Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You, CPA, work as an associate with Campbell and Associates LLP, a financial and business advisory firm. The board of directors of Pembroke Pulp

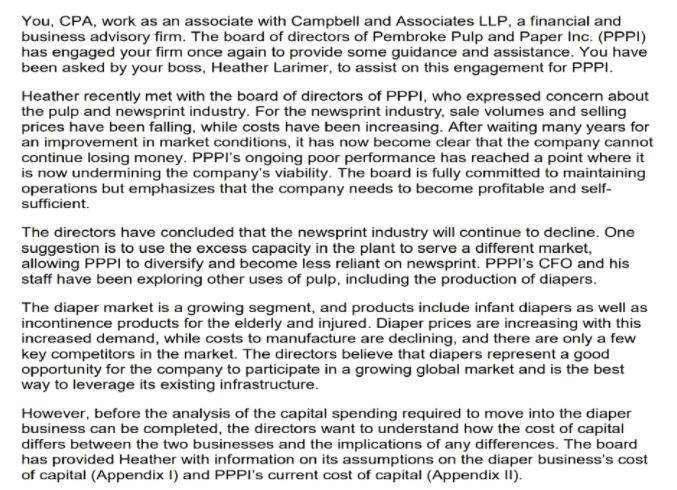

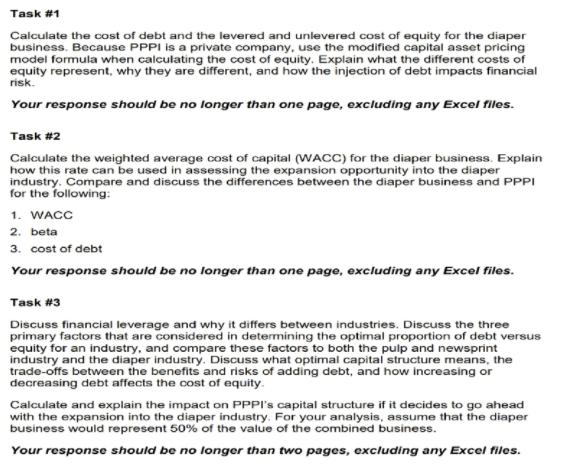

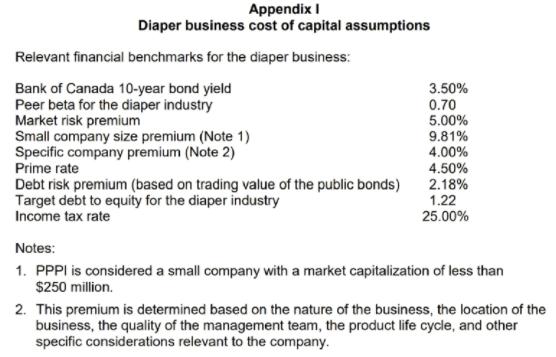

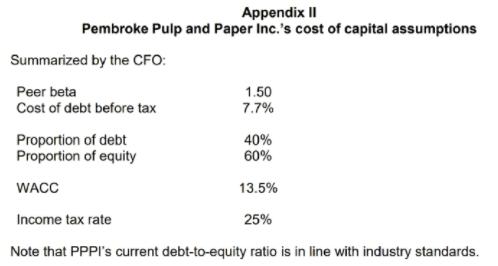

You, CPA, work as an associate with Campbell and Associates LLP, a financial and business advisory firm. The board of directors of Pembroke Pulp and Paper Inc. (PPPI) has engaged your firm once again to provide some guidance and assistance. You have been asked by your boss, Heather Larimer, to assist on this engagement for PPPI. Heather recently met with the board of directors of PPPI, who expressed concern about the pulp and newsprint industry. For the newsprint industry, sale volumes and selling prices have been falling, while costs have been increasing. After waiting many years for an improvement in market conditions, it has now become clear that the company cannot continue losing money. PPPI's ongoing poor performance has reached a point where it is now undermining the company's viability. The board is fully committed to maintaining operations but emphasizes that the company needs to become profitable and self- sufficient. The directors have concluded that the newsprint industry will continue to decline. One suggestion is to use the excess capacity in the plant to serve a different market, allowing PPPI to diversify and become less reliant on newsprint. PPPI's CFO and his staff have been exploring other uses of pulp, including the production of diapers. The diaper market is a growing segment, and products include infant diapers as well as incontinence products for the elderly and injured. Diaper prices are increasing with this increased demand, while costs to manufacture are declining, and there are only a few key competitors in the market. The directors believe that diapers represent a good opportunity for the company to participate in a growing global market and is the best way to leverage its existing infrastructure. However, before the analysis of the capital spending required to move into the diaper business can be completed, the directors want to understand how the cost of capital differs between the two businesses and the implications of any differences. The board has provided Heather with information on its assumptions on the diaper business's cost of capital (Appendix I) and PPPI's current cost of capital (Appendix II).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started