Question

You company purchased a 24-month insurance policy on April 1, 2022 for $ 6,200. When you made the payment it was recorded as an

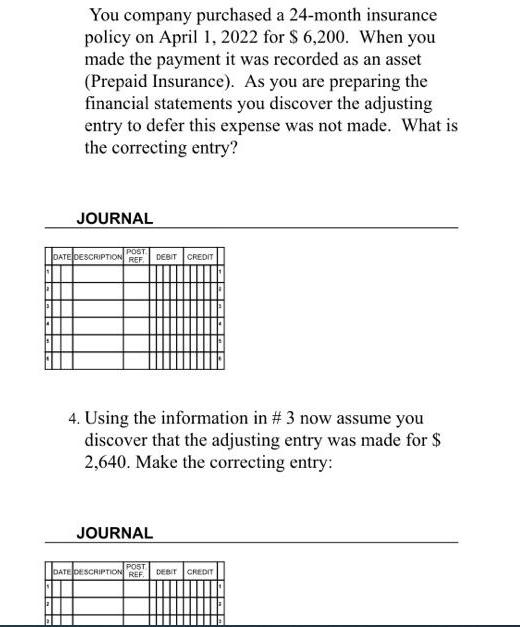

You company purchased a 24-month insurance policy on April 1, 2022 for $ 6,200. When you made the payment it was recorded as an asset (Prepaid Insurance). As you are preparing the financial statements you discover the adjusting entry to defer this expense was not made. What is the correcting entry? JOURNAL POST DATE DESCRIPTION REF DEBIT CREDIT 4. Using the information in # 3 now assume you discover that the adjusting entry was made for $ 2,640. Make the correcting entry: JOURNAL POST DATE DESCRIPTION REF DEBIT CREDIT

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Correcting Entry for the Missing Adjusting Entry Scenario 1 Adjusting Entry Not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App