Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You decide not to pay yourself a salary for the work you do for your company. You estimate that, in addition to your own

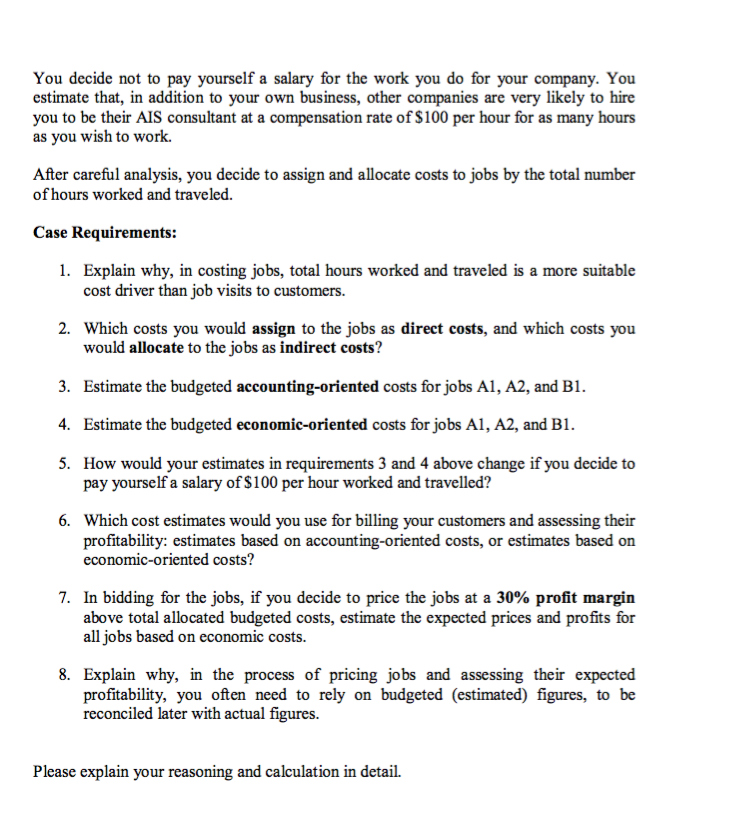

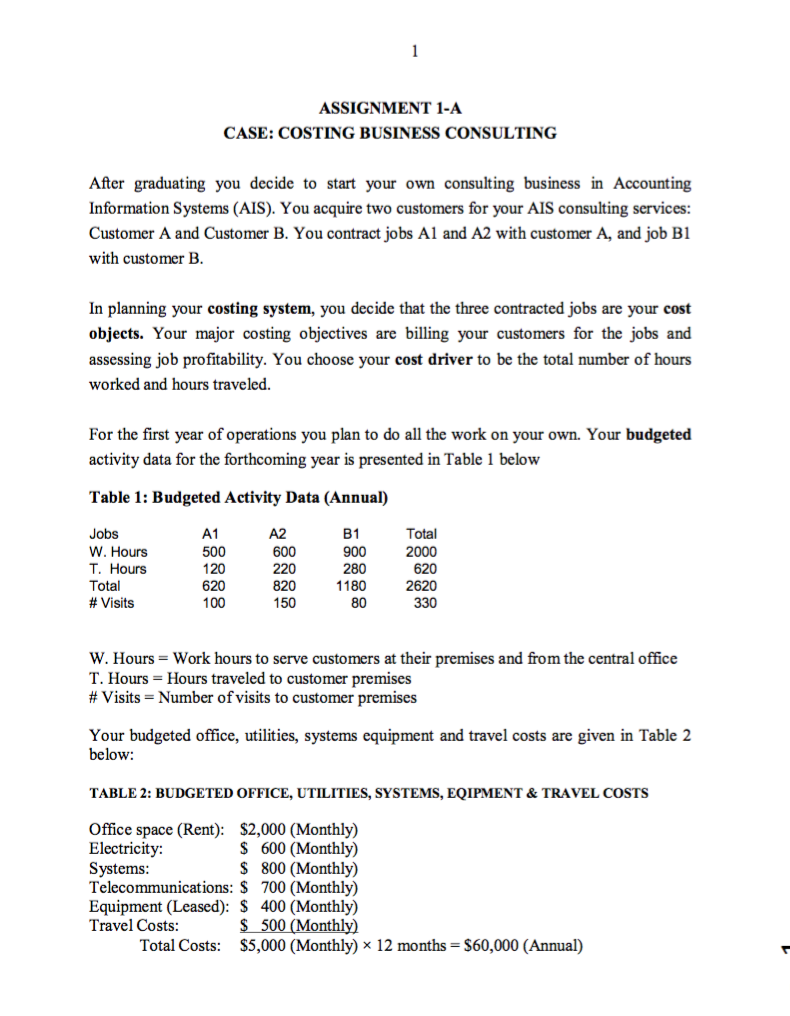

You decide not to pay yourself a salary for the work you do for your company. You estimate that, in addition to your own business, other companies are very likely to hire you to be their AIS consultant at a compensation rate of $100 per hour for as many hours as you wish to work. After careful analysis, you decide to assign and allocate costs to jobs by the total number of hours worked and traveled. Case Requirements: 1. Explain why, in costing jobs, total hours worked and traveled is a more suitable cost driver than job visits to customers. 2. Which costs you would assign to the jobs as direct costs, and which costs you would allocate to the jobs as indirect costs? 3. Estimate the budgeted accounting-oriented costs for jobs A1, A2, and B1. 4. Estimate the budgeted economic-oriented costs for jobs A1, A2, and B1. 5. How would your estimates in requirements 3 and 4 above change if you decide to pay yourself a salary of $100 per hour worked and travelled? 6. Which cost estimates would you use for billing your customers and assessing their profitability: estimates based on accounting-oriented costs, or estimates based on economic-oriented costs? 7. In bidding for the jobs, if you decide to price the jobs at a 30% profit margin above total allocated budgeted costs, estimate the expected prices and profits for all jobs based on economic costs. 8. Explain why, in the process of pricing jobs and assessing their expected profitability, you often need to rely on budgeted (estimated) figures, to be reconciled later with actual figures. Please explain your reasoning and calculation in detail. 