Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You currently are invested in a Biotech Fund. ErBIOTECH = 0.18 and BIOTECH = 0.2. r = 0.04. Should you add Hathaway Fund with

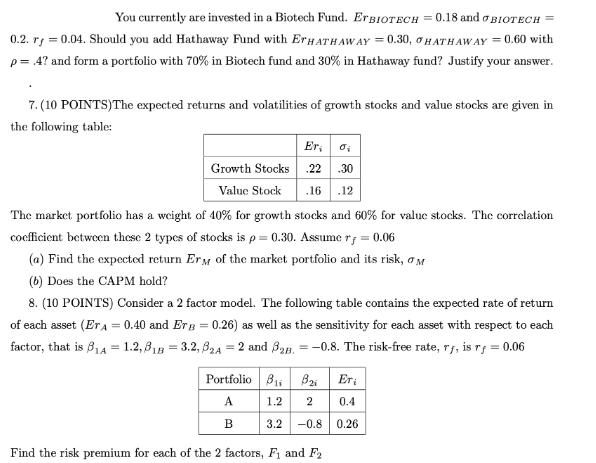

You currently are invested in a Biotech Fund. ErBIOTECH = 0.18 and BIOTECH = 0.2. r = 0.04. Should you add Hathaway Fund with ErHATHAWAY = 0.30, HATHAWAY = 0.60 with p = .4? and form a portfolio with 70% in Biotech fund and 30% in Hathaway fund? Justify your answer. 7. (10 POINTS) The expected returns and volatilities of growth stocks and value stocks are given in the following table: Er, di 22.30 .16 .12 The market portfolio has a weight of 40% for growth stocks and 60% for value stocks. The correlation coefficient between these 2 types of stocks is p=0.30. Assume r = 0.06 (a) Find the expected return Ery of the market portfolio and its risk, M (b) Does the CAPM hold? 8. (10 POINTS) Consider a 2 factor model. The following table contains the expected rate of return of each asset (ETA = 0.40 and Erg = 0.26) as well as the sensitivity for each asset with respect to each factor, that is 84 = 1.2,81B = 3.2, 82A = 2 and 32. = -0.8. The risk-free rate, rf, is rj = 0.06 Growth Stocks Value Stock Portfolio A B Find the risk premium for each of the 2 factors, F and F B Bi Eri 1.2 2 0.4 3.2 -0.8 0.26

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem 1 The expected return of the biotech fund is ErBIOTEC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started