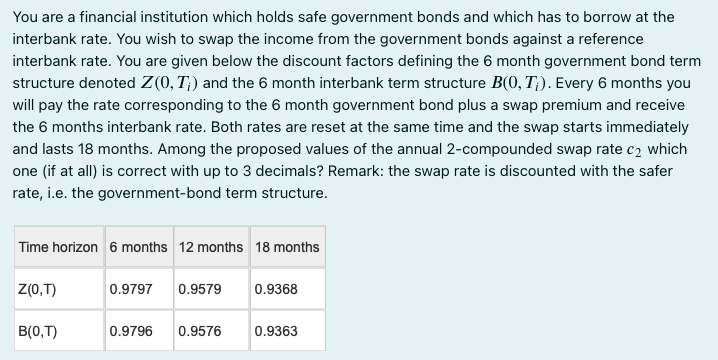

You are a financial institution which holds safe government bonds and which has to borrow at the interbank rate. You wish to swap the income from the government bonds against a reference interbank rate. You are given below the discount factors defining the 6 month government bond term structure denoted Z(0,T;) and the 6 month interbank term structure B(0,T;). Every 6 months you will pay the rate corresponding to the 6 month government bond plus a swap premium and receive the 6 months interbank rate. Both rates are reset at the same time and the swap starts immediately and lasts 18 months. Among the proposed values of the annual 2-compounded swap rate c2 which one (if at all) is correct with up to 3 decimals? Remark: the swap rate is discounted with the safer rate, i.e. the government-bond term structure. Time horizon 6 months 12 months 18 months Z(0,T) 0.9797 0.9579 0.9368 B(0,T) 0.9796 0.9576 0.9363 You are a financial institution which holds safe government bonds and which has to borrow at the interbank rate. You wish to swap the income from the government bonds against a reference interbank rate. You are given below the discount factors defining the 6 month government bond term structure denoted Z(0,T;) and the 6 month interbank term structure B(0,T;). Every 6 months you will pay the rate corresponding to the 6 month government bond plus a swap premium and receive the 6 months interbank rate. Both rates are reset at the same time and the swap starts immediately and lasts 18 months. Among the proposed values of the annual 2-compounded swap rate c2 which one (if at all) is correct with up to 3 decimals? Remark: the swap rate is discounted with the safer rate, i.e. the government-bond term structure. Time horizon 6 months 12 months 18 months Z(0,T) 0.9797 0.9579 0.9368 B(0,T) 0.9796 0.9576 0.9363Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started