1 ASSIGNMENT 1-A CASE: COSTING BUSINESS CONSULTING After graduating you decide to start your own consulting business in Accounting Information Systems (AIS). You acquire two customers for your AIS consulting services: Customer A and Customer B. You contract jobs A1 and A2 with customer A, and job B1 with customer B. In planning your costing system, you decide that the three contracted jobs are your cost objects. Your major costing objectives are billing your customers for the jobs and assessing job profitability. You choose your cost driver to be the total number of hours worked and hours traveled. For the first year of operations you plan to do all the work on your own. Your budgeted activity data for the forthcoming year is presented in Table 1 below Table 1: Budgeted Activity Data (Annual) Jobs A1 A2 B1 Total W. Hours 500 600 900 2000 T. Hours 120 220 280 620 Total 620 820 1180 2620 #Visits 100 150 80 330 W. Hours = Work hours to serve customers at their premises and from the central office T. Hours Hours traveled to customer premises #Visits = Number of visits to customer premises Your budgeted office, utilities, systems equipment and travel costs are given in Table 2 below: TABLE 2: BUDGETED OFFICE, UTILITIES, SYSTEMS, EQIPMENT & TRAVEL COSTS Office space (Rent): $2,000 (Monthly) Electricity: Systems: $ 600 (Monthly) $ 800 (Monthly) 700 (Monthly) Telecommunications: $ Equipment (Leased): $ Travel Costs: 400 (Monthly) $ 500 (Monthly) Total Costs: $5,000 (Monthly) 12 months = $60,000 (Annual)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Total hours worked and traveled is a more suitable cost driver than job visits to customers because it captures the actual effort and resources expended on each job Job visits to customers may not a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started