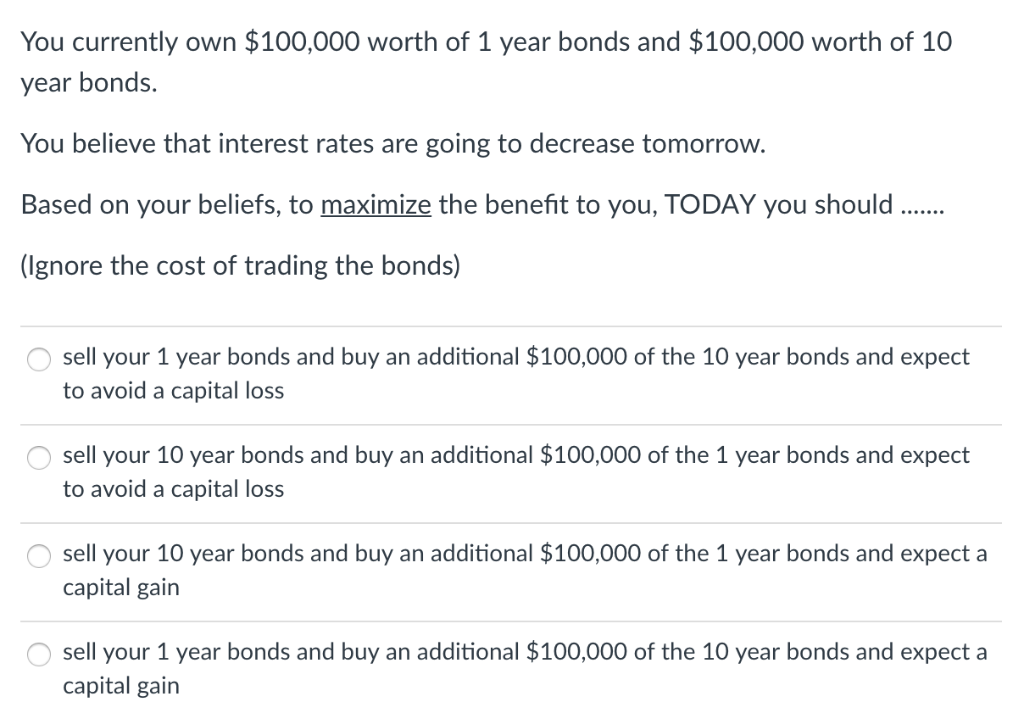

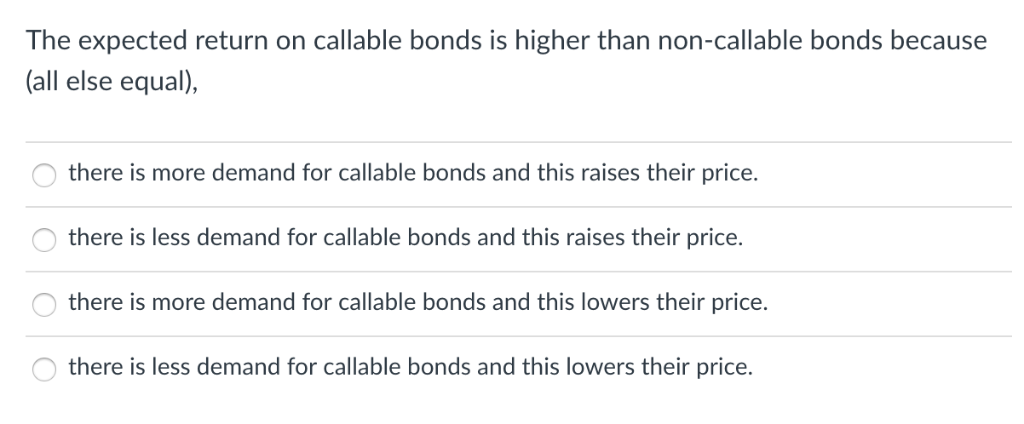

You currently own $100,000 worth of 1 year bonds and $100,000 worth of 10 year bonds. You believe that interest rates are going to decrease tomorrow. Based on your beliefs, to maximize the benefit to you, TODAY you shoul. (lgnore the cost of trading the bonds) sell your 1 year bonds and buy an additional $100,000 of the 10 year bonds and expect to avoid a capital loss sell your 10 year bonds and buy an additional $100,000 of the 1 year bonds and expect to avoid a capital loss sell your 10 year bonds and buy an additional $100,000 of the 1 year bonds and expect a capital gain sell your 1 year bonds and buy an additional $100,000 of the 10 year bonds and expecta capital gain The expected return on callable bonds is higher than non-callable bonds because (all else equal), there is more demand for callable bonds and this raises their price there is less demand for callable bonds and this raises their price. there is more demand for callable bonds and this lowers their price. there is less demand for callable bonds and this lowers their price. You currently own $100,000 worth of 1 year bonds and $100,000 worth of 10 year bonds. You believe that interest rates are going to decrease tomorrow. Based on your beliefs, to maximize the benefit to you, TODAY you shoul. (lgnore the cost of trading the bonds) sell your 1 year bonds and buy an additional $100,000 of the 10 year bonds and expect to avoid a capital loss sell your 10 year bonds and buy an additional $100,000 of the 1 year bonds and expect to avoid a capital loss sell your 10 year bonds and buy an additional $100,000 of the 1 year bonds and expect a capital gain sell your 1 year bonds and buy an additional $100,000 of the 10 year bonds and expecta capital gain The expected return on callable bonds is higher than non-callable bonds because (all else equal), there is more demand for callable bonds and this raises their price there is less demand for callable bonds and this raises their price. there is more demand for callable bonds and this lowers their price. there is less demand for callable bonds and this lowers their price