Question

You consider purchasing a 25-year 1000 par value bond with semi-annual coupons at a nominal rate of 6% convertible semi-annually with a yield of

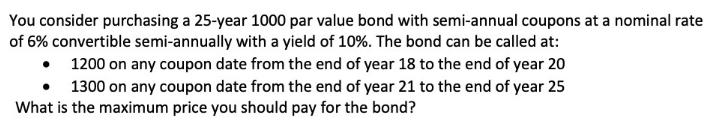

You consider purchasing a 25-year 1000 par value bond with semi-annual coupons at a nominal rate of 6% convertible semi-annually with a yield of 10%. The bond can be called at: 1200 on any coupon date from the end of year 18 to the end of year 20 1300 on any coupon date from the end of year 21 to the end of year 25 What is the maximum price you should pay for the bond?

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the maximum price you should pay for the bond we need to find the present value of all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App