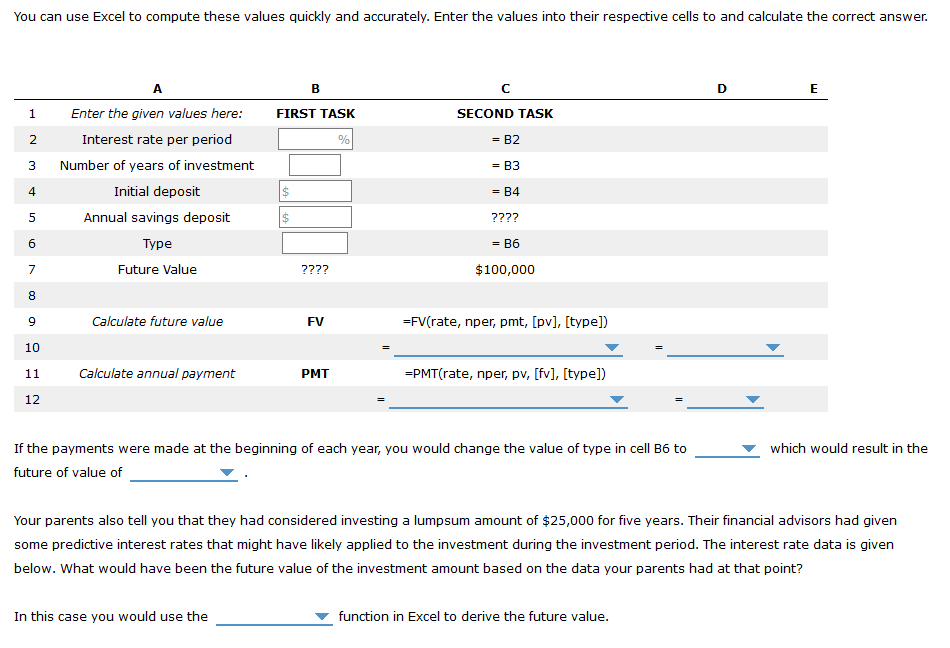

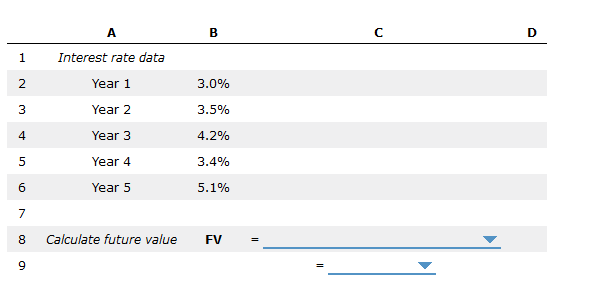

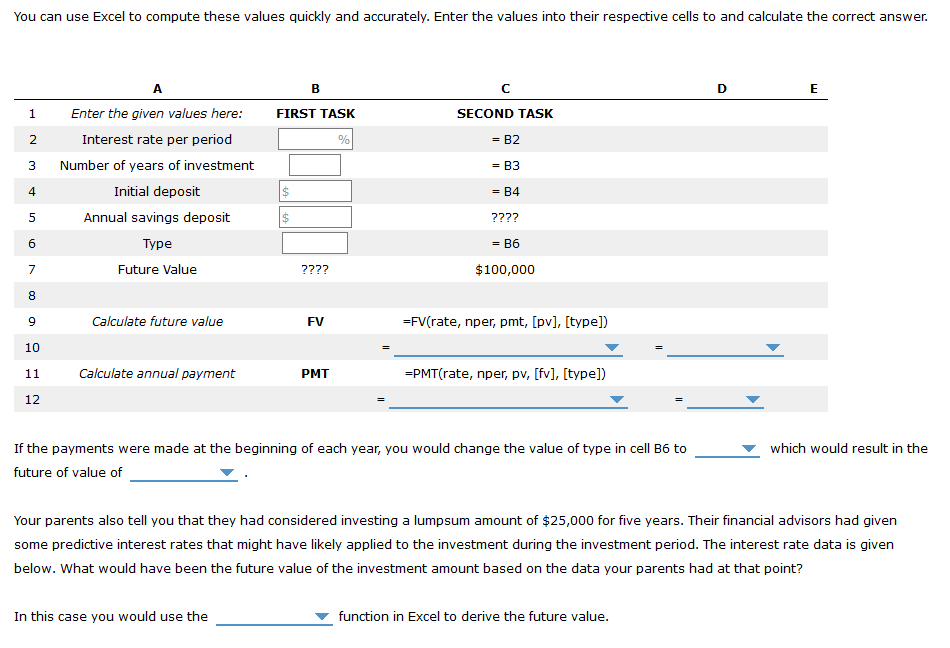

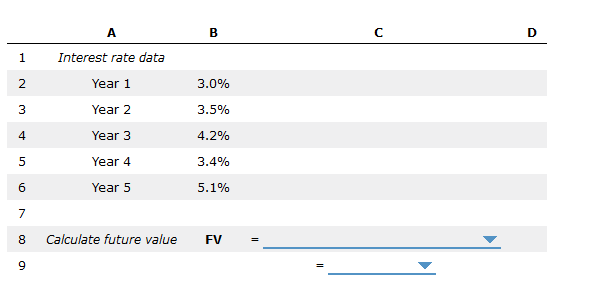

You can use Excel to compute these values quickly and accurately. Enter the values into their respective cells to and calculate the correct answer. FIRST TASK 1 2 3 SECOND TASK = B2 Enter the given values here: Interest rate per period Number of years of investment Initial deposit Annual savings deposit = B3 = B4 5 ???? Type = B6 Future Value ???? $100,000 Calculate future value FV =FV(rate, nper, pmt, [pv], [type]) 11 Calculate annual payment PMT =PMT(rate, nper, pv, [fv], [type]) 12 which would result in the If the payments were made at the beginning of each year, you would change the value of type in cell B6 to future of value of Your parents also tell you that they had considered investing a lumpsum amount of $25,000 for five years. Their financial advisors had given some predictive interest rates that might have likely applied to the investment during the investment period. The interest rate data is given below. What would have been the future value of the investment amount based on the data your parents had at that point? In this case you would use the function in Excel to derive the future value. 1 Interest rate data 2 Year 1 3.0% Year 2 3.5% Year 3 4.2% Year 4 3.4% 5.1% Year 5 8 Calculate future value FV = You can use Excel to compute these values quickly and accurately. Enter the values into their respective cells to and calculate the correct answer. FIRST TASK 1 2 3 SECOND TASK = B2 Enter the given values here: Interest rate per period Number of years of investment Initial deposit Annual savings deposit = B3 = B4 5 ???? Type = B6 Future Value ???? $100,000 Calculate future value FV =FV(rate, nper, pmt, [pv], [type]) 11 Calculate annual payment PMT =PMT(rate, nper, pv, [fv], [type]) 12 which would result in the If the payments were made at the beginning of each year, you would change the value of type in cell B6 to future of value of Your parents also tell you that they had considered investing a lumpsum amount of $25,000 for five years. Their financial advisors had given some predictive interest rates that might have likely applied to the investment during the investment period. The interest rate data is given below. What would have been the future value of the investment amount based on the data your parents had at that point? In this case you would use the function in Excel to derive the future value. 1 Interest rate data 2 Year 1 3.0% Year 2 3.5% Year 3 4.2% Year 4 3.4% 5.1% Year 5 8 Calculate future value FV =