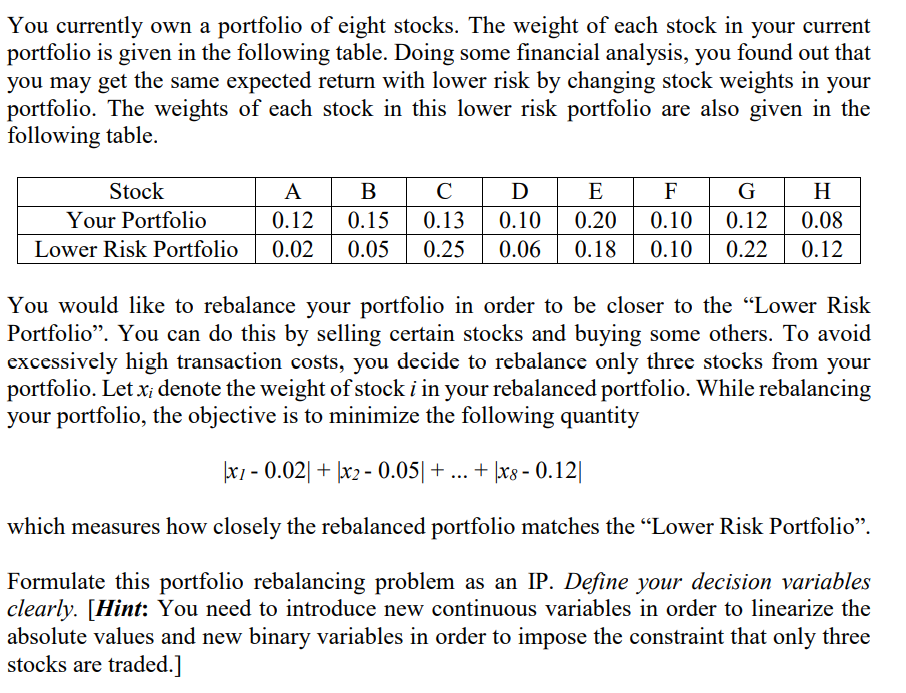

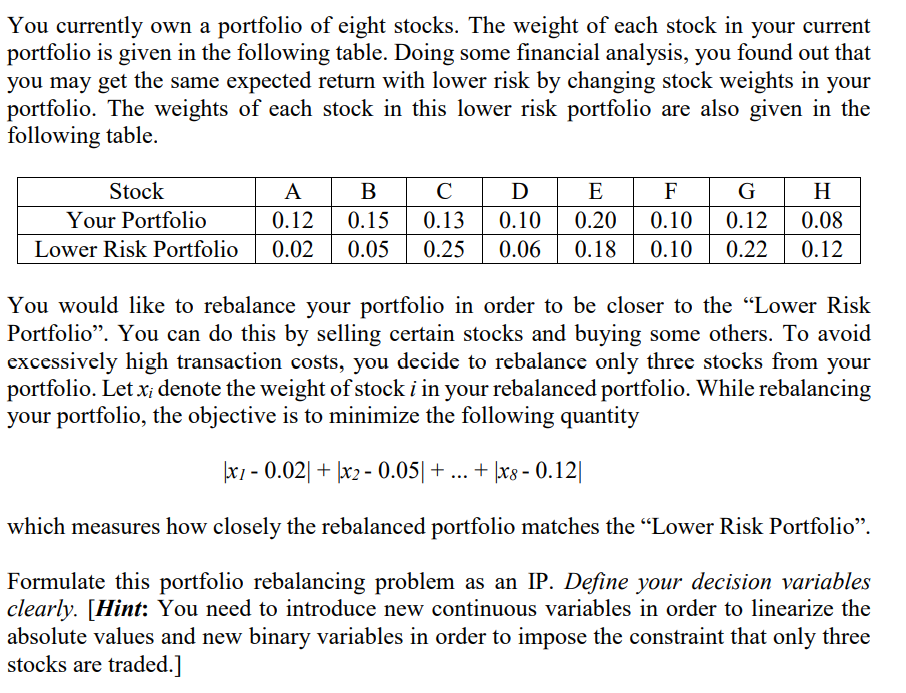

You currently own a portfolio of eight stocks. The weight of each stock in your current portfolio is given in the following table. Doing some financial analysis, you found out that you may get the same expected return with lower risk by changing stock weights in your portfolio. The weights of each stock in this lower risk portfolio are also given in the following table. Stock Your Portfolio Lower Risk Portfolio A 0.12 0.02 B 0.15 0.05 0.13 0.25 D 0.10 0.06 E 0.20 0.18 F 0.10 0.10 G 0.12 0.22 H 0.08 0.12 You would like to rebalance your portfolio in order to be closer to the Lower Risk Portfolio. You can do this by selling certain stocks and buying some others. To avoid excessively high transaction costs, you decide to rebalance only three stocks from your portfolio. Let xi denote the weight of stock i in your rebalanced portfolio. While rebalancing your portfolio, the objective is to minimize the following quantity \x1 -0.02% + 1x2 - 0.05] + ... + |x8 - 0.12| which measures how closely the rebalanced portfolio matches the Lower Risk Portfolio. Formulate this portfolio rebalancing problem as an IP. Define your decision variables clearly. (Hint: You need to introduce new continuous variables in order to linearize the absolute values and new binary variables in order to impose the constraint that only three stocks are traded.] You currently own a portfolio of eight stocks. The weight of each stock in your current portfolio is given in the following table. Doing some financial analysis, you found out that you may get the same expected return with lower risk by changing stock weights in your portfolio. The weights of each stock in this lower risk portfolio are also given in the following table. Stock Your Portfolio Lower Risk Portfolio A 0.12 0.02 B 0.15 0.05 0.13 0.25 D 0.10 0.06 E 0.20 0.18 F 0.10 0.10 G 0.12 0.22 H 0.08 0.12 You would like to rebalance your portfolio in order to be closer to the Lower Risk Portfolio. You can do this by selling certain stocks and buying some others. To avoid excessively high transaction costs, you decide to rebalance only three stocks from your portfolio. Let xi denote the weight of stock i in your rebalanced portfolio. While rebalancing your portfolio, the objective is to minimize the following quantity \x1 -0.02% + 1x2 - 0.05] + ... + |x8 - 0.12| which measures how closely the rebalanced portfolio matches the Lower Risk Portfolio. Formulate this portfolio rebalancing problem as an IP. Define your decision variables clearly. (Hint: You need to introduce new continuous variables in order to linearize the absolute values and new binary variables in order to impose the constraint that only three stocks are traded.]